Market Matters Afternoon Report Monday 5th September 2016

Good Afternoon everyone

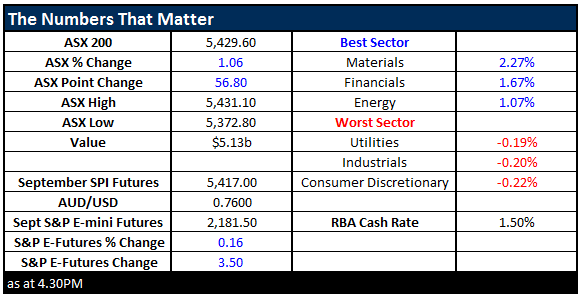

What Mattered Today

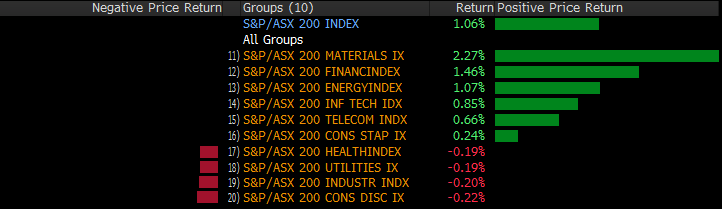

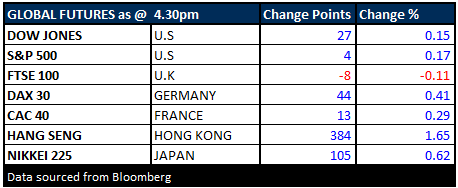

The market came back with some force today following some fairly obvious underperformance versus other global markets last week where we saw positive performances from S&P500 +0.5%, UK FTSE +0.8%, German DAX +0.9%, Japan's Nikkei +3.4%, Hang Seng +1.6%, Canada +1.1% and New Zealand +0.5% while the two weakest links were the ASX200 -2.6% & China -0.1%.

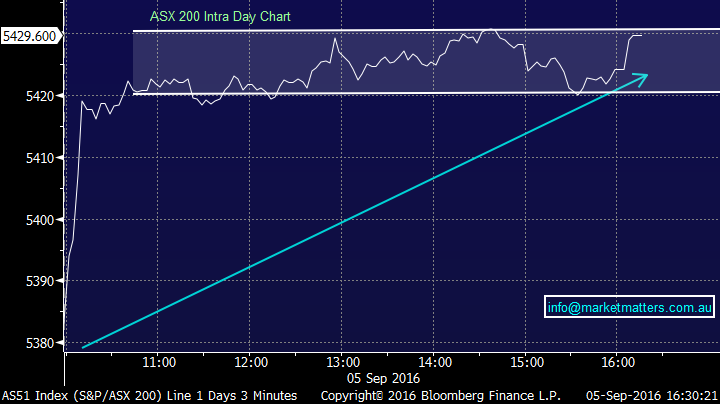

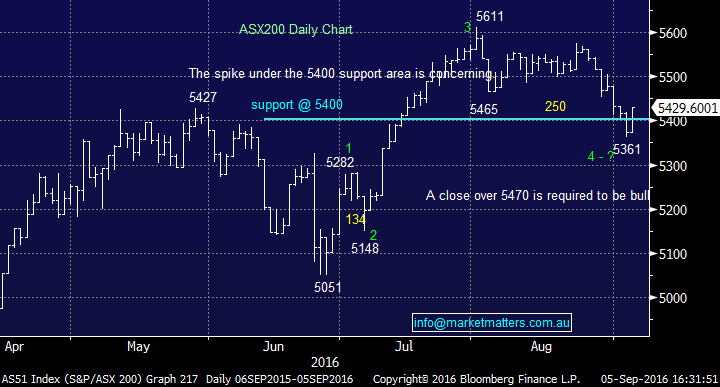

Clearly, we played some catch-up today – and rightly so with the index opening strongly before trading in a range for much of the session. A close on the session highs is encouraging particularly given there’s no trade in the US tonight. We had a range of +/- 49 points, a high of 5431, a low of 5382 and a close of 5429, up +57 points or +1.06%. Importantly, the 5400 region we highlighted last week as a potential tipping point is now back in play. We were reticent to reduce exposure last week - given the obvious underperformance of our market, so we maintained our positioning.

ASX 200 Intra-Day Chart

On the daily chart, we’re back up above support as shown below, and the nature of the buying today was strong – particularly in the resources and the banks. The banks accounted for nearly half of today’s gains for the ASX 200. We’re overweight the sector from a short-term tactical sense, however, will be wearing our sellers hat into any reasonable strength.

ASX 200 Daily Chart

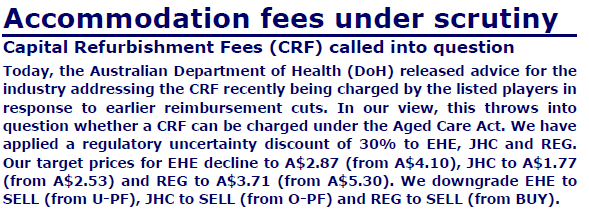

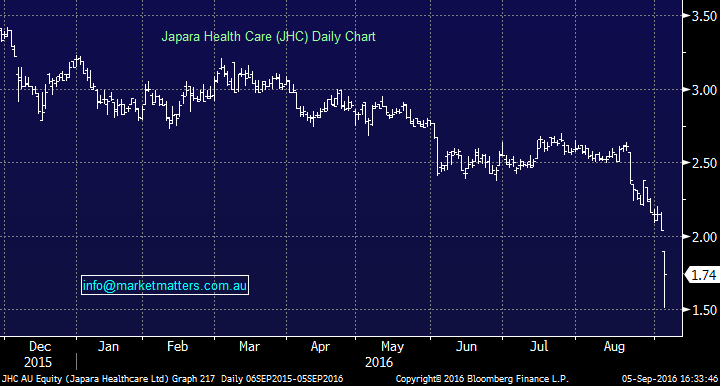

The Aged Care stocks were pummelled again today and suddenly the theory of an aging population – huge demand outstripping supply for aged care places – structural tail-winds for an industry that is ripe for consolidation all seem like distant memories.-

Research House CSLA downgraded all three listed players to a SELL which caused a pretty savage rout in the sector today with Estia Health (EHE) down 11.75% by the close although they were down -31% at their lows, Japara Health Care (JHC) lost -14.71% however, was down -25% at the lows while Regis Health Care (REG) – which is meant to be the lowest risk – highest quality operator in the sector fell -16.67% - which was actually +7.5% up from the intra-session lows.

MASSIVE volume on all three names and to us it had all the hallmarks of a panic low in early trade this morning. EHE normally trades about 4m shares – today they did 21m, JHC normally trades about 2m shares, today they did 26m and REG traded 7m shares today versus their average of less than 1m.

Without going into too much depth, the Department of Health has issued a new paper outlining what operators can and can’t charge residents in terms of fees, and there is concern from the market that this implies some of the additional charges which were going to offset the impact from changes to the Aged Care Funding Instrument ACFI) announced earlier in the year which would cut about $20 a day of Govt funding from the average bed. It was thought that the sector would simply pass on the added cost impost through other fee types to residents – and that now seems unlikely.

In short, CSLA which has a reputation for being exceptionally bearish on particular themes applied a ‘30% regulatory uncertainty discount’ to the sector and amended their valuations accordingly. This looks like a ‘scorched earth’ approach to us, and today's massive volume, capitulation style move early on has the characteristics of a low – although that said, we have no exposure to the sector.

Here’s what CLSA had to say.

Source; CSLA

Estia Health (EHE) Daily Chart

Japara Health Care (JHC) Daily Chart

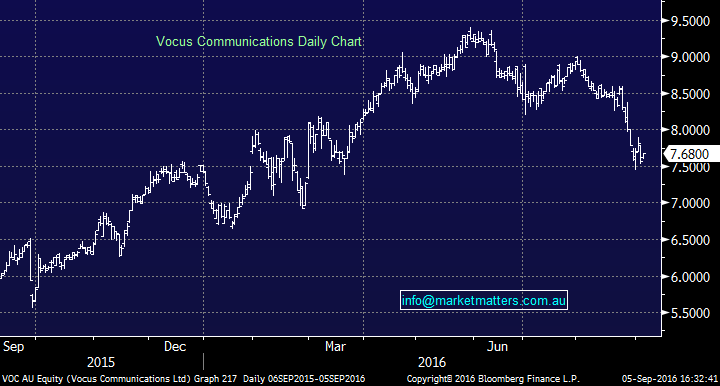

We attended a presentation with the CEO of Vocus (VOC) today along with the major shareholder (and founder of M2 Telecom) Vaughan Bowen. We own VOC in the MM portfolio and continue to think it’s a stock with strong growth potential – reasonably priced at the moment which is rare.

VOC built a very good network and have subsequently merged with M2 Telecom to acquire users. They’ve bolted on a couple of other acquisitions and are now in the bedding down phase – or as some put it, it’s now time to execute a clean integration on their big picture plans. We’re comfortable with our holding at present.

Vocus (VOC) Daily Chart

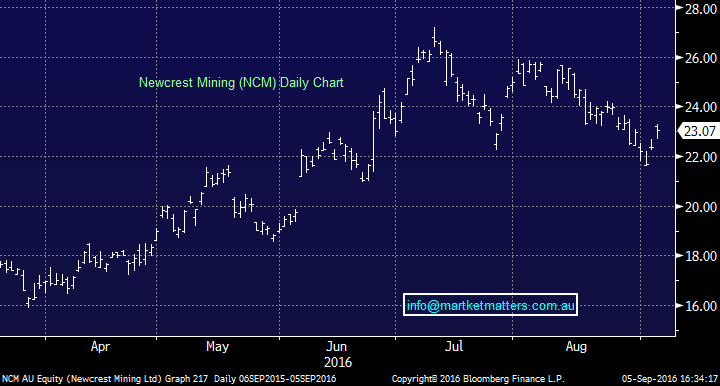

…and finally the GOLDS were reasonably well supported today and we discussed these in the weekend report on Sunday. We continue to look for good risk / reward entry points into the sector. It interesting to see Evolution (EVN) bounce the best +6.7% in the GOLDS today followed closely by Northern Star (NST) +4.2%. These two were the worst performing gold stocks (we follow) in the recent pullback. EVN lost -22% and NST was down -24% v the gold price which fell around 5%. Highlights the approach of buying weakness – selling strength!

The three-day rally in Newcrest (NCM) we’ve seen from sub $22 – although positive – does not look strong. Daily closes a long way off session highs, no meaningful uptick in volume etc. It looks like it being dragged higher reluctantly at this stage!

Newcrest Mining (NCM) Daily Chart

Sectors

Source; Bloomberg

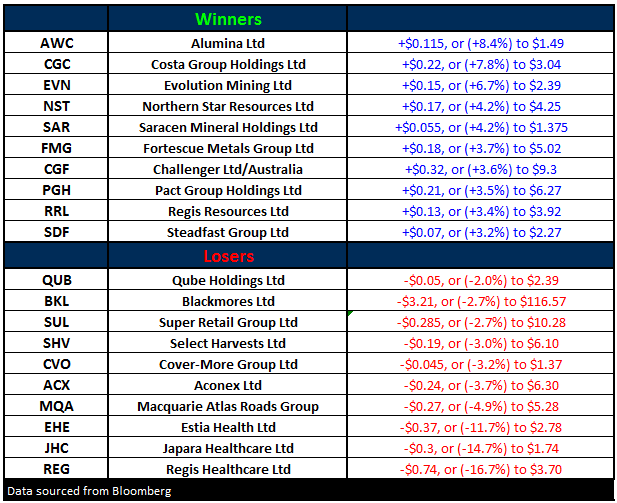

Movers

Blackmores (BKL) continues to feel the pinch of late and looks sick on the charts.

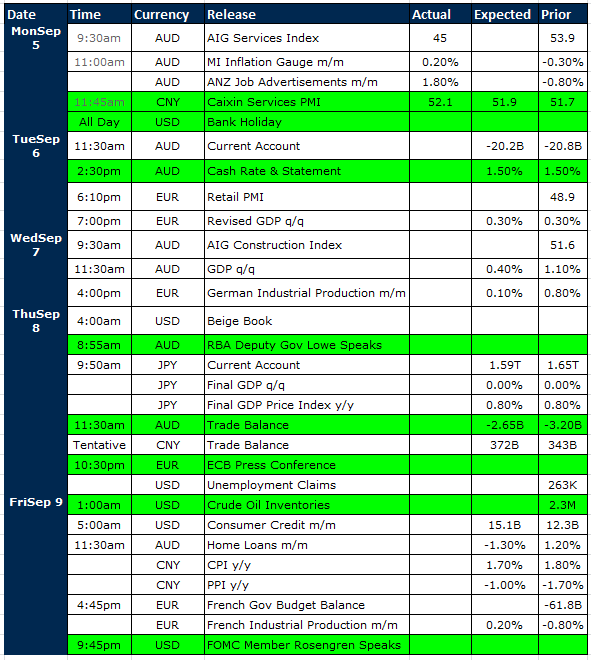

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

US Market + the Canadian bourse is closed tonight

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here