Market Matters Afternoon Report Friday 2nd September 2016

Good Afternoon everyone

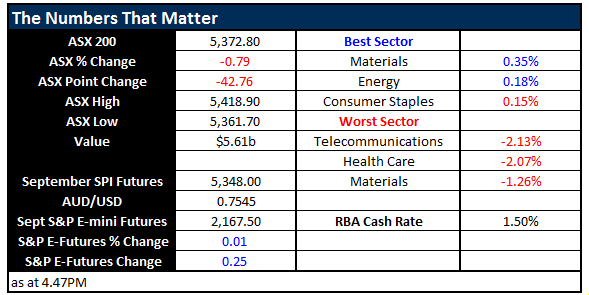

Market Data

What Mattered Today

The market broke through 5400 level today which is the main area of support we’ve been targeting for the past week or so. A break of that level is clearly a negative and puts us on a more heightened watch for a deeper pullback from here. That said, we’re only 28pts (or 0.51%) points below and we’ve had a week where the ASX 200 has dropped 3% versus the US market which is down only -0.7% - so some significant underperformance. We’re reluctant to reduce exposure after a week of such poor relative performance in Australia and will review our current positioning on Monday.

ASX 200 Daily Chart

We have US non-farm payrolls tonight which may be a big swing factor for the market. Consensus sits at +175k jobs to have been created in August with wages to increase by +0.2% for the period. The range is fairly wide from analysts (+125k to +215k) and the risk is clearly around a number that prints a long way out of this band.

A weak number and expectations for a US rate hike in 2016 will fall, putting pressure on the $US which is supportive of Gold and other commodities. The opposite would be a negative for Gold and other raw materials given their exposure to the US currency.

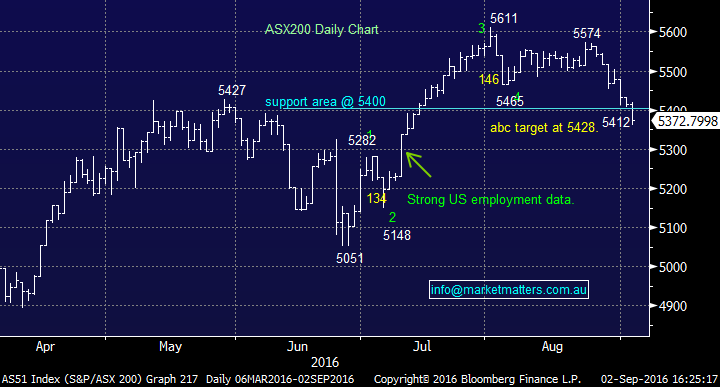

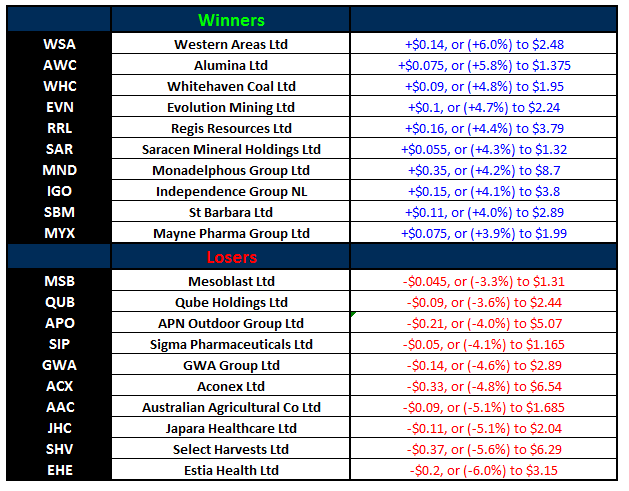

Interesting to look at trade overnight in the US, and today in Oz with the GOLDS the standout sector (on the upside) with the likes of Newcrest (NCM) and Regis Resources (RRL) in the green. We also saw some reasonably strong buying in the energy coys, Origin (ORG) and co despite a weaker Oil price overnight.

We continue to look for a reasonable entry point in Newcrest (NCM) following recent weakness and are well covered for energy exposure.

Newcrest (NCM) Daily Chart

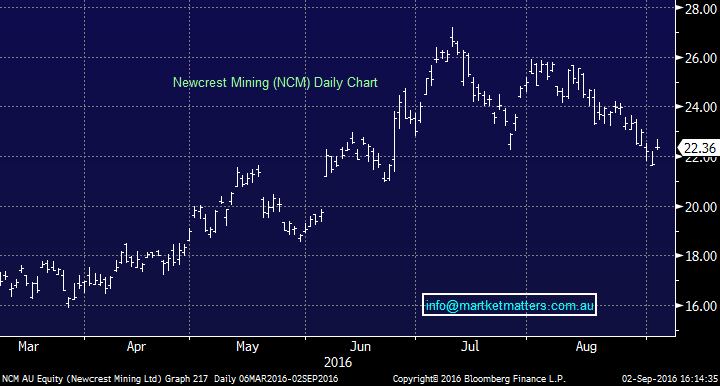

Banks were a drag today dropping somewhere between -0.81% and -1.21% however, we also saw Telstra (TLS) drop another 2.1% to close at $5.12. $4.75 is our downside target on Telstra (TLS) after having negative view on the stock since it tried to push towards $6 and failed. Their recent result was weaker than the market was expecting, they’ve got a reasonably complex path ahead to reinvest NBN proceeds into future growth and with that comes risk. At $4.75 and considering a full year dividend of 31cps that puts it on 6.5% plus franking or 9.28% gross.

Telstra (TLS) Daily Chart

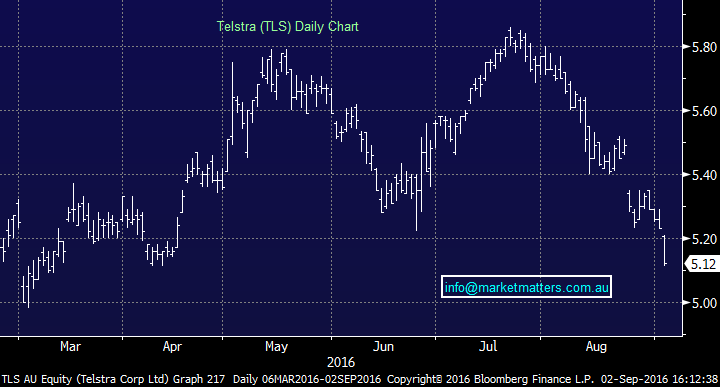

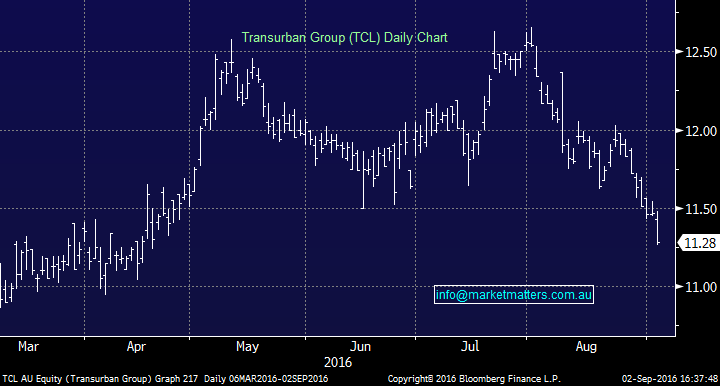

Staying with that yield theme, we’ve been fairly vocal about the risks around the expensive ‘bond like’ stocks on the ASX. The Transurban’s (TCL) and Sydney Airports (SYD) of the world. Great cash generating businesses - strong growth pipelines but they’ve simply become too expensive forced up on the back of low-interest rates. These stocks (and others of similar ilk) continue to present a risk in our view…weakness has started to play out.

Transurban’s Group (TCL) Daily Chart

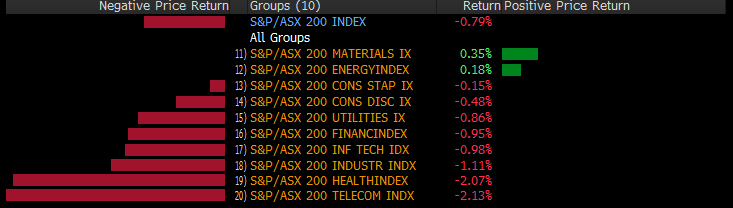

Overall today, we had a range of +/- 46 points, a high of 5418, a low of 5361 and a close of 5372, down -42 points or -0.79%. A poor week for Aussie stocks in absolute terms but even more so when we look in a relative sense v other global markets.

ASX 200 Intra-Day Chart

Sectors

Source; Bloomberg

ASX 200 Movers

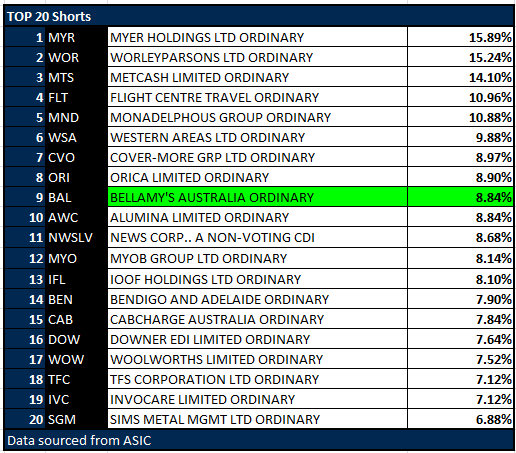

Top 20 Shorts

We met with Laura McBain (MD & CEO) of Bellamy’s (BAL) in a presentation today and its fairly clear that BAL is a high quality business with some great prospects – and above all, a very strong leadership team behind it. It’s set for growth and unfortunately at the moment, priced accordingly. We continue to keep a close handle on BAL for trading opportunities.

The other interesting aspect is they’ve got a large short position in the stock – just shy of 9% or 8.5m shares. It traded 783k shares today which is down on average but goes some way to show the potential upward pressure if shorts are forced to cover. The Q is though, why such a high proportion of shorts in such a high quality business?? Exposure to and scepticism of China is the obvious answer given they’re exposed to and will be impacted by Chinese regulation – which is a big swing factor. Understandably, the company is perplexed, as they should be.

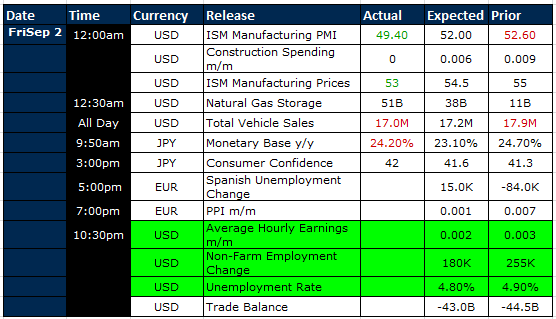

Select Economic Data – This week Stuff that really Matters in Green

US Non-farms the main game for markets this evening.

What Matters Overseas

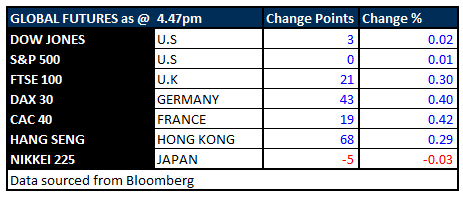

FUTURES Higher…

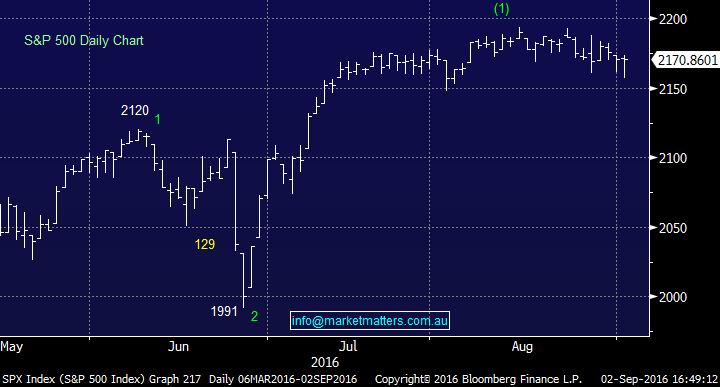

Good turnaround in US stocks overnight and the S&P 500 remains bullish. We continue to target a new high for US stocks and that has formed the basis for our positive view on Aussie stocks – which have clearly struggled this week .

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 2/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here