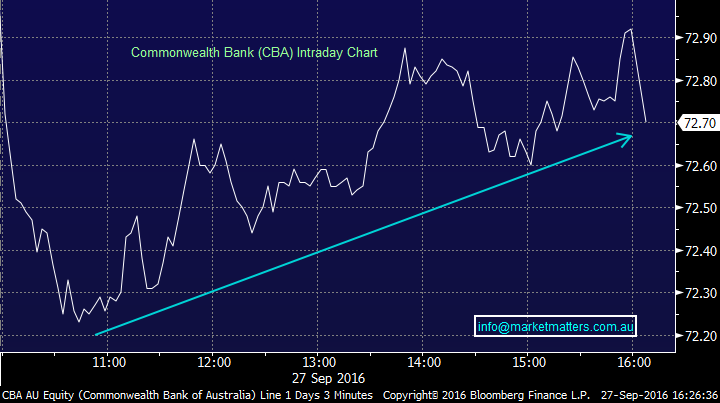

Market Matters Afternoon Report Tuesday 27th September 2016

What Mattered Today

The market opened weaker and was sold down fairly aggressively early on following the weakness across European financial stocks (courtesy of Deutsche Bank) and to a lesser degree, ahead of the first debate between Clinton and Trump which kicked off at 11am our time.

Source; http://www.abovetopsecret.com/

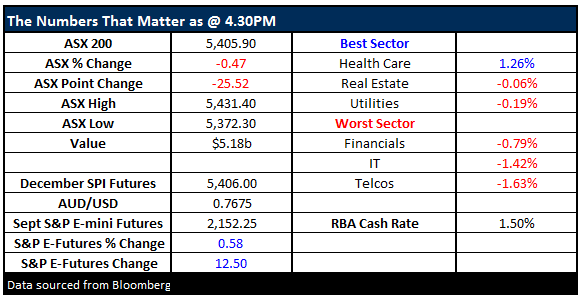

It was certainly and entertaining debate and although it seemed Clinton looked /came across as most Presidential, she did little to engage those very important swing voters. Trump lived up to his reputation with some classic one liners - off the cuff style with very little substance. “I think my strongest asset by far is my temperament, I have a winning temperament”…from the markets perspective at least, the gong went to Clinton. The Mexican peso rallied from a record low, U.S. stock index futures gained and gold retreated – which saw the Aussie market trade well up from the session lows.

Mexican Peso Vs USD Intra-Day Chart

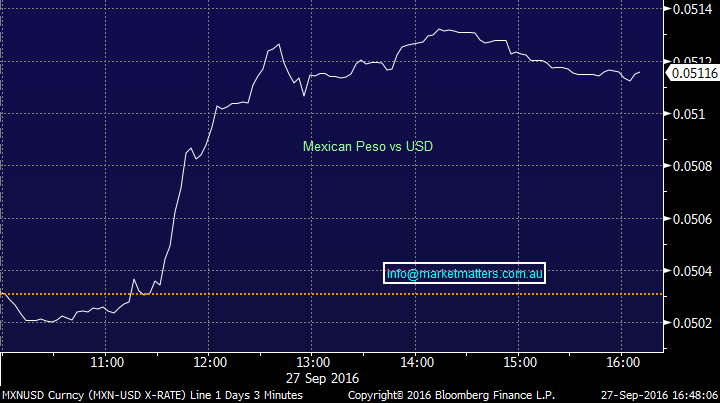

We had a range of +/- 49 points, a high of 5421, a low of 5372 and a close of 5405, Volume was again below average given school holidays. As we’ve written a number of times this week, our view is the ASX200 will spend a few days consolidating its recent gains around / above the pivotal 5400 area prior to continuing with its current advance. We saw that play out again today

ASX 200 Intra-Day Chart

ASX 200 Daily chart

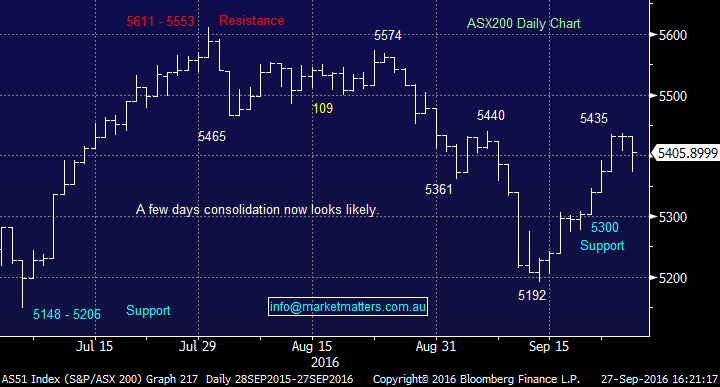

Interesting to look at the intra-session chart of Commonwealth Bank (CBA) which was down sharply in early trade before a sustained recovery played out. Interesting because banks/financials have been under a lot of pressure overseas in the last 24/48 hours and it’s obvious to see buying into this morning’s weakness – which shows underlying strength for our local banks. We’ve written a lot about this theme recently so our position is fairly clear however another positive sign today.

Commonwealth Bank Intra-Day Chart

Nickel and Gold stocks had a very good session today and that makes our holding in Independence Group (IGO) look fairly good. Close at $4.25 is around 25c below our guided target. We’re in from around $3.80.- it’s been a volatile ride!

Independence Group (IGO) Daily Chart

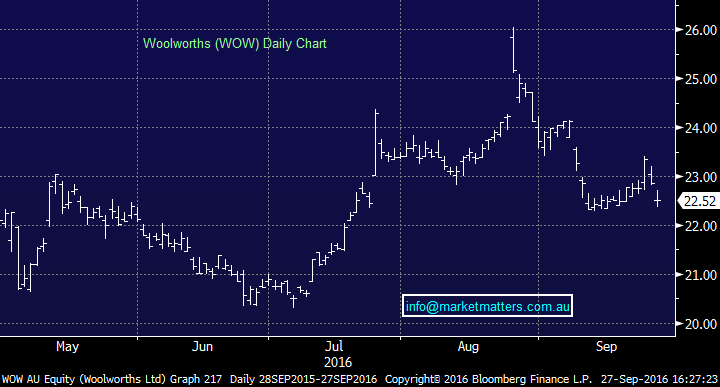

Woolies is interesting here and many are touting this as a very good turnaround play. Indeed, in June this year we were looking for a BUY sub $20 on one last capitulation style low but we were too picky and the stock rallied hard post their results to hit a high around $26. We’ve held fire for now and technically, we continue to see lower levels. The last wave of buying was weak with the stock only rallying around $1 in 10 trading sessions. Shorts are still high on this stock (nearly 8%) and it seems that another leg down is needed before that will change. This stock is on our radar but patience required here. BUY closer to $20.

Woolwoths (WOW) Daily Chart

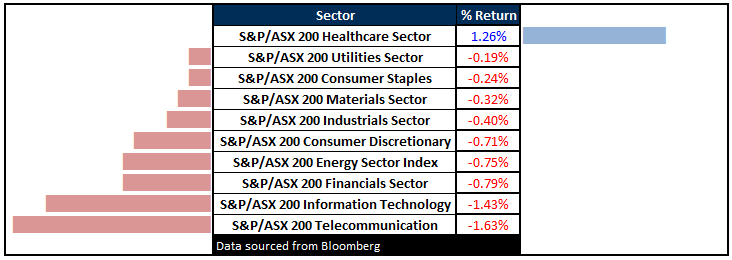

Sectors

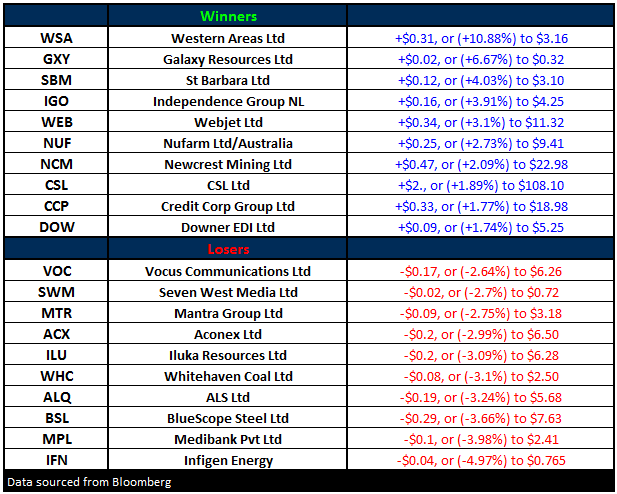

ASX 200 Movers

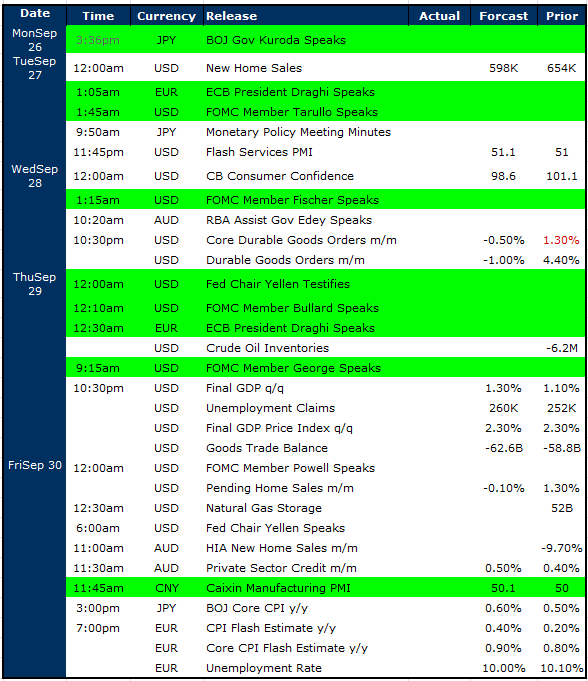

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

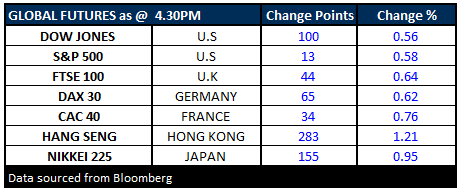

FUTURES rallied during the debate as Hillary trumped Trump….DOW up +100pts

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here