Market Matters Afternoon Report Friday 26th August 2016

Good Afternoon everyone

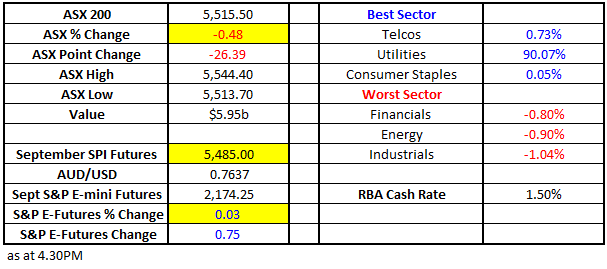

Market Data

What Mattered Today

Some selling filtered into the market today which shouldn’t come as a surprise really given Fed Chair Janet Yellen speaks in Jackson Hole on Saturday morning our time – the potential implications we’ve written about in a number of notes this week. There’s a lot of expectation built into this speech yet the market positioning (low volatility, complacency etc ) suggests otherwise.

In all likelihood, it’ll be a fizzer (and nothing actually happens), yet if it’s not, the market is not positioned for and it and this could create some real issues – prompting a short sharp drop. The risk in our view is clearly to the downside which prompted us to sell out of one position from the portfolio today – more on that below.

Although we have this concern, we still think any weakness (if it prevails) will be short and sharp rather than long and protracted – largely a result of large cash positions still held in the US (and elsewhere). That said, asset prices went up as interest rates went down. Clearly, higher rates is an impediment to higher asset prices and ultimately we think this will be catalyst for a major market selloff in time – but not yet.

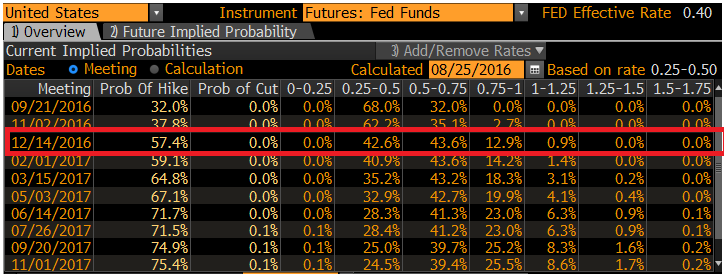

Looking at expectations for US interest rates, yesterday the chart below showed a 28% chance for a hike in Sep, a 32% chance in November and a 54% chance in Dec. Today we see those expectations have firmed somewhat.

On the market today we had a range of +/- 31 points, a high of 5544, a low of 5513 and a close of 5515, down -26 points or -0.48%. Weakness into the close was obvious…

ASX 200 Intra-Day Chart

As alluded to above, we sold Macquarie (MQG) today around $80.40 – not because we dislike the stock, or are overly concerned about the market, however, we had a good profit on the table, low cash levels in our portfolio and MQG is a high beta stock – which means it will typically move more than the market does. If we think the risk is to the downside leading into this speech it makes sense to de-risk the portfolio and increase cash to less aggressive levels….MQG closed the session at $79.75.

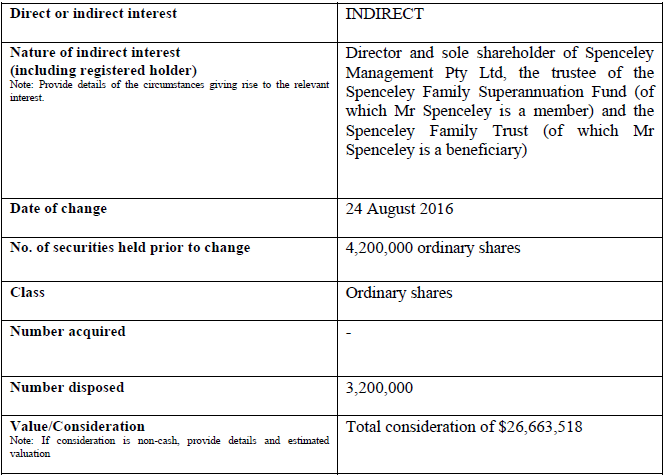

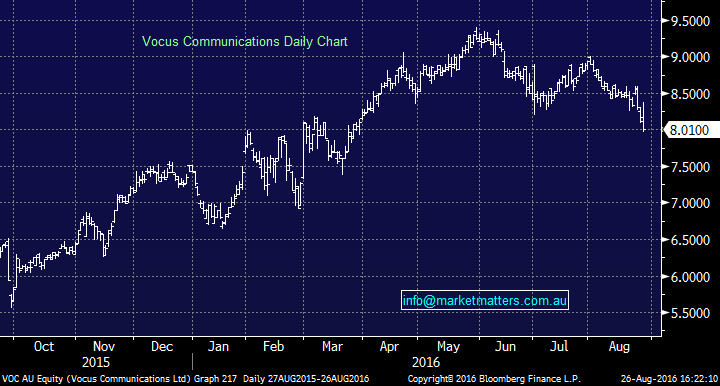

Vocus Communications (VOC) was weak again on news that James Spenceley – who has been the driving force behind the company since inception has sold down a fair amount of stock another 1m shares since Dec15. The announcement was out today as follows…

Is this bad news? Clearlythemkt doesn’t like it and it doesn’t read well, however, it’s not a new theme. James held a lot of stock – about 8.7m shares and is no longer CEO of the company. He’s been selling for some time – yet the value of sales has ticked up in recent times. We’re unsure what he plans to do with the remaining 3.2m shares held however we’ll endeavour to find out.

List of sales for James since 2010.

Source; Shaw and Partners

Vocus Communications (VOC) Daily Chart

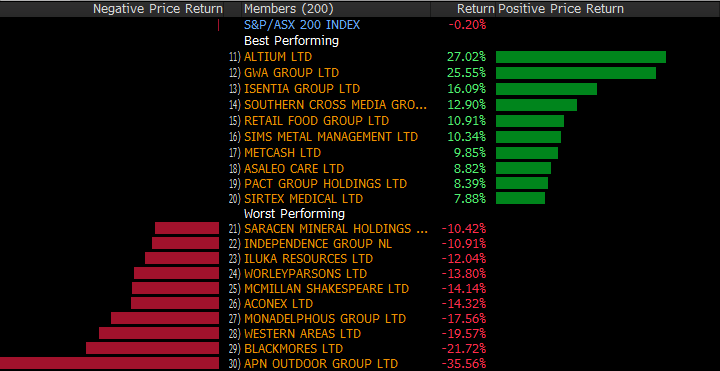

Looking more broadly at the week in aggregate, Altium (ALU) topped the leader board adding +27%....APN Outdoor (APN)the weakest link

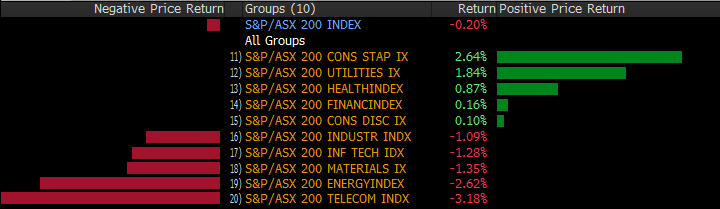

Sectors

Source; Bloomberg

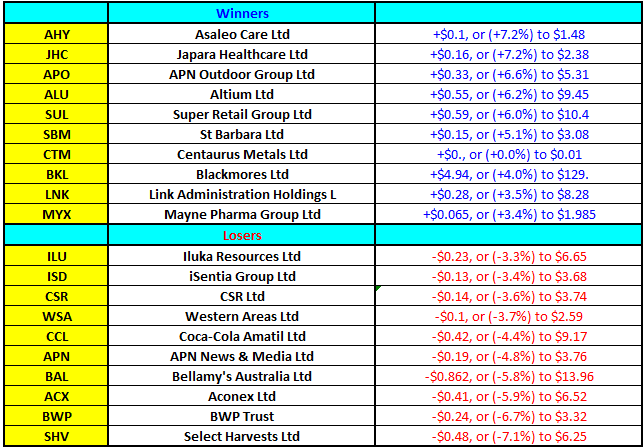

ASX 200 Movers

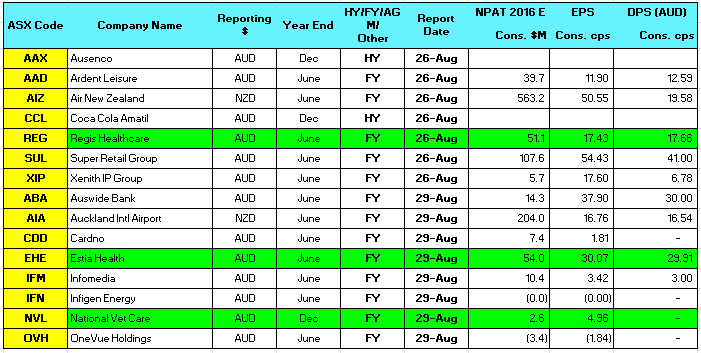

Reporting this week

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

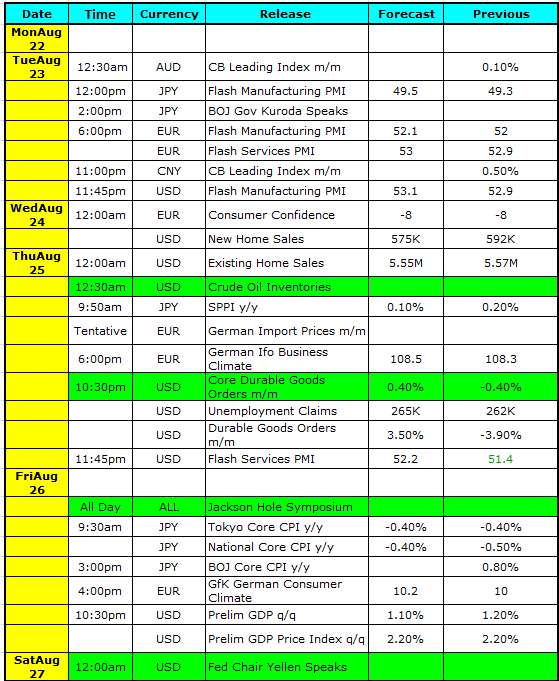

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

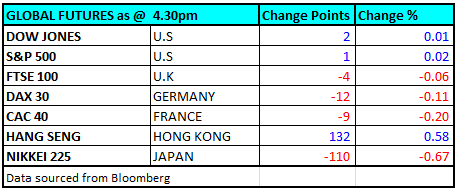

FUTURES flat…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here