US Interest Rates – why should we care?

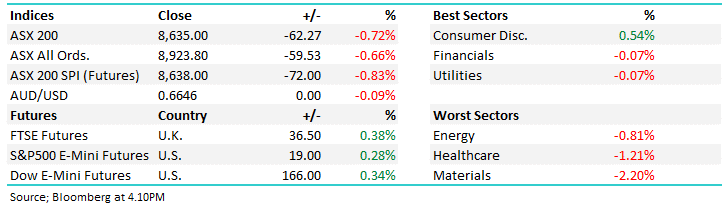

What Mattered Today

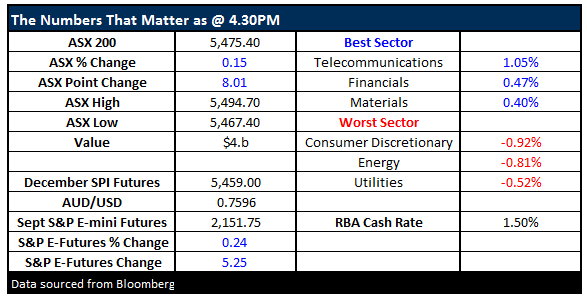

The market ran out of puff today closing well off the session highs as BHP & RIO copped some selling after being strong early while we also some weakness creep into the banks which pushed them back from their earlier highs. It’s been a very strong bounce in the market from the 14th Sep low of 5192 – with the index up +282pts or +5.43% to the close today. As we’ve written at length recently, although the market has been strong collectively, there has been some obvious weakness amongst those quasi-bond like infrastructure stocks, the defensive telco space and the property plays. That theme is likely to continue as the expectations for a US rate hike in December firms. More on that below…

We had a tight range today of +/- 25 points, a high of 5494, a low of 5469 and a close of 5475, up +8pts or +0.15%. Volume was still weak – about 25% below the20 day average – which is usual on the first day back from school holidays as insto’s brush themselves off and get back into the swing of it after a week or two with the kids…

The Clinton v Trump debate dominated news wires with a lot actually saying that Trump won – but it seems he’ll need to do more to get his campaign back on track. Losing interest fairly quickly here!

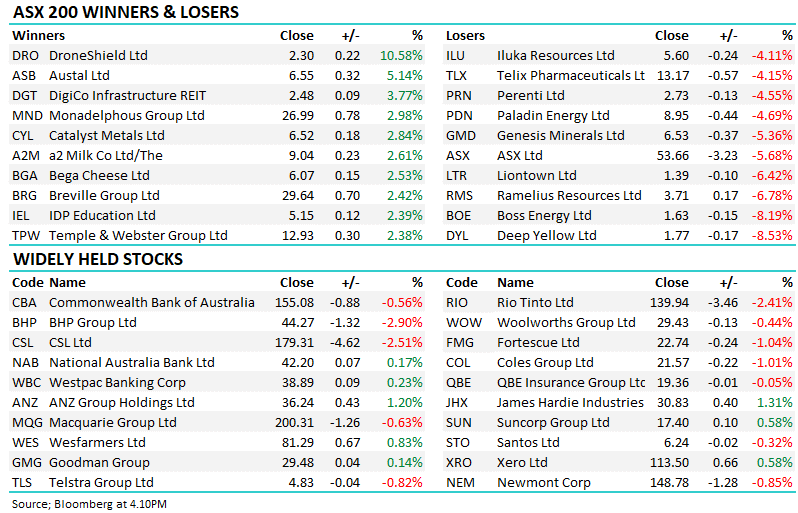

ASX 200 Intra-Day Chart

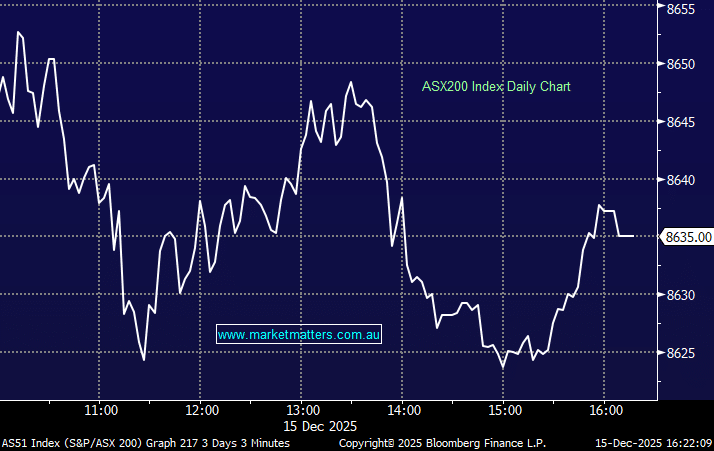

ASX 200 daily chart

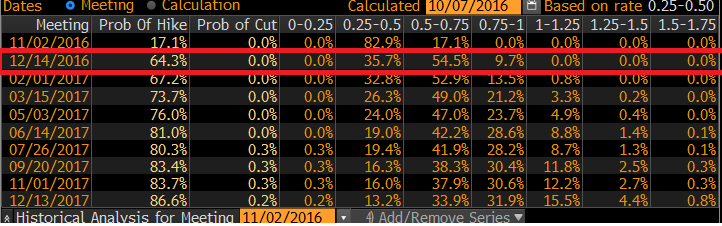

US Interest Rates – why should we care? US economic data has been reasonable in recent times and certainly not an impediment to any decision to raise interest rates while FED members led by Janet Yellen have continued to guide towards a December rate hike of 0.25% - so why doesn’t the market believe it?

As it stands, the FUTURES market is pricing in just a 64% chance for a December rate hike which seems a bit light on to us. We have three Fed Members speaking this week and given that in the latest Fed update, 17 of the 20 members or 85% see interest rates above 0.5% in 2016, then surely the market is not being aggressive enough. November is unlikely given the US election - a 17% probability seems about right however December is very likely – more so than the FUTURES market is currently prescribing.

Source; Bloomberg

If fed members start to ‘show their hand’ for a December hike, then this expectation will firm and the $US will rally. Bonds should be sold (pushing yields up) which would provide a headwind for those assets that are negatively impacted by higher interest rates. This pretty much sums up our thinking when we look at the ‘yield trade’ such as the higher yielding telco’s, infrastructure, property etc, while it’s also the basis for our positive stance towards the banks which is also supported by very strong seasonals. 3 of the big 4 banks go ex-divi early November and we typically see buying leading into this, however, this year things could be more positive than usual because;

1. Banks have underperformed for so long and have pretty much been hated by institutional money for the last few years

2. They’ve dropped a lot more than their earnings in recent times

3. The regulatory concern about further capital raisings has eased

4. Bank earnings have been under pressure from low rates, which are now turning up

5. Investors are holding a lot of cash

6. The bank bashing from Canberra is being ignored by the market

7. The average return during October from CBA over the past 5 years is 6.6%

CBA v ASX 200

In terms of resource stocks, they’ve obviously had a very big run up in price and we highlighted BHP as being overbought towards the end of last week – which is still the case when we look at it on the daily charts. If / when rate expectations firm, and the market prices in a December hike, then a higher US currency should be a short-term headwind for commodity stocks. We saw this theme play out in the Gold market last week. One caveat to that stance – and we typically hate caveats as it’s what everyone else tends to do, is if data shows an acceleration in global growth then commodities can rally in unison with the $US, however, we ascribe a low probably of that happening.

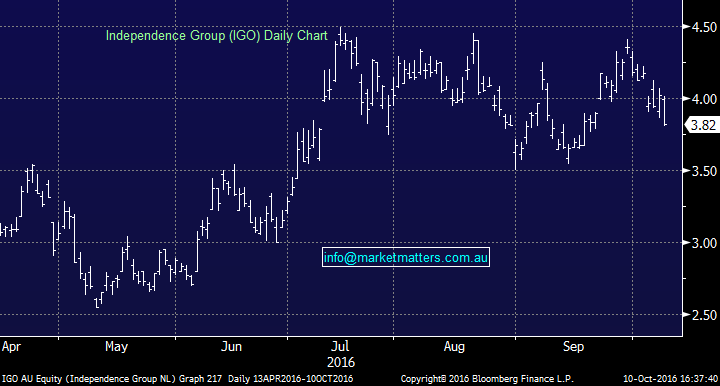

Elsewhere on the market today, Independence Group (IGO) was sold down fairly hard – more so than the other Nickel coy Western Areas (WSA) so its relative weakness is to do with the small takeover they’re executing on Winward Resources (WIN) for around $20m. Not large however it does make IGOs intentions clear – they’ll make acquisitions to grow their asset base which makes sense – however the market hates resource companies buying resource companies because they typically pay too much, and they typically buy at the wrong point in the cycle. In the case of IGO, they’ll be buying into the depths of despair (sort of) and they’re buying an asset that is close to their existing operations, which again seems to be sensible. Whatever the case, the market has given it the cold shoulder and the stock fell nearly 5% back to our buy price. This one is clearly testing our patience.

Independence Group (IGO) Daily Chart

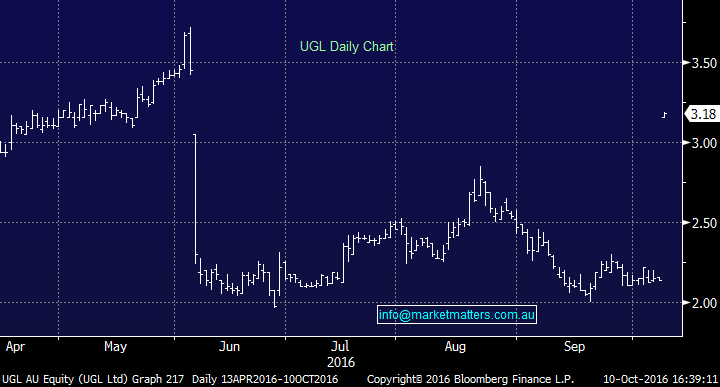

UGL (UGL) had a day in the sun – rallying 48% to close at $3.18 after copping a takeover bid from Cimic (CIM) – which is the old Leighton’s. This is a slight premium to the $3.15 offered and represents a 47% premium to the last traded price of $2.14 - the bid is hostile and CIM are saying this is ‘one and done’ meaning this is their first and final. CIM have 13.84% of UGL after we saw a special crossing this morning at $3.15 a share…

UGL (UGL) Daily Chart

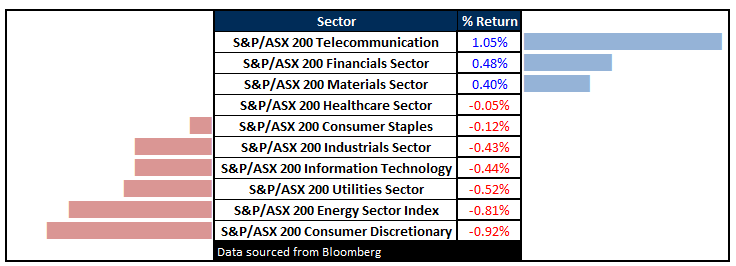

Sectors

ASX 200 Movers

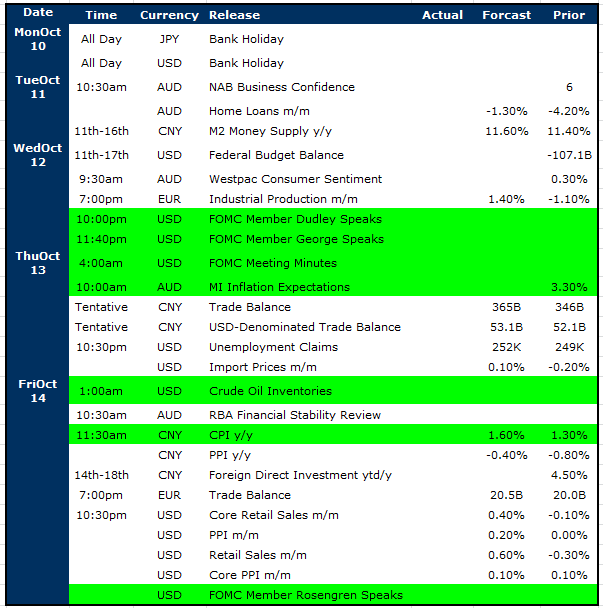

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

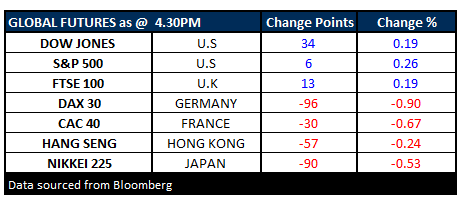

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here