Market Matters Afternoon Report Thursday 1st September 2016

Good Afternoon everyone

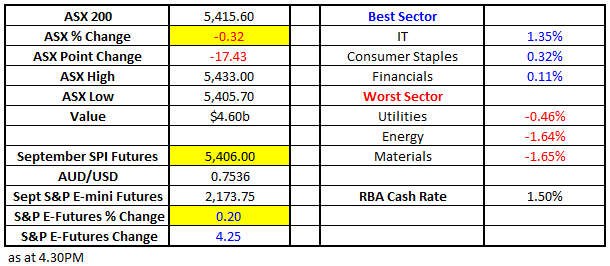

Market Data

What Mattered Today

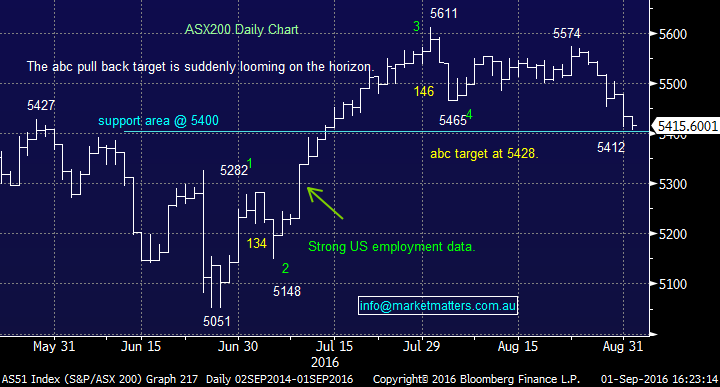

The index was fairly benign again trading within a tight range today however importantly, the 5400 level that we’ve written about numerous times continues to hold firm.

ASX 200 Daily Chart

From an index perspective, BHP weighed by nearly 6 index points after trading ex-dividend – but it was only by 18c plus franking and the stock was down 59c (or -2.89% to close at $19.84). The Oil price the main drag on BHP (and others) today with the energy sector whacked - Origin (ORG) down -3.23% to $5.09 – while Oil Search (OSH) was off by 0.97% to $6.65 although that was some way off the intra-session low of $6.56…

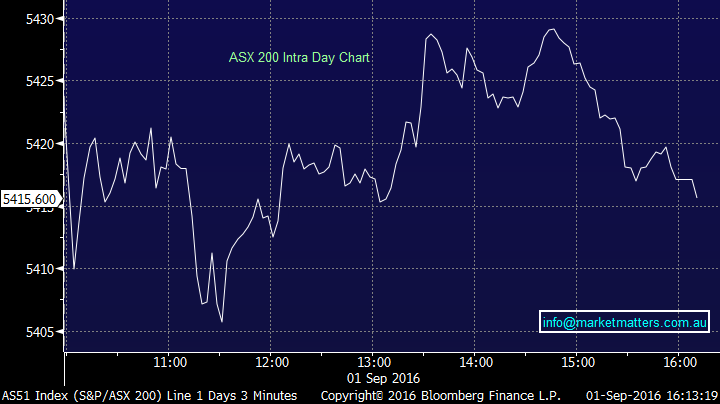

Overall, we had a range of +/- 24 points, a high of 5429, a low of 5405 and a close of 5415, down -17 points or -0.32%. A choppy session that saw some reasonably important economic news flow from Oz and China….

ASX 200 Intra-Day Chart

At 11.30am retail sales came out and were flat v a rise of +0.3% expected relative to a gain of +0.1% from last month. The Aussie dollar dropped initially but then traded higher throughout the session. As they say, one sunny day does not make a summer and it’s unlikely the RBA will be prompted to cut following one weaker than expected economic print.

In China, we had manufacturing data for August with the official print better than expected while the Caixin – which is the old HSBC number was a tad weak – but still at 50.0 v 50.1 expected so nothing overly concerning.

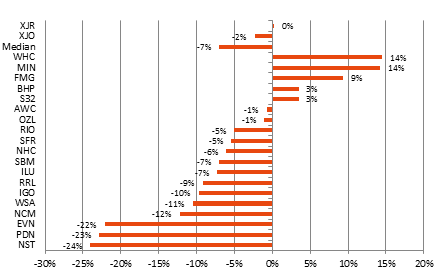

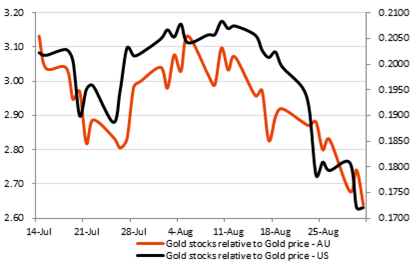

We’ve spoken a lot about GOLD stocks in recent times and it’s a sector we’re watching closely. Weakness prevailed again today with some of the names we’re watching once again under pressure. Newcrest (NCM) down another -2.25%, Regis (RRL) off -1.89%, Northern Star off -0.99%...As we’ve written lately, we’re buyers of weakness here targeting slightly lower levels. Subscribers – keep an eye out for SMS/Email alerts.

The Gold miners have been big losers in August – Of the TOP 5 Australian names – NCM, EVN, NST, SBM, RRL. Newcrest (NCM) looks the cheapest on a price to book metric but EVN and NST have really given up a lot of recent premium.

Here’s a quick chart courtesy of Shaw and Partners Research highlighting the weak performance.

Source; Shaw and Partners

Gold equities (USD and AUD) are now underperforming the physical gold price after a significant period (from 19 January low) till the first couple of days of August where there was massive outperformance….They tend to outperform when the GOLD price is rising and underperform when it’s falling.

Source; Shaw and Partners

As discussed in recent reports – we’re keen on Newcrest Mining (NCM) but at slightly lower levels…

Newcrest Mining Daily Chart

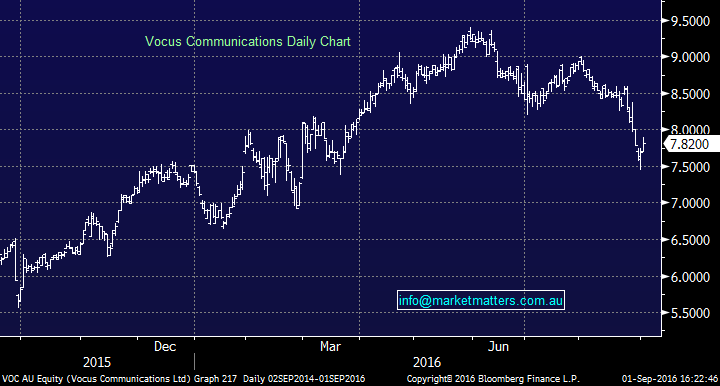

Vocus (VOC) continued to trade higher today showing further signs that the obvious seller in recent weeks is now done and dusted (hopefully). The bounce is encouraging for now and we think the stock is good value here….

Vocus (VOC) Daily Chart

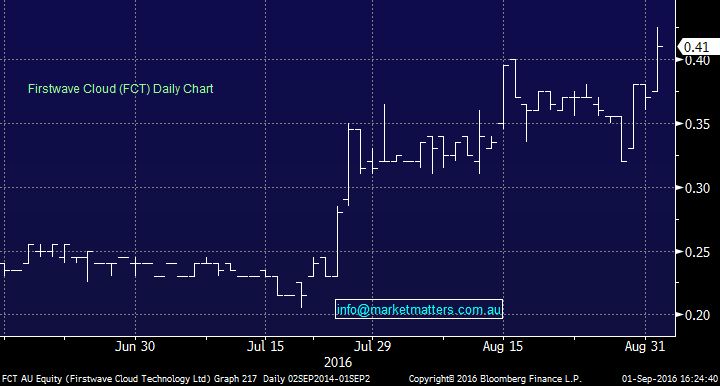

….and finally, Firstwave (FCT) is a small tech coy we’ve written about in recent times. It’s had another good day today adding +10% and now trading above 40c. Speculative but interesting!!! Good volume today.

Firstwave (FCT) Daily Chart

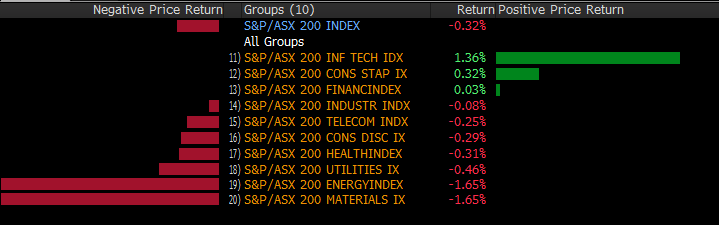

Sectors

Source; Bloomberg

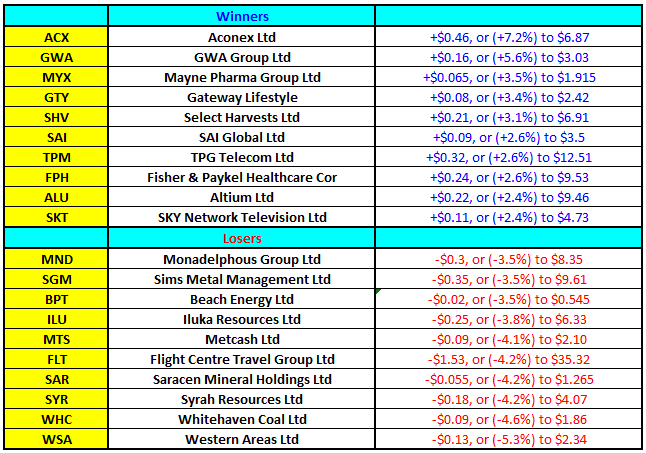

ASX 200 Movers

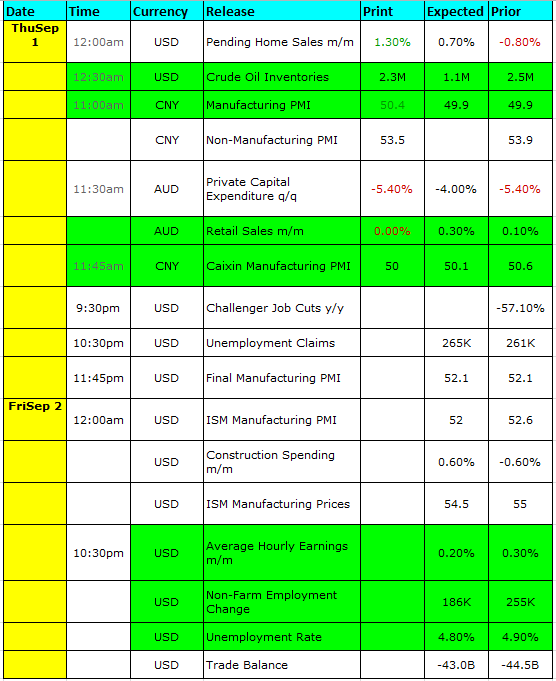

Select Economic Data – This week Stuff that really Matters in Green

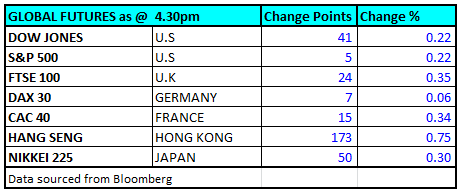

What Matters Overseas

FUTURES higher…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 1/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here