What’s the story with Vocus?

Good Afternoon everyone

To align our morning report format with that of our ‘arvo report’ we will now be headlining each afternoon missive with one specific topic that caught our eye. We’ll also cover other themes as we do now, however, most attention will be given to one specific aspect of the trading day – whether it be a stock, sector, market event or economic musing. With that in mind, Vocus Communications (VOC) – a stock we hold (somewhat reluctantly) will be today's feature. More on that below….

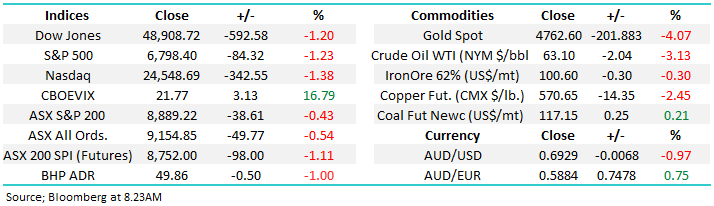

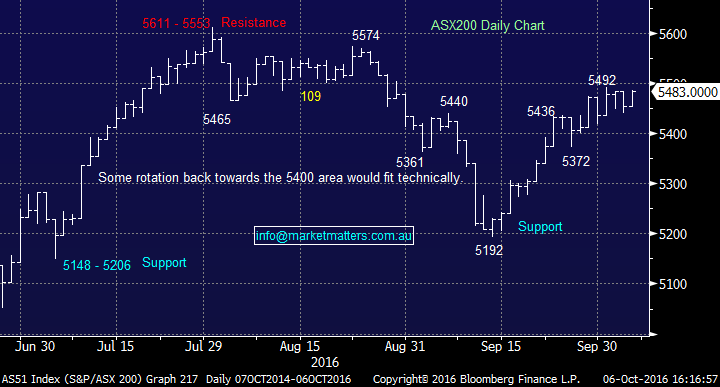

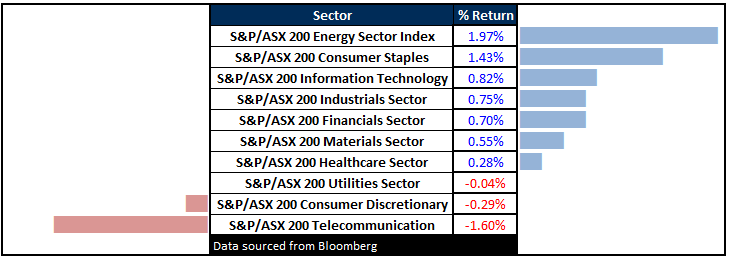

More broadly, the market was bid up again today led by the energy stocks following another +2% move higher in the Oil price overnight. WTI is now trading just shy of $50 and we continue to target ~$60. Of the majors today, Origin (ORG) and Santos (STO) were the stars adding over +3% a piece while Oil Search (OSH) & Woodside (WPL) put on almost 2%.

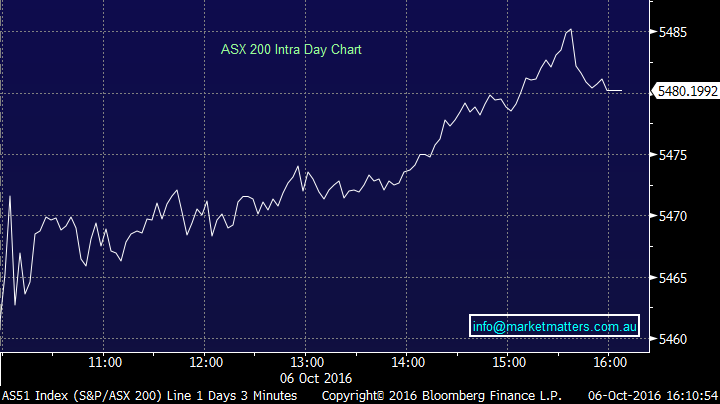

Banks continue to be well supported and we’re content with our significantly overweight positon in the sector. On the market, we had a range today of +/- 26 points, a high of 5485, a low of 5459 and a close of 5483, up +30pts or +0.55%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

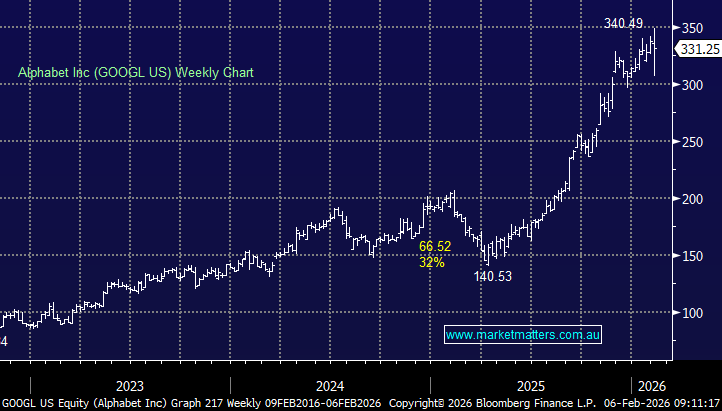

Vocus Communications (VOC) $5.83; Today VOC hit its lowest point since August 2015 at $5.52 – a drop of 41% from its high set in May this year of $9.40. We hold the stock, have an entry price just shy of $8 and are clearly feeling the pain. Do we buy, hold or fold?

First and foremost, our underlying feeling is to be a buyer rather than a seller. Clearly, there’s been a lot of mud thrown at the stock, and the sector in recent weeks. Initially the sell down from Vocus founder James Spenceley , the resignation of the CFO, the downgraded earnings outlook from rival TPG Telecom (TPM) and today we had CLSA release a research report questioning VOC’s accounting practices. When it rains it pours!

If we had our time over again, clearly it would have been prudent to cut earlier and move elsewhere particularly given our negative stance towards to broader telecommunications space. This is the primary reason why we are not averaging in further in our own portfolio. That said, if we had a smaller position - or no position at all in the stock (we have a 10% weighting) then we’d be buyers.

The main issue at the moment is uncertainty and when a stock trades on a high multiple – as Vocus did, it becomes susceptible to a fairly big correction. There’s uncertainty about the impact of the NBN, on telco margins more generally, the integration of the Amcom and M2 businesses into the Vocus framework + culture and this all filters into a greater risk margin applied by investors. In addition to this, Telco’s globally have been weak as the ‘safety trade’ unwinds.

It’s pretty clear that there is some form of conflict between M2 and Vocus management and that’s unsettling the ship. As a very learned client of ours commented recently, mergers are never as seamless in reality as they are on paper.

If we stand back and look at the facts here, Vocus Communications (VOC) reported their FY16 result on the 23rd August – was better than market expectations and management provided a positive update. For that reason, it’s highly unlikely that recent turmoil is earnings / performance related. Another update will be provided by the company at its Annual General Meeting (AGM) on or before 29 November.

Company insiders haven’t been sitting on their hands either with Director Anthony Grist taking advantage of the price falls to buy 250,000 shares on the market last week. An investment of $1.57m at about $6.30 a share. A sign of confidence.

Following the CLSA report this morning, David Spence, the Chairman of VOC has come out and confirmed that he stands by the financial statements his board signed off on only six weeks ago – as do Deloitte, the Auditors.

Following this, the stock bounced in afternoon trade to close at $5.83 – up from the $5.52 low but still down -1.19% on the session. In short, we’re holding, not folding but given the size of our existing position, we’re reluctant to up-weight any further.

Vocus (VOC) Daily Chart

Bank of QLD (BOQ) $11.15; Reported full-year numbers today that were a tad light on – about 1-2% miss on earnings while the dividend was inline (but payout ratio high at 79%). The stock dropped -2.71% however it was down more than 5% early on before some degree of sanity prevailed. The main issue comes around net interest margins, which were 1.94% v 1.96% expected however the second half was 1.90% so the trend was weak.

That said, they do struggle with low-interest rates more than the big four given they rely more heavily on deposit funding. When rates are low and term deposits are hard to sell, they need to get $$ through the door by offering better rates. That puts pressure on funding costs and margins struggle. Because of that, they made the decision during the period to be less competitive on home loan rates which will help margins (eventually) but it will impact volume growth.

The other aspect worth noting was cost growth outpaced revenue growth – the concept of ‘negative jaws’. When we spoke to the CEO today he did outline a lot of new investment during the period that should improve efficiency in the future so we’ll let that one slide particularly given they think cost growth for FY17 will only be 1%. The payout ratio is also high and they’ll need to grow top line for any future dividend growth.

All in all, a weak result but not a disaster. We hold Bendigo (BEN) in the regionals which added +0.63% on the session to close at $11.17

Bank of Queensland (BOQ) Daily Chart

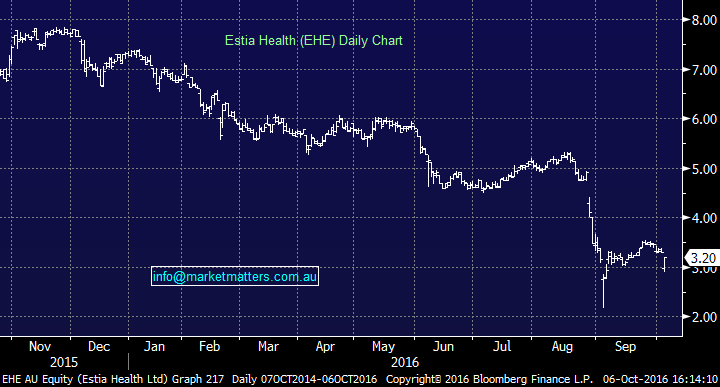

Estia Health (EHE) $3.20; When you’ve got negative news and the market already suspects it, it’s always better to just come clean. That’s whatEstia did today downgrading guidance by about 16% yet the stock dropped only 3% by days end. It was off more than 10% at the worst but buying stepped up during the afternoon.

Uncertainty will remain here until the sector receives clarification around Government funding later in the year, however, for those with a high-risk tolerance and time, this now looks cheap and we now have some signs that a low is in place. Caution – bottom feeding in unloved sectors can be hazardous!

Estia Health (EHE) Daily Chart

Sectors

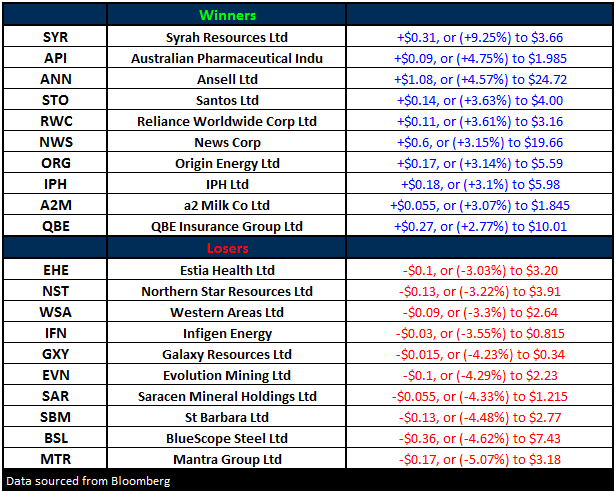

ASX 200 Movers

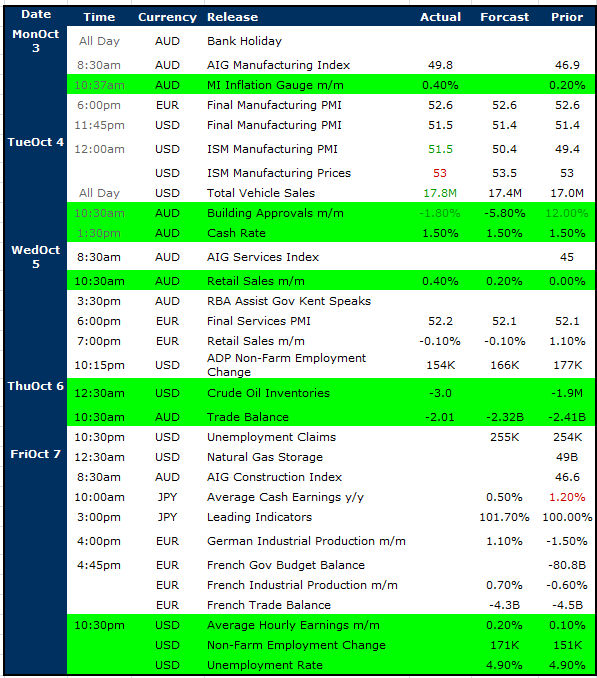

Select Economic Data - Stuff that really Matters in Green

**Chinese Bank holiday for the rest of the week**

What Matters Overseas

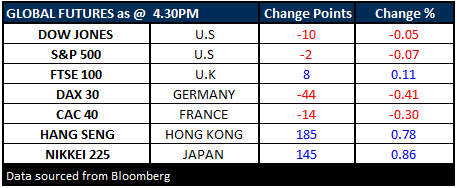

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here