Market Matters Afternoon Report Monday 12th September 2016

Good Afternoon everyone

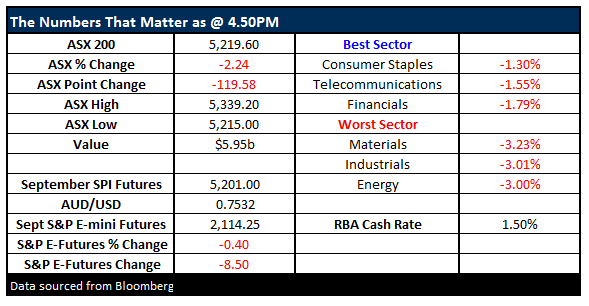

Market Data

What Mattered Today

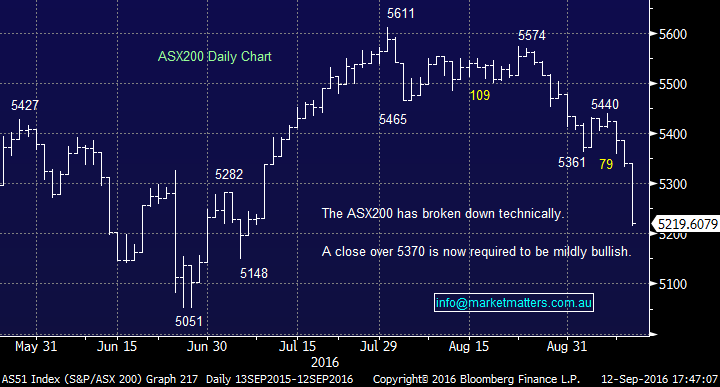

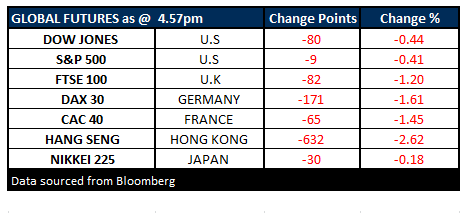

The ASX200 got hammered today as expected, but the lack of any recovery intra-day, plus yet another awful close from the futures market does not bode well for the next 24-48 hours. We closed down a depressing 120-points (-2.2%), yet all day the best bounce the market could manage was 16-points, prior to the aggressive sell-off into the close. With the Japanese Nikkei down 2.7%, New Zealand -2.5%, Hong Kong -2.7% and the US futures down 0.6% at the time of writing this report, it's no surprise that buyers did not resurface with any enthusiasm - we actually performed ok on a relative basis!

Unfortunately and technically, we believe the local market has broken down and we will look to reduce our market exposure into the next 80-100 point bounce. The next 2 levels of support are at the 5150 and 5050 areas respectively.

ASX 200 Daily Chart

ASX 200 Intraday Chart

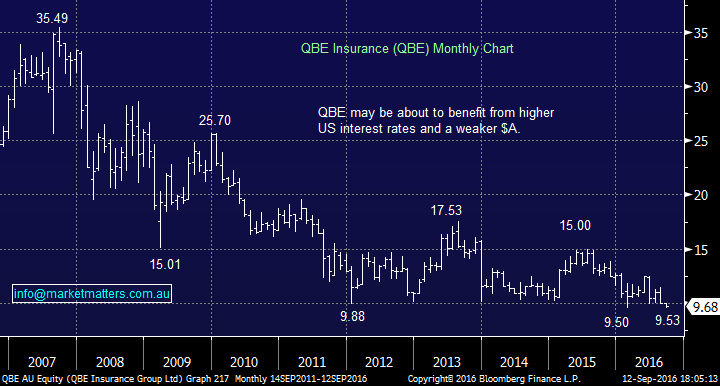

Stock markets are coming under pressure, as bond markets start pricing in higher interest rates and it comes as no surprise that one of the very few stocks that managed to close in the black today was QBE Insurance, whose profitability benefits from higher US interest rates and a weaker $US.

Technically and fundamentally we like QBE but ideally would be buyers under $9.50.

QBE Insurance (QBE) Monthly Chart

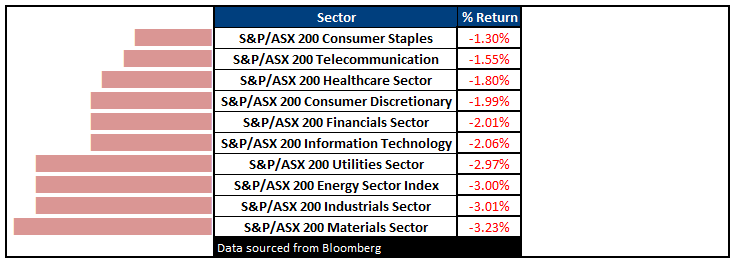

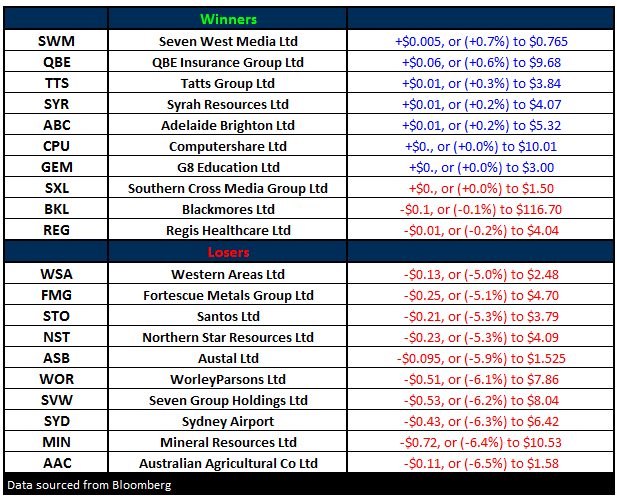

Within the market itself, there were few standouts in either direction, with most stocks / sectors very weak.

A few stocks / sector that caught our eye were:

1. CBA only down 0.9%, as it received a "safety" bid.

2. Stocks that have performed well over the last month / year, getting whacked as investors grabbed any remaining profits e.g. Macquarie Bank (MQG), JB Hi-Fi (JBH) and Challenger (CGF).

3. The energy sector underperformed, falling 3% after enjoying a strong Friday.

4. Major resource stocks underperformed with BHP, FMG, S32, NCM and FMG all down over 4%.

5. Quasi-bond stocks that we have been bearish were getting thumped e.g. Sydney Airports (SYD) -6.3% and the REIT's -2.9%.

We reiterate that while it's not time to panic, this is the first time in 3-years that we have no interest buying an aggressive sell-off.

Sectors

Source; Bloomberg

ASX 200 Movers

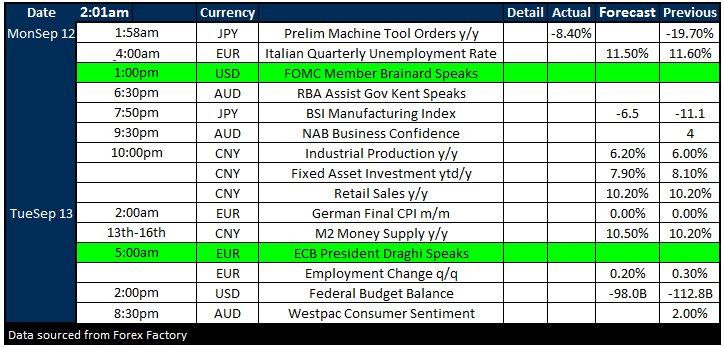

Select Economic Data – Stuff that really Matters in Green

What Matters Overseas

FUTURES LOWER…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here