Market Matters Afternoon Report Tuesday 13th September 2016

What Mattered Today

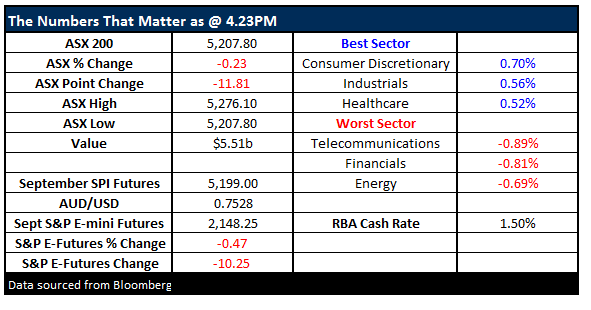

We opened with a BANG this morning up +56pts on the back of a good lead from US markets with the DOW putting on +240pts – recouping about 60% of Fridays big sell off. Early buying was short lived and selling pressure kicked in from 10.30am onwards. Stocks were offered all day with weakness in US FUTURES adding to the pain. A range of +/- 69 points, a high of 5276 a low of 5207 and a close of 5207 down -11 points or -0.23%

ASX 200 Intra-day chart

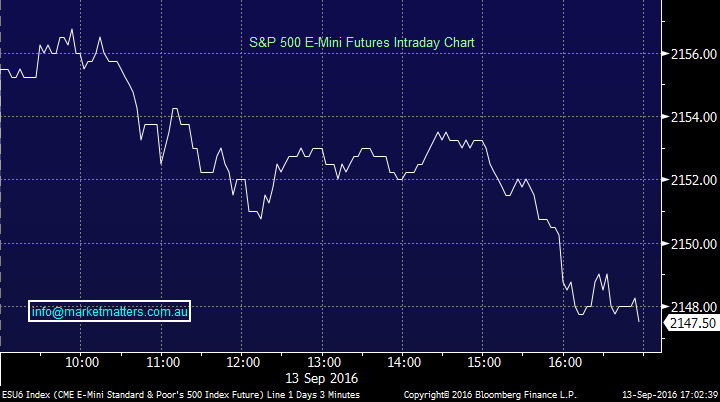

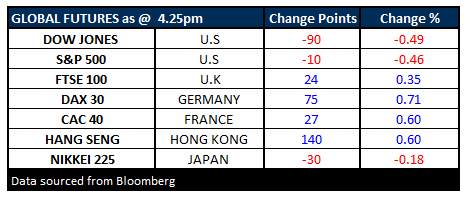

US Futures Today

It felt a lot worse today particularly following the beat up the market received yesterday + the positive start we saw this morning. We wrote yesterday afternoon that we’d look to increase cash on any 80-100pt rally and we were almost there this morning. We’ll continue in that frame of mind over the coming days with the view of increasing our currently low cash levels.

ASX 200 Daily Chart

Clearly, it’s been a very tough few months in the Australian market with the ASX 200 falling -404pts or 7.2% from the 1st August high while the US market has fallen just 1.5% from their recent high – a theme that we failed to predict.

Source; Bloomberg

It seemed that a tightening policy bias in the US would be the catalyst for some potential underperformance there, whilst a recovery in commodity prices, clarification around bank capital requirements and an easing bias from our own central bank would be the basis for some local outperformance. We also watch Emerging Markets closely and the flow of money into those markets was starting to become obvious – again, another reason to think that Australia would perform well relative to the US and other developed markets.

Unfortunately, to date, that has not played out and we find ourselves down for the calendar year by -1.66%. The easiest way to react to a tough period in the markets is to be annoyed, to cast judgments and become disengaged. During these periods it’s important to understand that tough periods happen, they’ll continue to happen – that’s the reality of the market and more importantly, that’s the reality of investing / trading the markets as we all do.

As we’ve written in the last day or so, the market had technically broken down after breaking the 5400 level and todays weakness from early on in the session is supportive of that view. When markets move one way with some aggression, as we saw yesterday and again from the highs early on today, we will often see counter trends rallies and that is generally the time to be reducing exposure. We had one this morning however it failed (only just) to reach our suggested +80pts bounce.

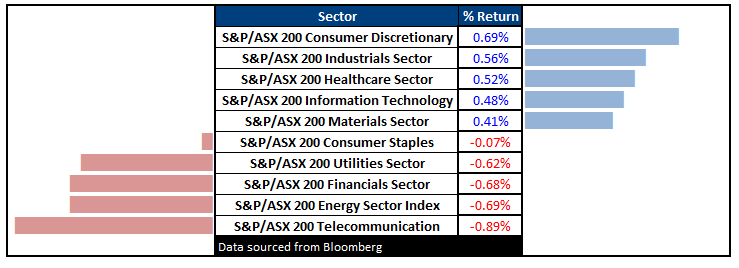

In terms of stocks, the hardest hit names in recent times have been the quasi-bond type names, infrastructure, telco’s, real-estate names – the sectors we ‘ve highlighted as a risk for some time now – they’ve copped some significant selling as US interest rates have moved higher. If we focus on the Real Estate sector (REITs), they still trade at about a 25% premium to their Net Tangible Assets (NTA) on average – which is still high – and clearly there is plenty of room for further weakness as interest rates rise – which they will.

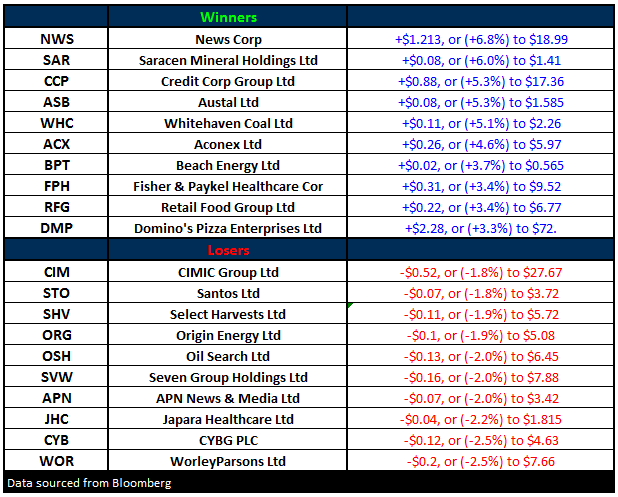

We flagged the banks as stocks to benefit from higher interest rates – if rates are moved higher gradually. QBE was another ‘relative performer’ today given they like higher interest rates and a higher US currency (given their earnings flow back into Australia). Computershare (CPU) is another stock to benefit from high rates given they hold shareholder funds before distributing them, beaten down aged care stock hold funds, and they too would be a beneficiary of higher interest rates, however they’re exposed to local interest rates rather than overseas rates, while more broadly, growth stocks over and above yield stocks should be more heavily focussed upon in an environment of higher interest rates.

We’ll cover more of these names in morning reports over coming days.

Sectors

ASX 200 Movers

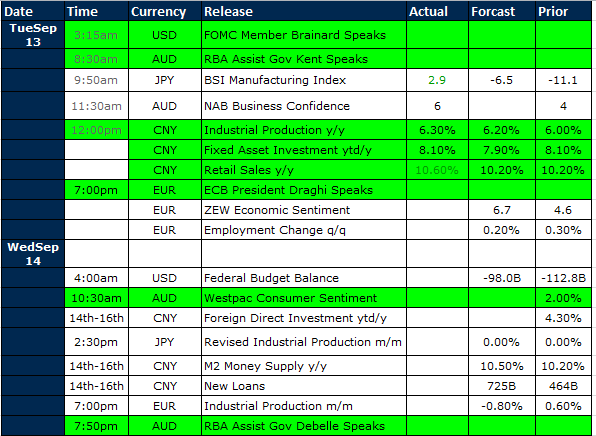

Select Economic Data – Stuff that really Matters in Green

What Matters Overseas

Futures are once again pointing to a lower open overseas…Much of today’s weakness was led by US FUTURES. Interestingly Mario Draghi – ECB President speaks tonight…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here