Market Matters Afternoon Report 30th September 2016

What Mattered Today

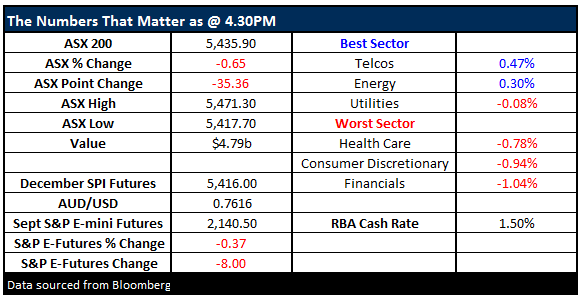

Today was extremely quiet ahead of the Labour Day long weekend - for most of Australia. Even a sharp decline of almost 200-points was not going to be enough to get the local market excited today and the ASX200 closed down 35-points, or 0.65%.

Our short-term view of the ASX200 is we anticipate further weakness next week down towards 5370, ideally prior to resumed strength.

ASX200 Daily Chart

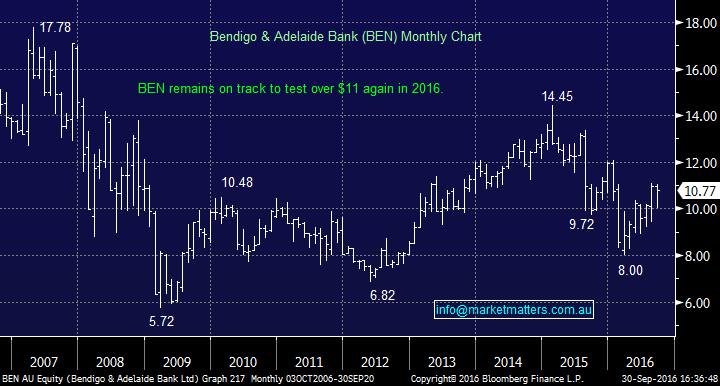

The banking sector was resilient today considering the global concerns around Deutsche Bank with the overall sector declining 0.59% and our most recent purchase in the sector Bendigo Bank (BEN) actually climbing a very impressive 24c / 2.3%. We remain bullish BEN targeting ~$11.50 in October.

Bendigo Bank (BEN) Monthly Chart

The oil sector had another solid session and managed to finished up 0.4%. We remain bullish crude oil targeting over $US60/barrel in coming months.

Crude Oil Weekly Chart

Lastly, the resources stocks gave back a little of their recent gains today but they still enjoyed a stellar week e.g. BHP +5.3% and RIO +5.4%.

For the month, the ASX 200 was marginally higher, up 0.2% with the real estate sector the outperformer for the month, up 3%. The utilities sector underperformed, down 4.5%.

SAI Global, led the way in September, up 35.9% for the month, while telco, TPG (TPM) drew the short straw, down 28% for the month.

We had a range of +/- 54 points, a high of 5471, a low of 5417 and a close of 5436, Volume finally beat the 20 day average by 24% with a turnover of $6.1b.

ASX 200 Intra-Day Chart

Interesting to look at Macquarie Group (MQG), being hit due to the debacle with Deutsche Bank, we see this as an opportunity for good risk / reward, with both fundamental and technical positive (please see further details in the weekend report).

Macquarie Group (MQG) Daily Chart

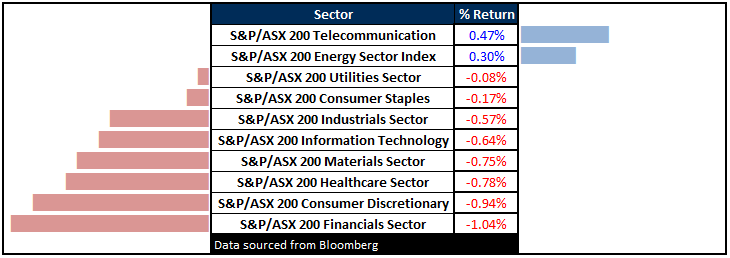

Sectors

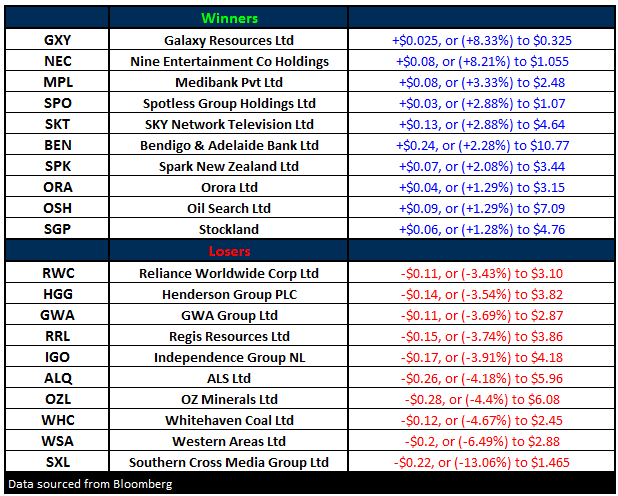

ASX 200 Movers

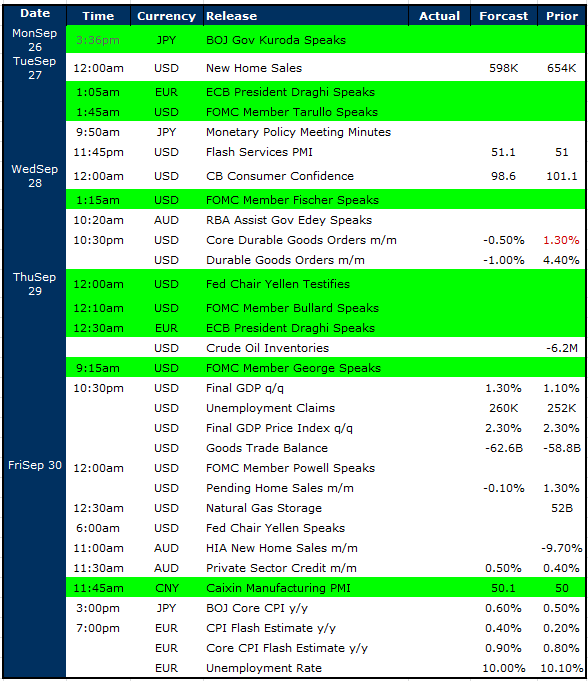

Select Economic Data - Stuff that really Matters in Green

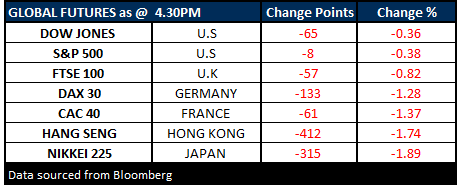

What Matters Overseas

FUTURES weaker across the globe with both the S&P and Dow Futures pointing to -0.4% weakness.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here