Market Matters Afternoon Report Thursday 8th September 2016

Good Afternoon everyone

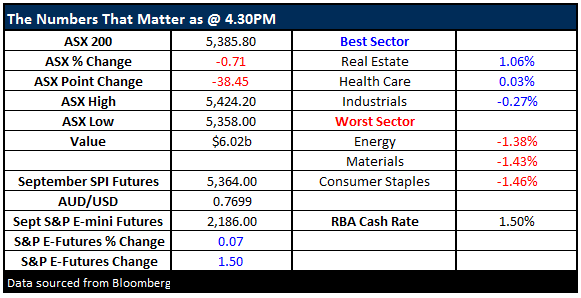

Market Data

What Mattered Today

The market got hit hard this morning across the board with what seemed like FUTURES led selling. It was indiscriminate and the large capswhere hardest hit. Someone out there was running with the SELL AUSTRALIA thematic today and the futures were under significant pressure from the get go – which obviously flowed through to stocks. A low at 10.30am before a fairly reasonable recovery late in the session saw the market finish down – but not as much as it was.

We had a range of +/- 56 points, a high of 5416 a low of 5358 and a close of 5385 down -38 points or -0.71%

ASX 200 Intra-Day Chart

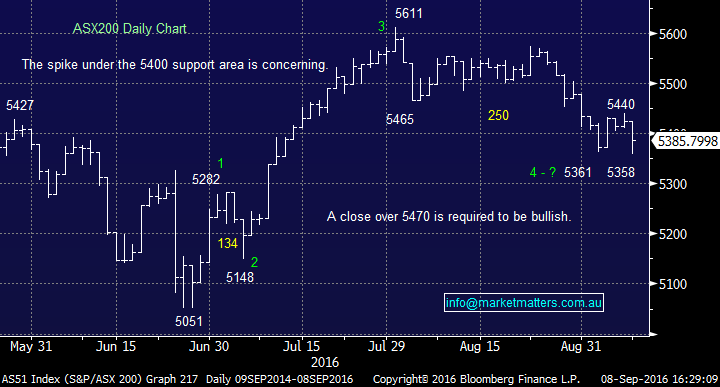

Selling ticked up a few gears when the index broke below 5400 early on – which continues to be a reasonably important level for the ASX 200. Overseas futures are green, the rest of the Asia Pac region was mixed with no real pockets of major weakness so our index down -65pts – as it was early on was certainly overdone.

ASX 200 Daily Chart

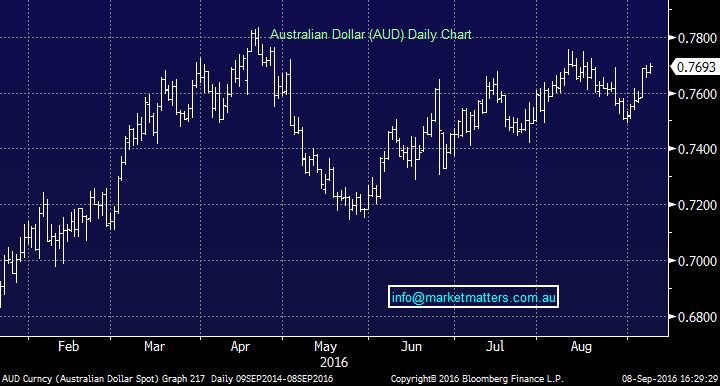

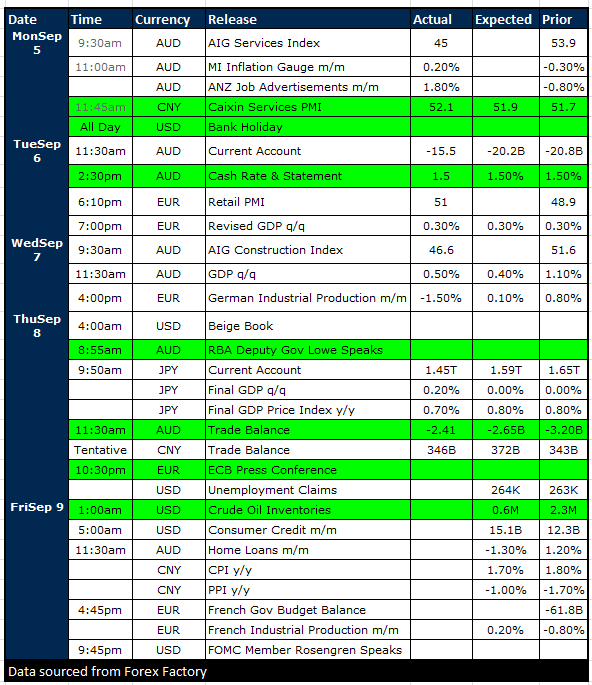

On the economic front today we had the Australian Trade Balance show a lower deficit than expected - 2.41B v -2.65B expected – which is a good thing with rising export prices offsetting largely flat imports. The Aussie Dollar is a major factor here with the +5.5% rally this year in the currency meaning the value of exports go up, although we seevolume of exports decline given the headwind of the higher currency.

Taking this number with the decent GDP print earlier in the week and the Aussie economy seems to be tracking along reasonably well. The September QTR inflation read will be key for rate decisions this year and that’s due for release at the end of October.

That said, the trend in the Aussie is clearly higher and it will take a surprise move by the US Fed to ‘HIKE’ in September for the Aussie to stay below 80c in our view.

Australian Dollar (AUD) Daily Chart

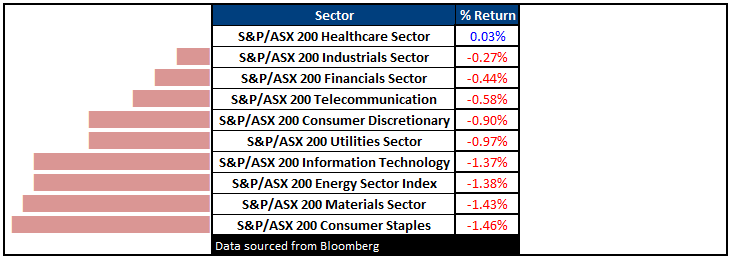

Sectors

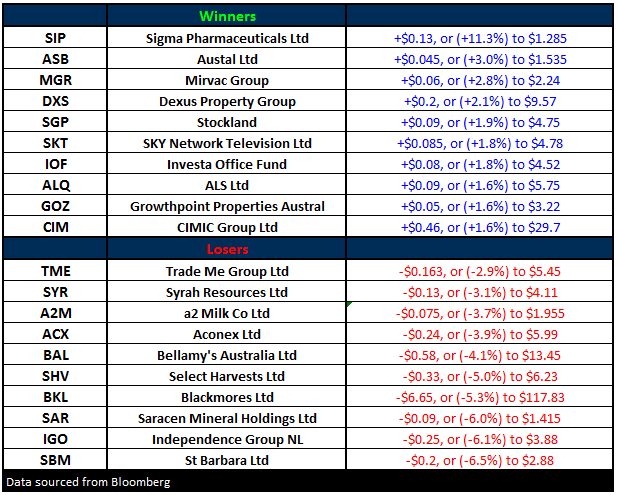

ASX 200 Movers

Select Economic Data – Stuff that really Matters in Green

What Matters Overseas

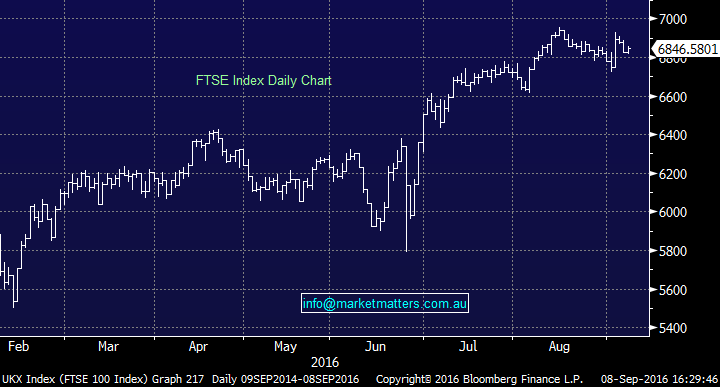

Overseas markets continue to look reasonable. Taking a look at the UK’s FTSE 100, the BREXIT panic seems a distant memory. The ebbs and flows of markets are dictated by fear and greed andclearly the BREXIT was a major fear event. When sanity prevails, the market has continued higher – helped by a weaker currency no doubt.

FTSE Index Daily Chart

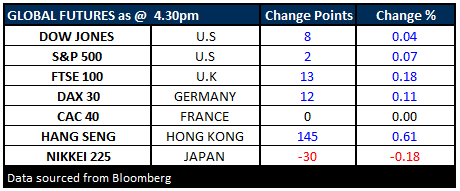

FUTURES are pointing to a higher open the

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here