Market Matters Afternoon Report Tuesday 20th September 2016

Good Afternoon everyone

What Mattered Today

Another reasonable session for the broader market today with the resource stocks keying off a positive session overseas prompting some strong buying amongst the larger caps. BHP put on +2.33% to close at $20.61 while RIO – which looks bullish on the charts put on +1.55% to close at $47.25.

Banks were also reasonable following a good note from DB yesterday, which suggests that banks may not need to raise as much capital as the market is factoring in. Again, this fits with our view that banks will continue to outperform given 1. Improving margins as interest rates gradually move higher 2. Better capital positons. CBA & WBC the best on ground today adding 0.57% a piece followed by ANZ then NAB.

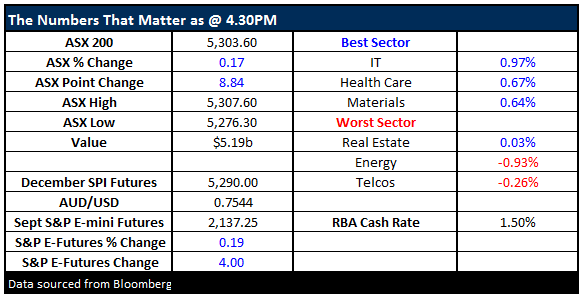

The market opened flat, was sold off early on before a post-lunch recovery played out. We had a range of +/- 31 points, a high of 5303 a low of 5276 and a close of 5303, up +8 points or +0.17%

ASX 200 Intra-Day Chart

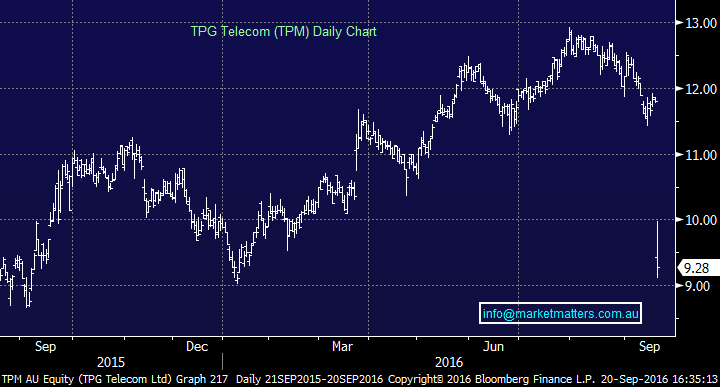

TPG Telecom (TPM) got whacked today after releasing results that were in line with market expectations – however, they disappointed in terms of future guidance. The market sold them off by 21.56% which also took Vocus (VOC) down by 3.64%. It’s just another example of the market getting too bullish on particular themes and pushing valuations to extremes. TPM was on 30 times FY16 earnings ahead of today’s result with a strong track record of under promising and over delivering - not the case today and the shares were sold off accordingly.

The 21% drop in the share price is clearly BIG however when you think consensus earnings forecasts (EBITDA) for FY17 was sitting around $884m and they guided to $820-$830m, that’s about a 7% miss plus we get a PE re-rating for the lower than expected future growth profile. The other major takeout was around capital expenditure which they reckon will be somewhere between $370-$420m – which is up from $281m last year.

That said spending is being deployed into future capacity which is good for outer year earnings but the market tends to focus on the shorter term. We saw a similar theme play out with CSL recently where higher investment into new products knocked around near-term earnings growth and the market sold the stock as a result.

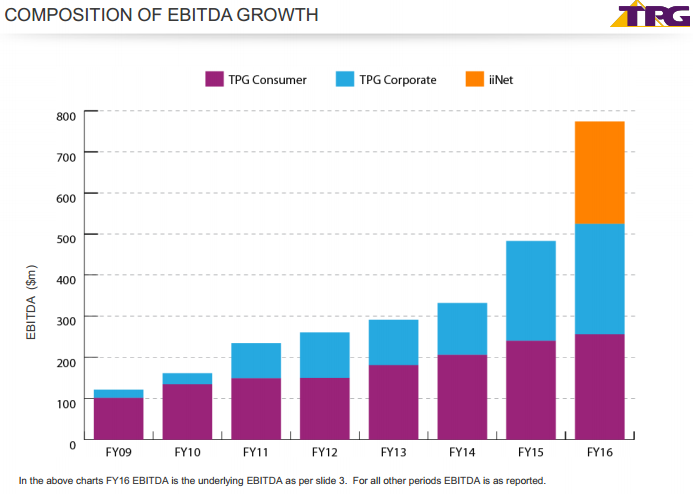

The composition of TPG’s growth is interesting, with the acquisition of iiNett shown below. Longer term subscribers of Market Matters would re-call favourably the takeover of iiNett given we had a positon in the stock at the time. Clearly TPG has grown organically over the past 7 years, however, the graph below shows that organic growth has slowed between FY15 & FY16 – and it’s simply the acquisition of iiNet that has had the most dramatic impact on earnings.

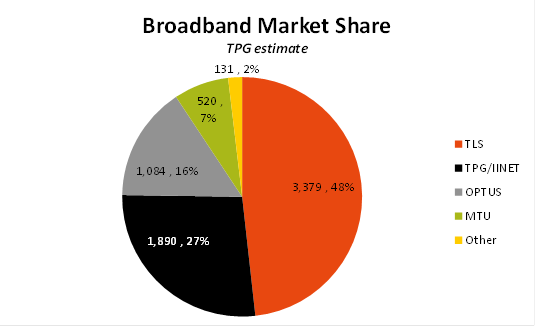

It seems the period of very strong growth for these telco businesses is coming to an end and the market has re-rated them accordingly. The next obvious growth opportunity is taking market share from Telstra (TLS) as part of the ‘NBN churn’ but this won’t be as easy as simply buying growth as we’ve seen in recent times.

Source; Shaw and Partners

The obvious question is, at what multiple should these more mature businesses trade on while they bed down recent acquisitions? Both TPG and VOC have been re-rated. TPG now trades on 17 times FY18 while VOC is on 14 times FY18. TPG is the better business, with better margins and less churn of customers, however, Vocus is cheaper and has more levers to pull in terms of organic earnings growth. We might see some meddling with the numbers today post the TPG outlook, however, we still have VOC growing earnings by more than 25% in FY17. Based on today’s guidance, TPG will grow underlying earnings by just 6.4% in FY17.

TPG made a high of $12.93 in August and today closed at $9.28; a drop of 28%.

TPG Telecom (TPM) Daily Chart

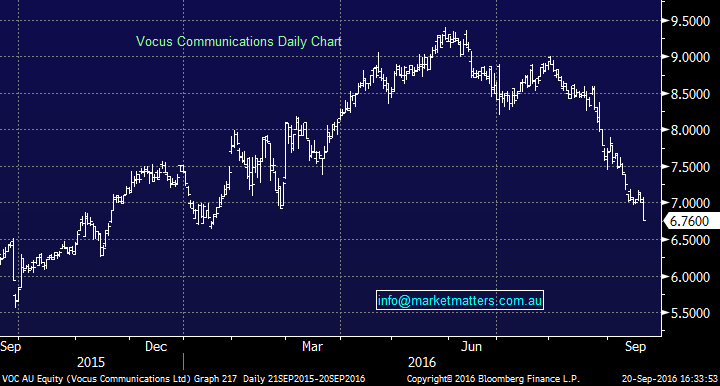

VOC made a high of $9.40 in May and today closed at $6.76; a drop of 28%.

Vocus Communications (VOC) Daily Chart

Clearly, both have come back to earth with a thud and it’s interesting to think they’ve both dropped 28% to today’s close. Taking a step back and looking at Vocus trading at $6.76, with an underutilised network, weak margins and a clear growth opportunity with the NBN, we continue to think the near-term weakness presents an opportunity in that stock, while TPG still has some re-rating left in it!

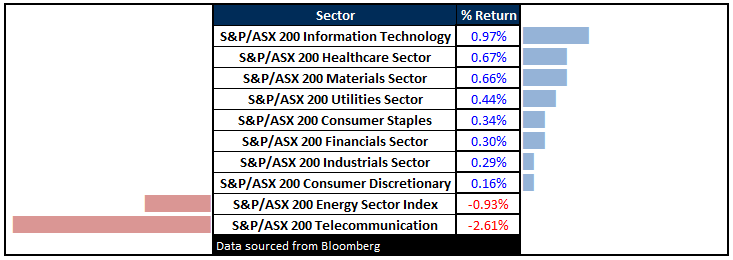

Sectors

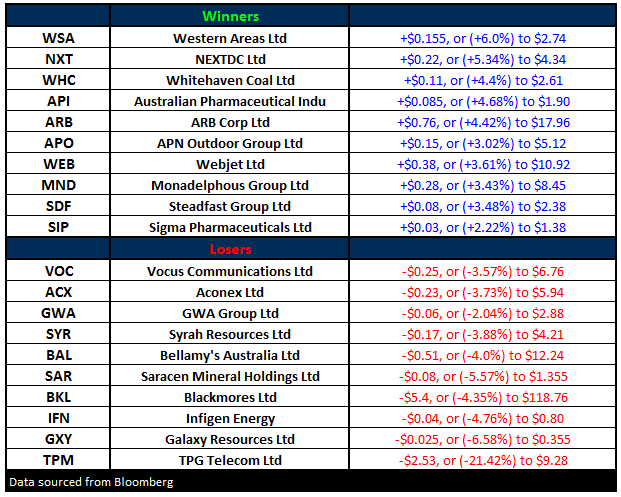

ASX 200 Movers

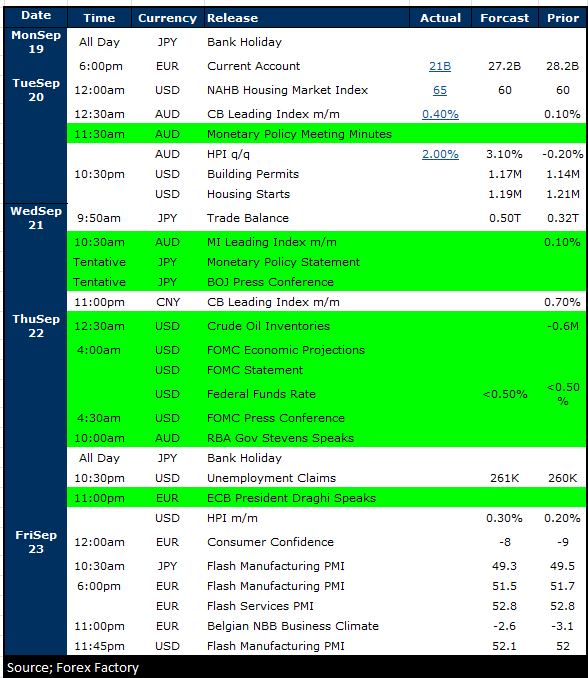

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

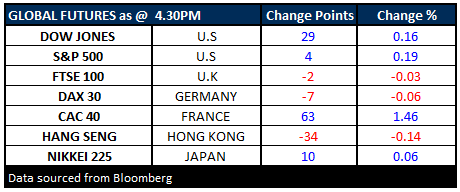

FUTURES higher in the US….

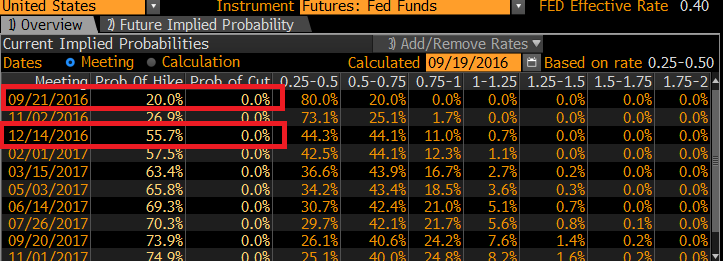

Fed meeting starts tonight and ends Wednesday with the press conference Thursday morning our time. As it stands, only a 20% chance of a Sep hike, however, the economic forecasts they publish will be the key in determining the probability for future months. As it stands, December is odds on (55%)

Source; Bloomberg

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here