Market Matters Afternoon Report Thursday 25th August 2016

Good Afternoon everyone

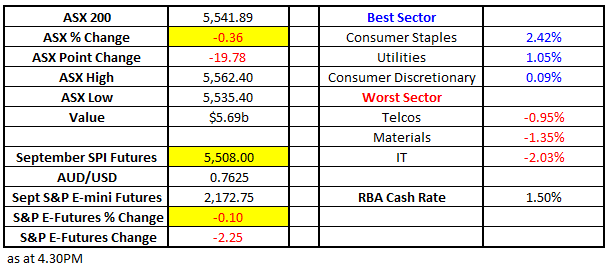

Market Data

What Mattered Today

Stock options expiry today with an overlay of company reports which added to some of the intra-day volatility. The market opened fairly flat – ran up into lunch time then got on the skids in the afternoon session.

Another very tight range of +/- 27 points, a high of 5562, a low of 5535 and a close of 5541, down -19 points or -0.36%.

ASX 200 Intra-Day Chart

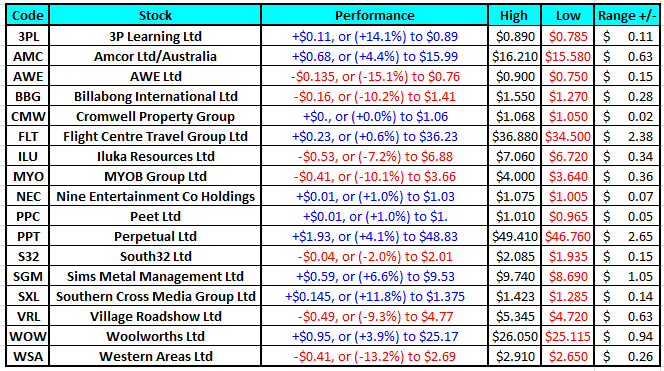

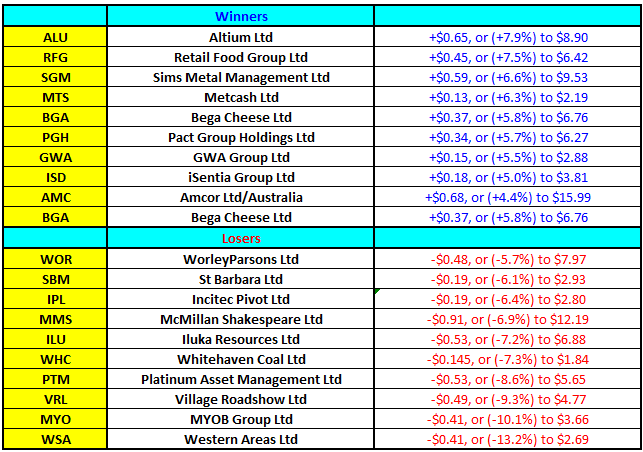

Once again company reporting ensured BIG intra-day stock moves. Below is a list of companies that reported today… Some good, others not.

Woolies (WOW) was interesting today storming higher (+3.92% to close at +$25.17) after being up at $26.05 early on. Their profit missed consensus by about 1% - however it was always going to be about any signs on incremental improvement in the Supermarkets divisions…and the market latched on the smallest of positive signs and bid the stock up strongly.

Food Like For Like sales growth for 4Q was -1.1% vs. -1.3% for the FY – so it was a slight improvement however they did say that 1st 8 weeks of FY17 LFL sales growth is +0.3%...If we compare to WES yesterday, they had good LFL sales growth for the year, but it dropped off in Q4, just as Woolies improved.

A lot of short covering today one would think so the +4% rally is BIG. In terms of guidance, the company said “Given the lack of visibility on our FY17 financial performance at this stage of the year, and consistent with our previous announcements, we will not provide full-year profit guidance.” We liked it – we thought we would get one more bite at the cherry under $20 yet that ship looks like it has now sailed!!!

Woolworths (WOW) Daily Chart

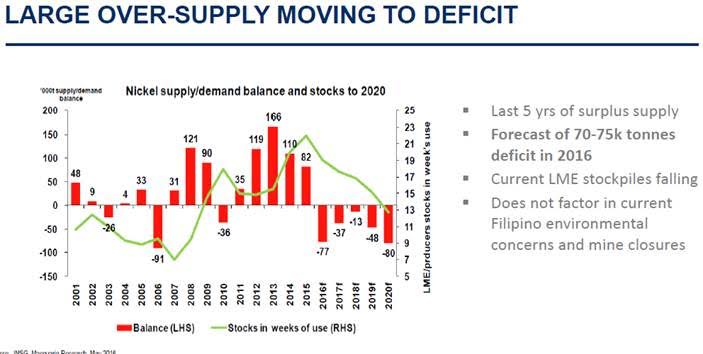

Of the other larger cap companies to report today, Perpetual (PPT) was a good result printing underlying NPAT of $128.2m, exceeding consensus expectations of $126.0m while the dividend of $2.55 (90% franked) was also better than the market expected. Western Areas (WSA) missed the mark and dropped -13% dragging down other Nickel plays like Independence Group (IGO) which fell -3.42%.

Western Areas (WSA) Daily Chart

One interesting slide within their presentation pack centred on the outlook for Nickel prices…all indications are that Nickel is about to go into global deficit which should support prices after 5 years of surplus…

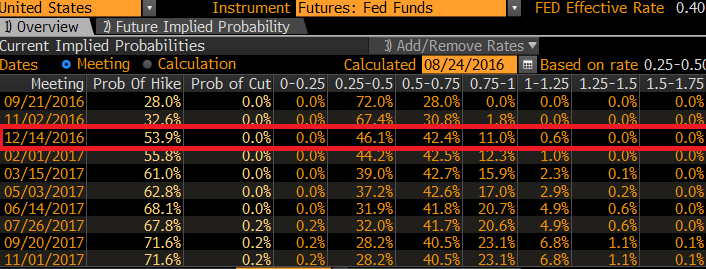

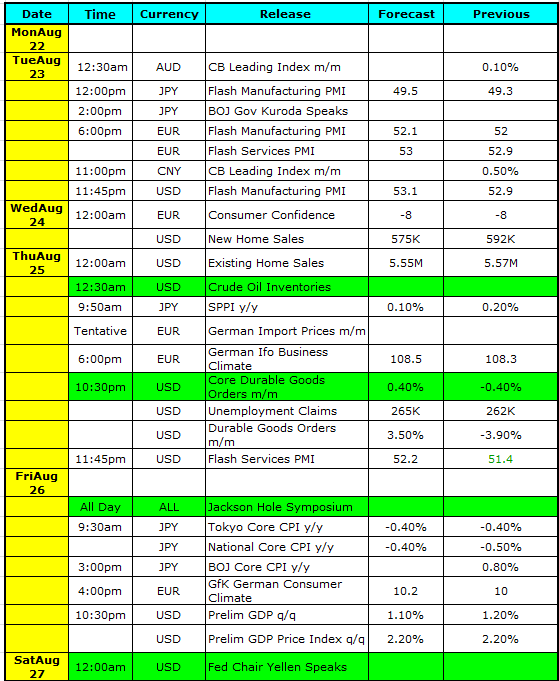

Much of the talk around town today (aside from Wollies) was about Jackson Hole – Janet Yellen and the potential for her to massage current expectations around US interest rates. As it stands, the market is pricing just a 53% chance for a 2016 rate hike yet commentary from a number of Fed members in the last week or so, suggests the Fed is more than a 50/50 chance.

We would have thought that J Yellen might be uncomfortable with the markets misalignment with the current Fed view, and if she uses this opportunity to ‘setthemkt straight’ we should see a higher USD and therefore lower Gold and other commodity prices in the short term.

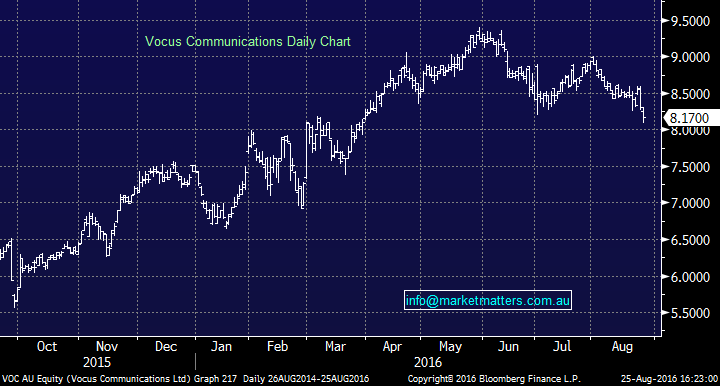

Vocus Communications (VOC) continued to slide today – down another -1.57% to finish at $8.17 after CIMIC announced they had sold their stake in NextGen Networks. This does not change the deal VOC has negotiated to acquire NextGen assets and the sell-off we think presents an opportunity.

If we think about the earnings potential of VOC over the next three years, annualising their Q416 result, add cost out and take off reinvestment costs, add Nextgen we get growth of around 9.5% pa. Put a ‘growth’ multiple on that of say 17 and we get a stock that should trade above $10 in that time…

Vocus Communications (VOC) Daily Chart

Sectors

Source; Bloomberg

ASX 200 Movers

We touched on Altium (ATU) yesterday and interesting to see it was up again today – topping the 200 leader board above - for those not familiar with the company, it’s an interesting technology play with some great growth prospects in the years ahead. It may have run too hard in the short term but certainly one worth watching. Here is current broker consensus. Stocks closed today at $8.90

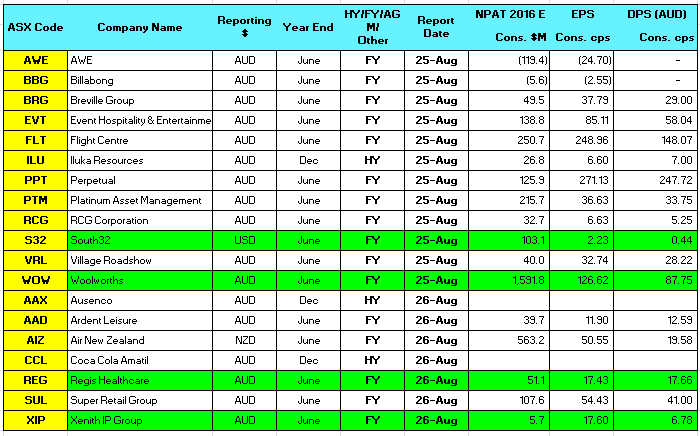

Reporting this week

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

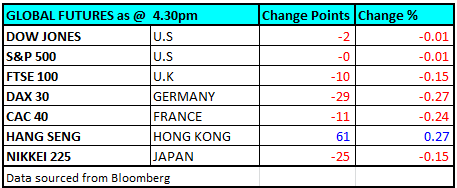

FUTURES flat TONIGHT…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here