Banks – still the place to be this month

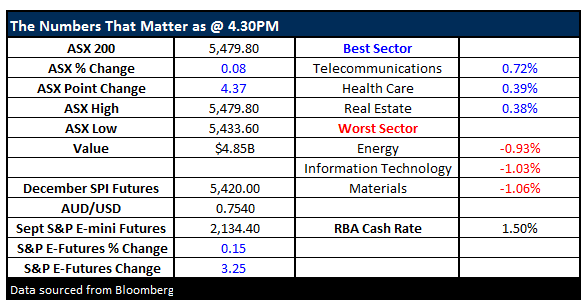

What Mattered Today

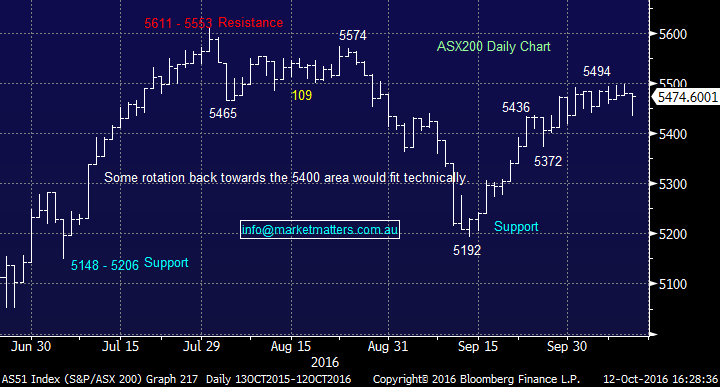

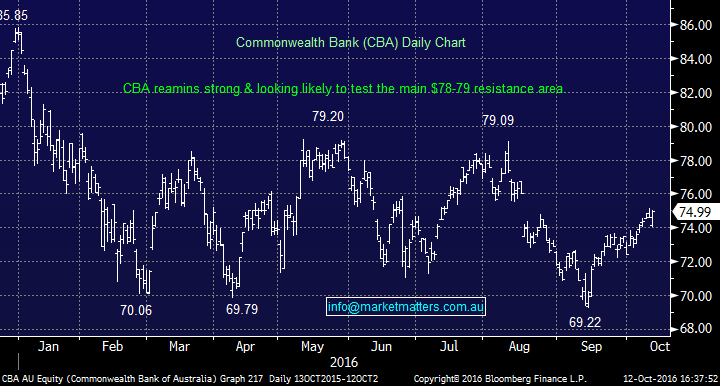

It seems the market wants to go higher after a weak open which saw the index off by around -46pts early before the banks led the recovery with the index closing on its highs. CBA added almost $1 from its $74.00 low, the other banks also copped some buying into early weakness while the miners chimed in, finishing down on the session but a long way from the lows.

CSL had their AGM today and the stock ended higher by 1% - they reaffirmed earnings guidance + confirmed they’d buy back another A$500m of stock– which was first flagged at their recent results. Not a bad effort from CSL given the US health sector was the weakest link in the US overnight and CSL had a low today of $104.40 before closing at 106.54.

CSL Daily Chart

Overall, we had a range today of +/- 41 points, a high of 5474, a low of 5433 and a close of 5474, off -5pts or -0.09%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

Banks; October is a very bullish month for the banks with the average return for the sector +4% since we hosted the Olympics in 2000. We’ve quoted an average return for CBA of +6% for the month over the past 5 years and we’re significantly overweight the sector in our own portfolio – holding CBA, ANZ, WBC & BEN + we also have a decent position in Suncorp (SUN). Combined it accounts for more than 50% of the portfolio. If we’re trading seasonality we need to be conscious of when to get off the bus. We’re overweight the sector – which has served us well this month however we should be looking for opportunities to trim into strength – that’s what we’ll be doing.

Today was a good example of the underlying appetite for the sector with early selling more than offset by strong buying into the close.

Commonwealth Bank (CBA) Daily Chart

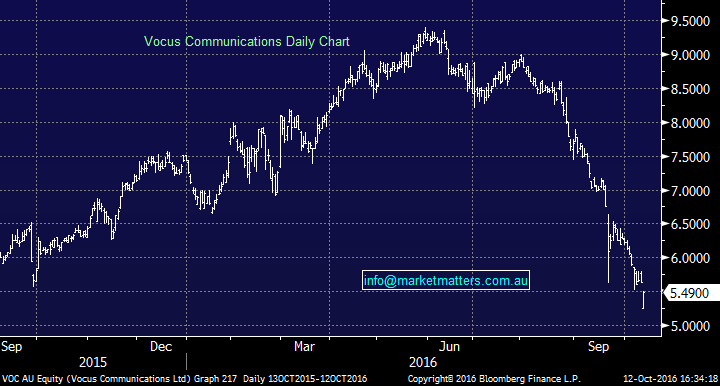

Vocus Communications (VOC) was again the source of headlines this morning after James Spenceley – the VOC founder and current Executive Director resigned along with Non-Exec Tony Grist. They put a proposal forward for new leadership (as in they wanted to replace the CEO) while they also wanted to shake up the board. No other support was forthcoming so they fell on their sword and resigned. The stock was down early by around 6% before buying stepped in and the stock rallied up from its $5.25 low to close at $5.49 – down -2.49% which is probably a good result. We’ve written about VOC at length – with our past commentary available here however there two obvious ways to think about this.

The negative stance would be one of concern given the high chance that some of the key tech staff on the network side (which was the VOC business) will follow them out the door, however, that’s probably unlikely given that Spenceley has gone in the funds management game.

The positive spin would be that it’s a good move, the destabilisation of the company will probably be over, the current CEO now has the support of the ‘entire’ board and if Spenceley had the overwhelming support of shareholders, the CEO would have been gone and the board rolled. That obviously wasn’t the case. Tony Boyd from AFR who’s been around for decades wrote a good article which supports the view’s that we’ve outlined above however two things are important here;

1. On the face of it, a move like this should have seen the stock down a lot

2. Buying into early weakness suggests the market - although clearly concerned – is seeing value.

This has been a horrible stock for the last few months – as has TPG Telecom (TPM) with the market simply taking the sword to them both. It’s such a quick passageway from the penthouse to the outhouse when things start moving against a stock/sector. Clearly, we think value is there and once the sideshow calms down, and we realise that this has not filtered into a big deterioration in earnings, then the stock should get some clear air and trade up.

Vocus Communications (VOC) Daily Chart

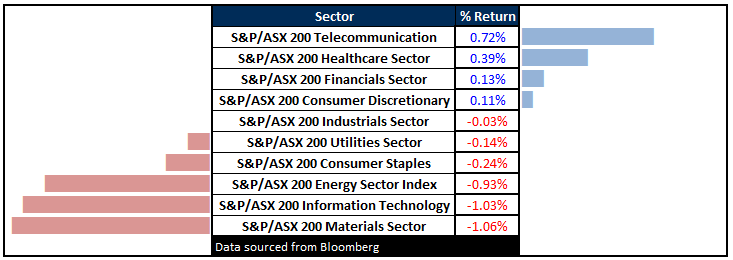

Sectors

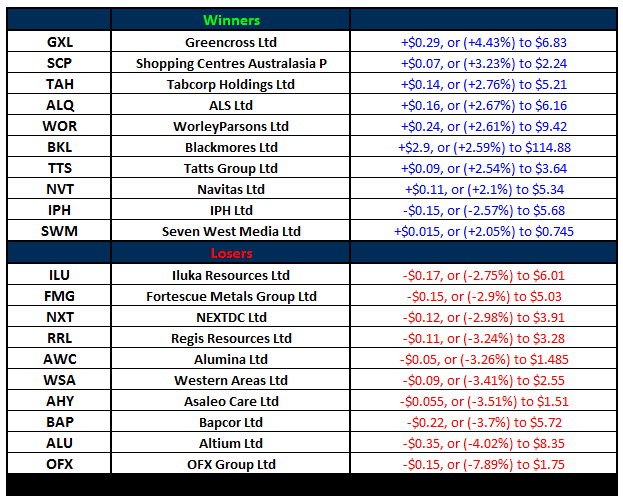

ASX 200 Movers

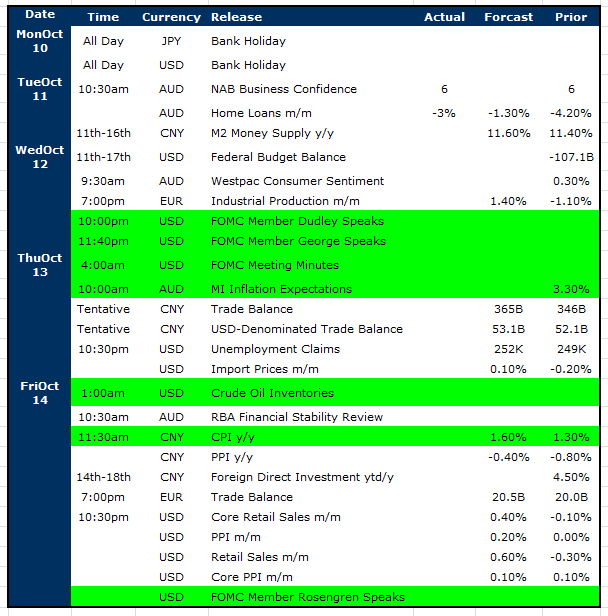

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

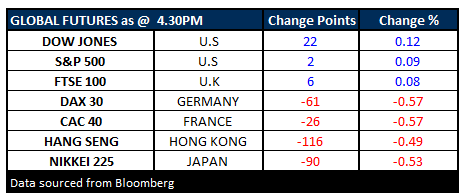

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here