Market Matters Afternoon Report Tuesday 23rd August 2016

Good Afternoon everyone

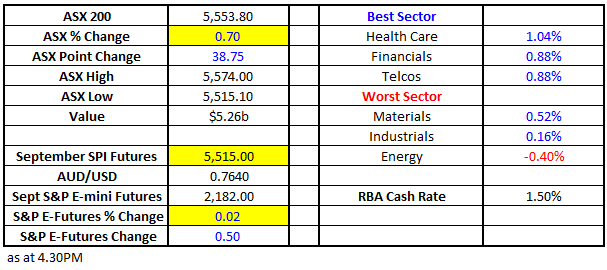

Market Data

What Mattered Today

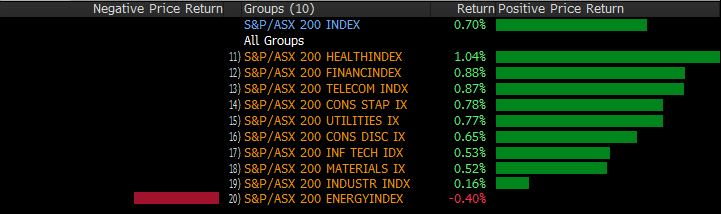

A more bullish day than expected with the index keying off some reasonable results – the banks were strong contributing +14 index points – resources recovered from early weakness, Telstra (TLS) copped abid (sort of), Macquarie (MQG) put on +1.01% to close at $80.20 and CSL finally saw some buying into recent weakness closing up +2.24% to $110.11. The first bit of zing in the market for a while and that was met with strong volume – the desk was busy, which we like!

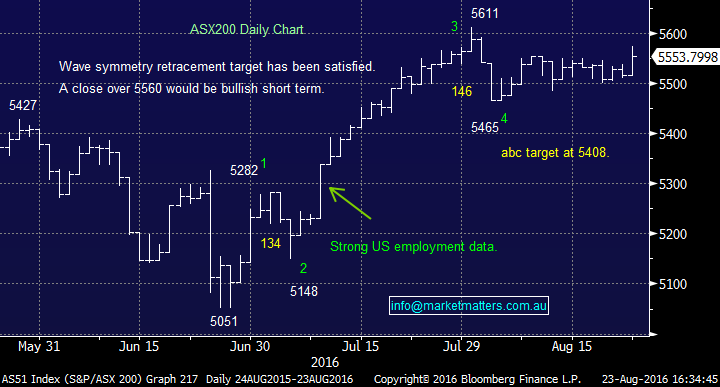

The below daily chart of the ASX 200 shows the biggest daily range for the last week or so – and upside momentum kicking in today. A re-test of 5600 the next logical level.

ASX 200 Daily Chart

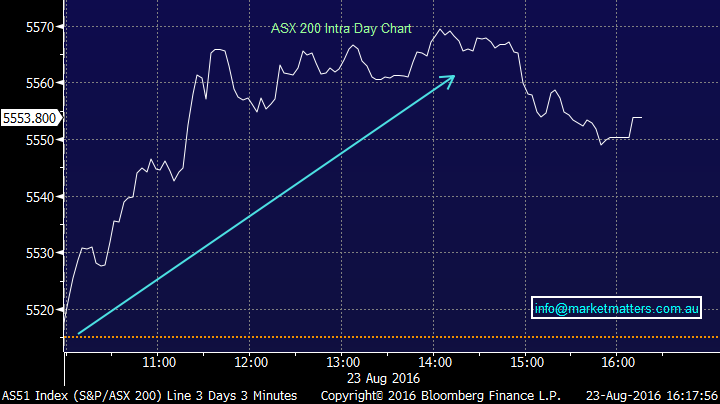

We had a range of +/- 59 points, a high of 5574, a low of 5515 and a close of 5553, up +37 points or +0.7%

ASX 200 Intra Day Chart

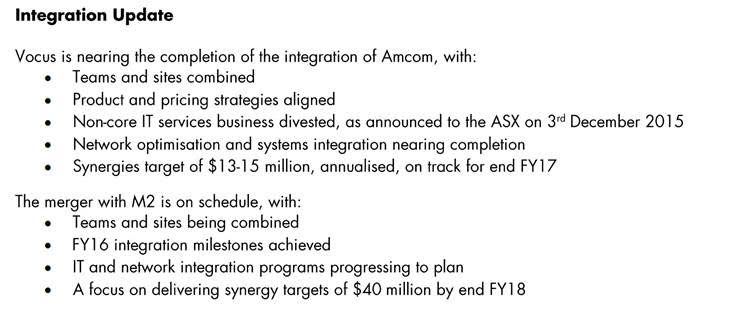

Vocus (VOC) reported a strong set of numbers this morning although most was fairly well known given the recent update following their acquisition of NextGen. Revenue of $831m v guidance of $820m to $835m, EPS of 29.9cps v 27.6cps consensus while the dividend was 15.6cps v consensus of 18cps. The dividend was a tad light however you don’t own VOC for income – it’s a growth stock and their growth profile remains sound.

VOC has been on the acquisition trail over the last few years – buying Amcom & merging with M2 Telecom – integration is important here and the below guidance / update in worth considering.

Vocus Communications (VOC) Daily Chart

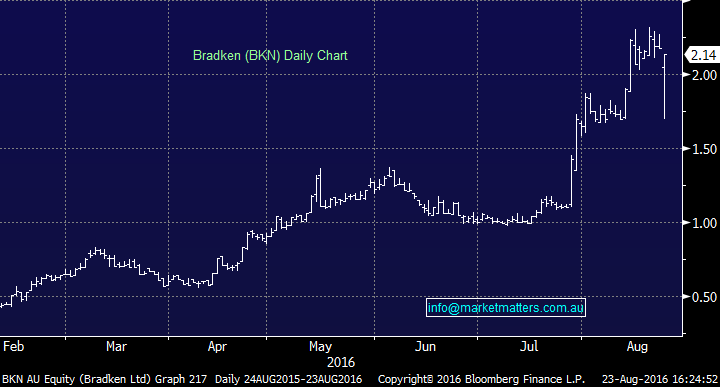

Elsewhere, mining services stocks were in focus with Monadelphous (MND) and Bradken (BKN) both reporting and both getting sold off the varying degrees. Bradken (BKN) finished the better of the two down -1.83% - which was a massive +25% from its lows of $1.70!! Big lines of selling hit the stock early after BKN once again (for the 3rd straight year) called the bottom in mining. The result was OK yet it’s a very capital-intensive business.

Bradken (BKN) Daily Chart

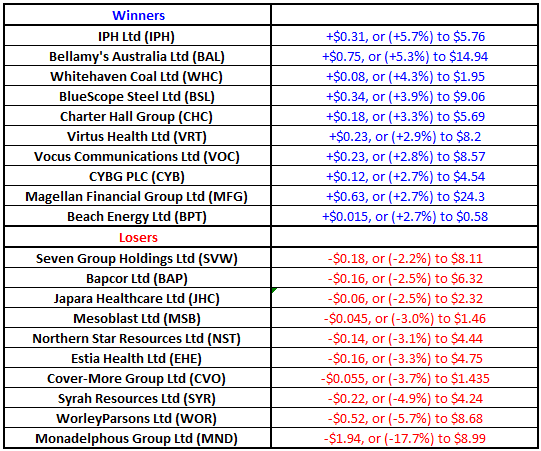

Monadelphous (MND) got hit but didn’t recover – ending the session down -17.75% to $8.99. Weaker than expected earnings by about 8%, and a poor outlook more than offset a marginally better than expected dividend (60cps v 59cps).

The issue with mining services coys collectively, is they’ve been bid up on the back of higher commodity prices and the assumption that mining companies will start exploring again – which is yet to happen. MND and co are being priced for better future earnings and simply, we’re just not seeing it as yet. Worley Parsons (WOR) reports tomorrow which will provide some more insight into the sector. They were off -5.65% today.

Monadelphous (MND) Daily Chart

Sectors

Source; Bloomberg

ASX 200 Movers

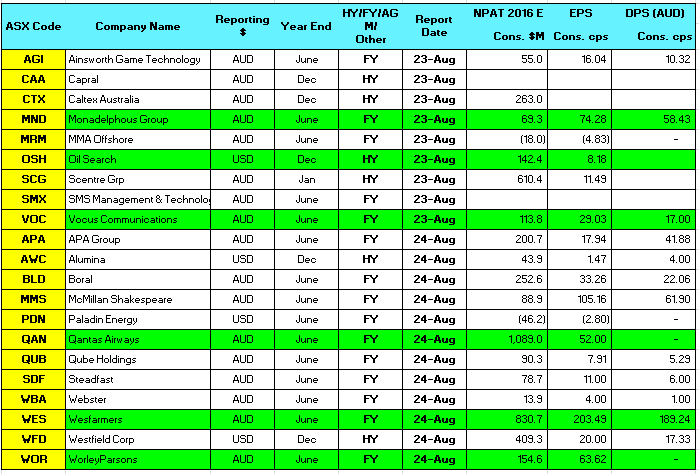

Reporting this week

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

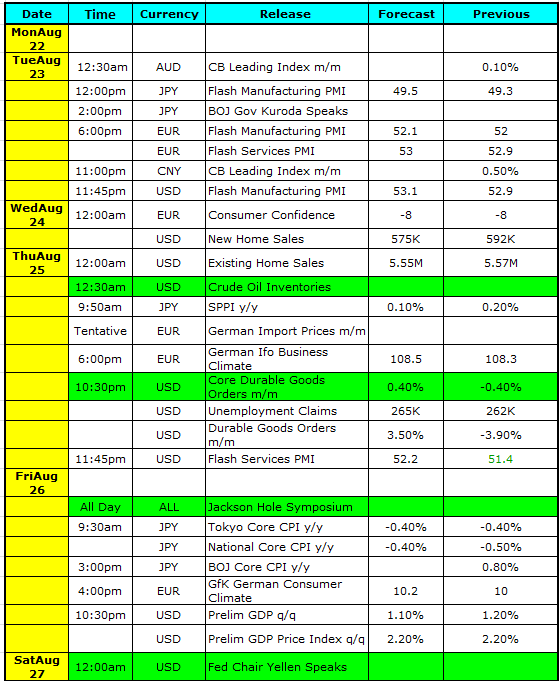

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

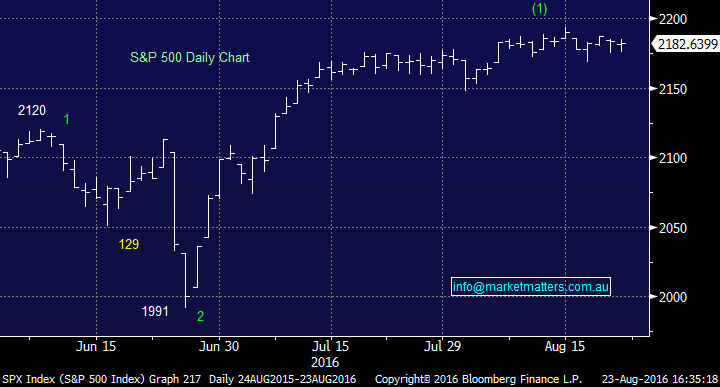

All is quiet in the US ahead of Jackson Hole - indecision – low volatility – complacency all obvious in the S&P 500 below.

S&P 500 Daily Chart

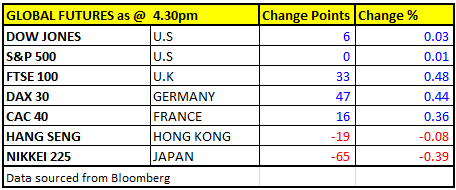

FUTURES pointing to a good start…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here