Market Matters Afternoon Report Thursday 15th September 2016

Good Afternoon everyone

What Mattered Today

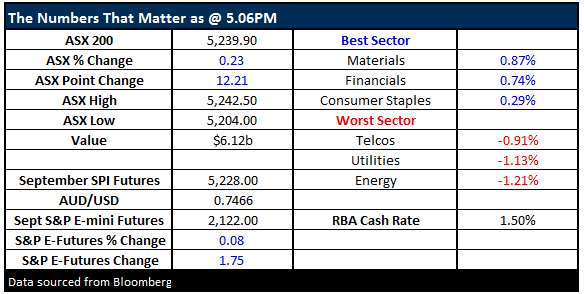

A pretty good effort by the local market today – bucking weakness overseas with the ASX closing in the black. A weak open with index options expiry saw the market down about 30pts early – before a pretty solid recovery took hold from midday onwards. A range of +/- points, a high of 5230 a low of 5192 and a close of 5228, up +20 points or +0.38%

ASX 200 Intra-day chart

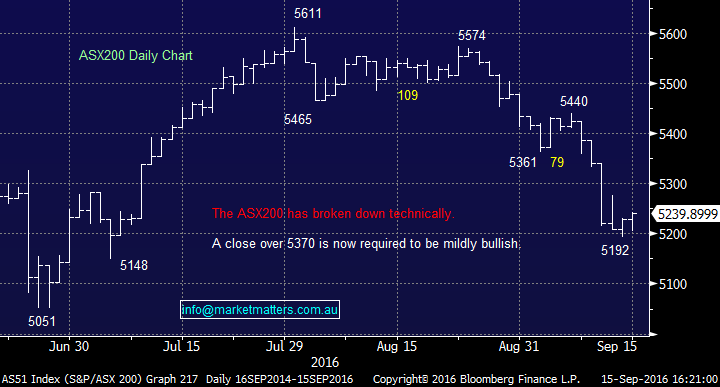

ASX 200 Daily Chart

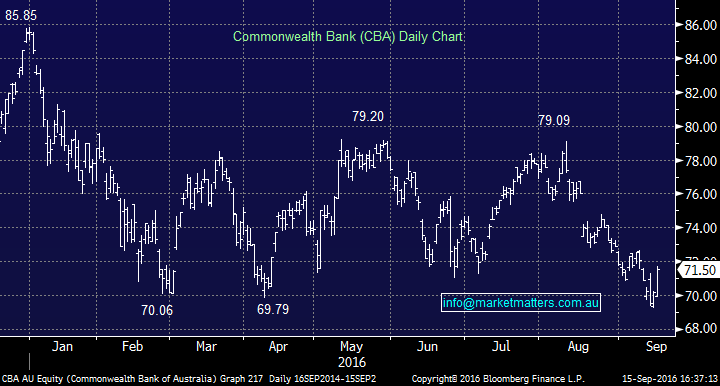

Goldman Sachs + Macquarie both upgraded Commonwealth Bank (CBA) today and the stock put on +1.91% to close at $71.47. Goldman’s were the more bullish of the two calling it a BUY and giving it an $82.79 price target – implying +18% upside from yesterday's close.

The rationale is probably most interesting.

1.The stock has dropped more than the sector has, largely a result of some PE re-rating, or in other words, the market believing that CBA should no longer warrant such a premium price to the others. GS reckon this is now done.

2. They also think that CBA’s earnings mix, being more housing, more deposits, more wealth management is of a higher quality than the other majors – who are more overweight institutional banking (which is under pressure)…

However, the main point of interest was around earnings expectations given their view that interest rates had now bottomed. We have also incorporated our economics team’s view that the easing cash rate cycle has now ended. As a result, we upgrade our FY17/18/19E EPS by 1.3%/1.5%/1.9% (Source Goldman Sachs)

That’s a theme we’ve been speaking about in the last few weeks – and that’s the theme that had underpinned our overweight call amongst the banks. Stocks tend to perform well when their earnings are being upgraded – it makes sense. If we start to see incremental upgrades to bank earnings at a time when they’re cheap relative to the broader market, banks should outperform. Important to note here that banks are typically always cheap relative to the market – they trade at about a 10% discount, yet right now they trade at about a 20% discount to the market. Food for thought.

Commonwealth Bank CBA Daily Chart

The other sector that should see earnings upgrades are the resource stocks. Consensus commodity price forecasts are generally lower than where spot prices currently trade. Once analysts roll forward their price forecasts – we should see higher numbers for resource stocks. We put a table in yesterday afternoon about BHP’s performance relative to the index. BHP us now up since the 1st August market high and has been a clear relative performer. We use BHP as a proxy for the resource space however when a stock remains firm in a weak market, it’s a clear sign of underlying strength.

BHP Billiton (BHP) Daily Chart

Myer (MYR) reported today and they were pretty much in-line with company guidance (slightly below the market) but a weak Q4 sales print took some of the shine off the result. They’re undergoing a major (5 year) transformation strategy - which the market seems to like, given shares are up more than 40% in the last 12 months. However the result today does nothing to warm ones heart. Top line revenue still struggling, margins remain under pressure, their major competitor – DJs have continued to do better on most metrics, and importantly, competition continues to intensify.

Listening to the CEO today gave us clear insight into the complexity of this business – weather, currency, fickle consumers, staff, competition and legacy issues are just some of the considerations. You’ve just got to back management on this one and keep your fingers crossed. A trading stock at best.

Myer Holdings (MYR) Daily Chart

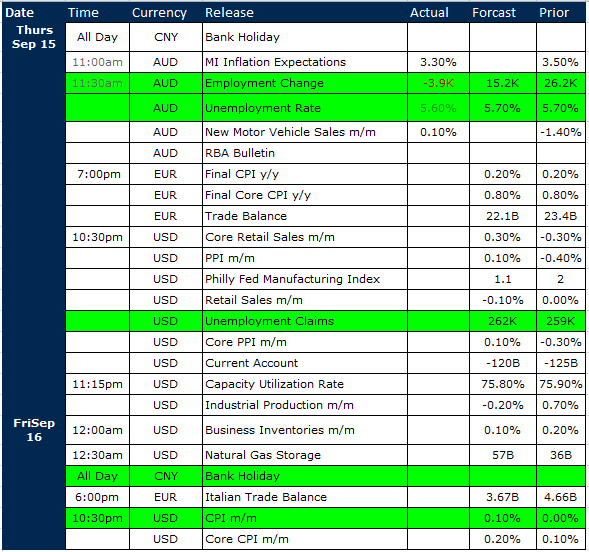

On the economic front, we had employment data today with the jobless rate down last month to its lowest level in almost three years despite a decline in overall employment. Unemployment dropped to 5.6% from 5.7% in July versus an anticipated rate of 5.7%.

Overall employment dipped by 3900 jobs v an expected 11,500 job gain however the mix was stronger with full-time jobs up by 11,500, while part-time work fell by 15,400.

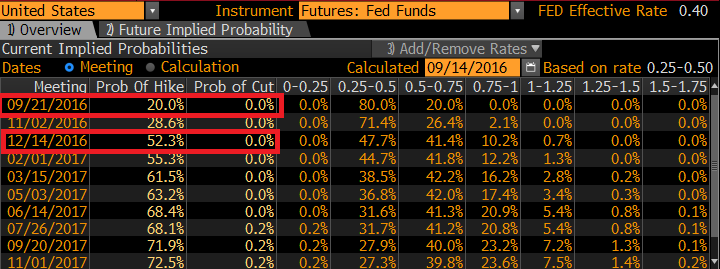

All up – nothing in this print to sway the RBA one way or another – they’ll be more focused on inflation and in particular, what happens with US interest rates when the Fed meet next week. The market has backed off on their expectations for September – now rating it a 20% probability while the market has December as a 52% chance.

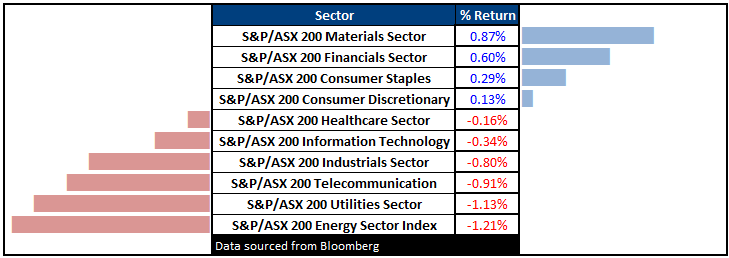

Sectors

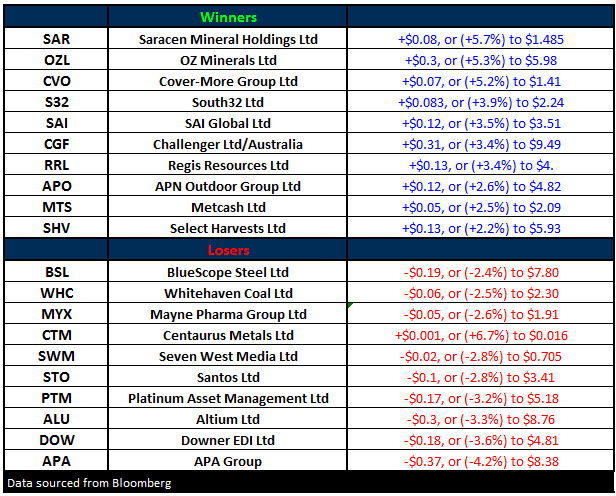

ASX 200 Movers

Select Economic Data - Stuff that really Matters in Green

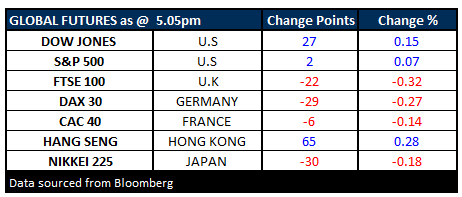

What Matters Overseas

FUTURES down in Europe – up in the States.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here