Market Matters Afternoon Report Friday 16th September 2016

Good Afternoon everyone

What Mattered Today

A good bounce in the Aussie market today with the banks once again seeing some reasonable buying. CBA, NAB & ANZ the main drivers while WBC lagged – but only slightly. Telstra (TLS) was also good today adding another +1.59% to close at $5.10 while some of the recent laggards – namely Mantra (MTR), Estia Health (EHE) and Blackmores (BKL) also had a good session – all bouncing from oversold levels.

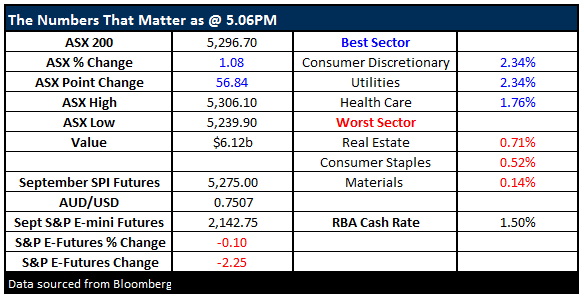

On the index today we had a range of +/-61 points, a high of 5306, a low of 5245 and a close of 5296, up +56 points or +1.08%

ASX 200 Intra-day chart

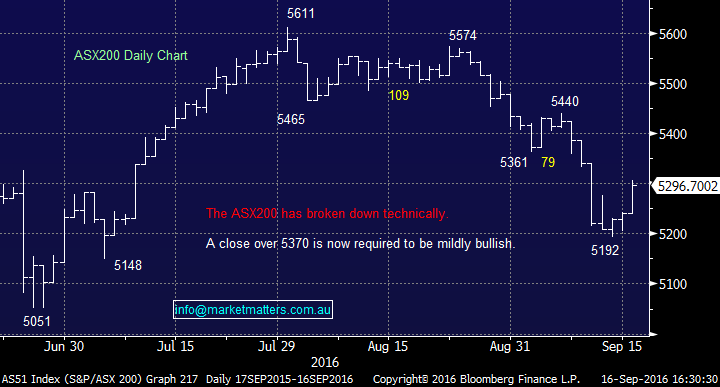

ASX 200 Daily Chart

We sold one of our energy holdings today – Woodside (WPL) – more a result of the desire to increase our reasonably low cash levels but also because it was showing a slight profit after accruing the dividend. Higher cash levels giving us more flexibility and as we’ve learnt over many years in the market, flexibility and an open mind remain one of the keys to investment success over the longer term. Investing in the stock market over and above property means we’re liquid – and can increase/decrease cash levels fairly easily. That’s primarily what we’ve done today.

As subscribers know, we trade real money in the market daily, we’re not theoretical as many are, and we wear our heart on our sleeve. We live and die by our calls and at times they’ll simply be wrong . Market Matters isn’t for everyone – we realise at times we can be an acquired taste, but the most important aspect in our minds, the real basis for why we write reports and communicate with our subscribers, is to call it as it is. The good, the frustrating, the bad and the confusing. When a week comes to an end we often reflect. It’s been a tough one – not doubt about it – but we’ve had many weeks like it in the past. If making money from the stock market consistently was easy, we suspect they’d be very few people reading this report today. That said, we’ve got a very good track record – which you can see here - and we’ll continue to put our views on the line!

In terms of Woodside (WPL), here’s some of what we wrote to subscribers today…

The market has moved up from recent lows – with the ASX 200 trading ~5300. Given our low cash levels in the Market Matters portfolio, we suggest selling Woodside (WPL) around $27.50. The position was originally purchased at $27.70 and we have accrued a 34c dividend.

We have Origin Energy (ORG) in the portfolio which will provide a more leveraged exposure to the Oil price and we are reticent to reduce our overweight holding in the banks. Elsewhere, Vocus Communications (VOC) seems to have found some support around $7.00 and has started moving higher. Independence Group (IGO) has been volatile – however, again, we see reasonable price support around $3.50 while CSL is clearly oversold after a tough few weeks.

As a result, we suggest increasing cash levels by selling our 7.5% position in Woodside (WPL) to increase cash weighting to 11%. Higher cash levels give us more flexibility to deal with the volatility likely in the weeks/months ahead.

Woodside (WPL) Daily Chart

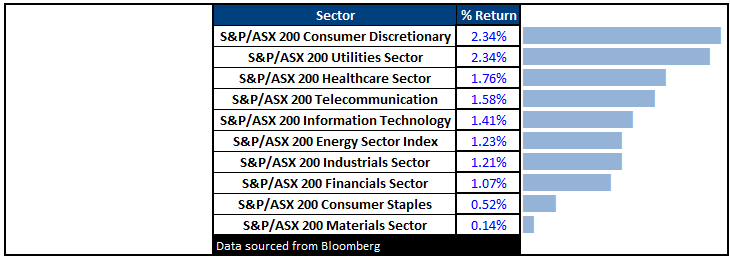

Sectors…clearly all sectors in the black today which is a foreign theme in recent times….

ASX 200 Movers

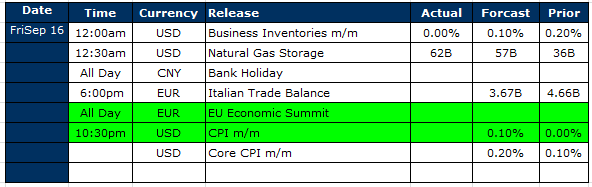

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

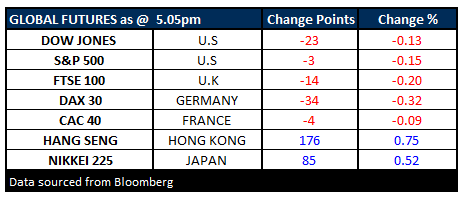

FUTURES lower – but only marginally

***Keep an eye out for the weekend report on Sunday***

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here