Resources hit as US Dollar firms + China data weak…

What Mattered Today

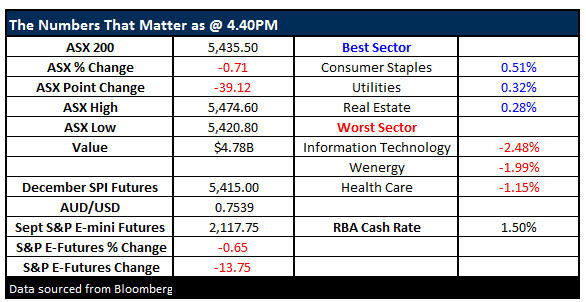

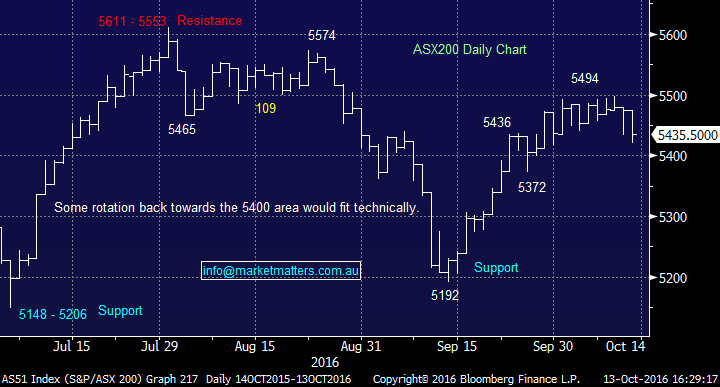

The market opened down smalls and tread water until weaker than expected trade data from China + a weak open on the US FUTURES got the sellers active and we saw the market trade down as much as -54pts before a tepid recovery into the close. We had a range today of +/- 48 points, a high of 5468, a low of 5420 and a close of 5435, off -39pts or -0.71%. Volume was good today and it seems we’re back into the swing of it post school holidays.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

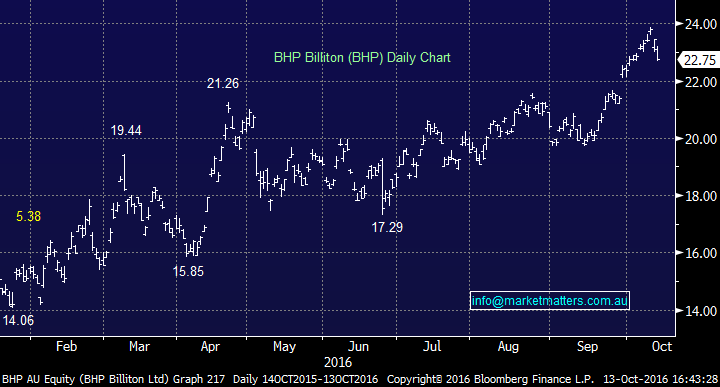

Resources; Came off today as a strengthening $US and weaker than expected Chinese trade balance of +278B v 365B expected was enough to prompt some profit-taking amongst the miners. We also had Citi join UBS in their call to reduce exposure to miners downgrading both BHP and RIO – both are now on a SELL…BHP was off -2.94% to $22.75 while Rio Tinto (RIO) gave back -2.70% to close at $51.57.

For aggressive traders out there Fortescue Metals (FMG) looks like a short (going down) given its failure to punch through the $5.20 region on three separate occasions before rolling over today…A pullback seems inevitable from here. We’ll shortly be introducing more active trading ideas through the Market Matters subscription service and benefitting from downside moves will certainly feature. Stay tuned.

BHP Billiton (BHP) Daily Chart

Fortescue Metals (FMG) daily chart

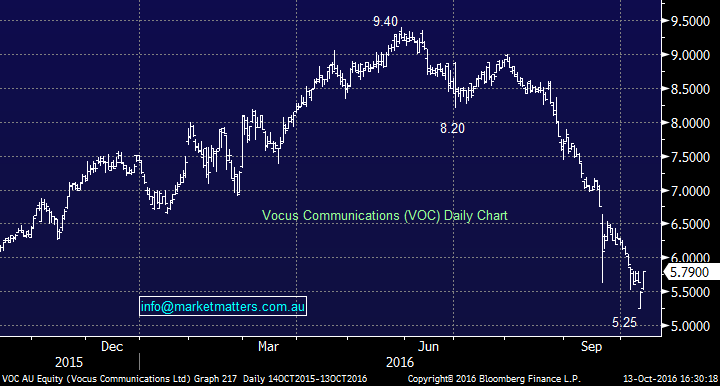

Elsewhere, Transurban (TCL) released reasonable traffic numbers + a good set of revenue figures which pushed the stock up slightly (+0.38% to $10.66) however we continue to think these yield stocks will remain under pressure – even if they bounce short term. Vocus (VOC) finally had a day in the sun as talk of a potential Share buy-back got the buyers back out in force with the stock rallying +5.46% to close at $5.79 – after being as low at $5.25 at the depths of despair yesterday morning.

The key here is earnings and whether or not recent uncertainty in management/board has impacted focus and the momentum of the business. We won’t know until the end of Nov at their AGM however, as we’ve said numerous times, they only reported about 6 weeks ago, offering fairly upbeat guidance so it seems unlikely that there would have been any meaningful deterioration from that point to now.

Vocus Communications (VOC) Daily Chart

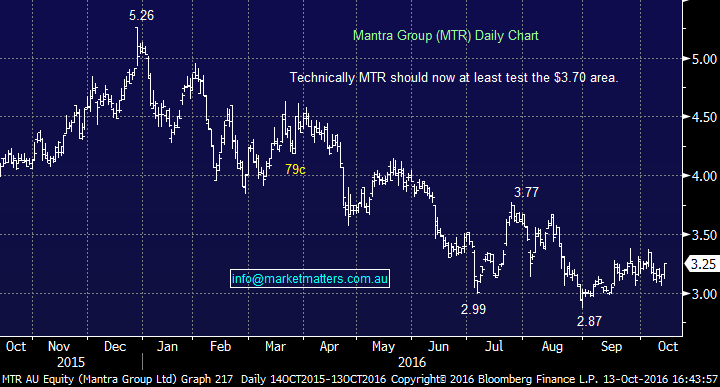

Mantra (MTR) held their AGM today and the stock put on +2.85% to close at $3.25. This is a stock we hold on the MM portfolio – bought it recently and it's bouncing along the bottom. $2.87 low seems a meaningful one, however, any upside momentum has been snuffed out in recent times. We like it fundamentally + technically and are pleased today from the companies rhetoric at their AGM.

Mantra Group (MTR) Daily Chart

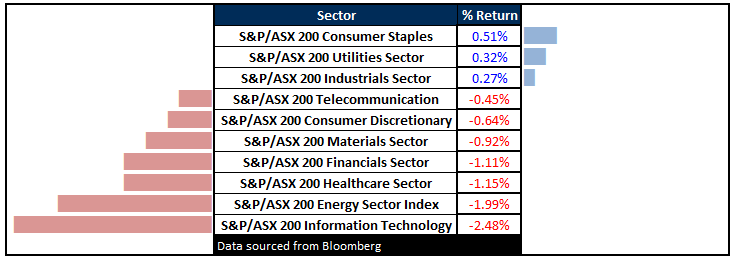

Sectors

ASX 200 Movers

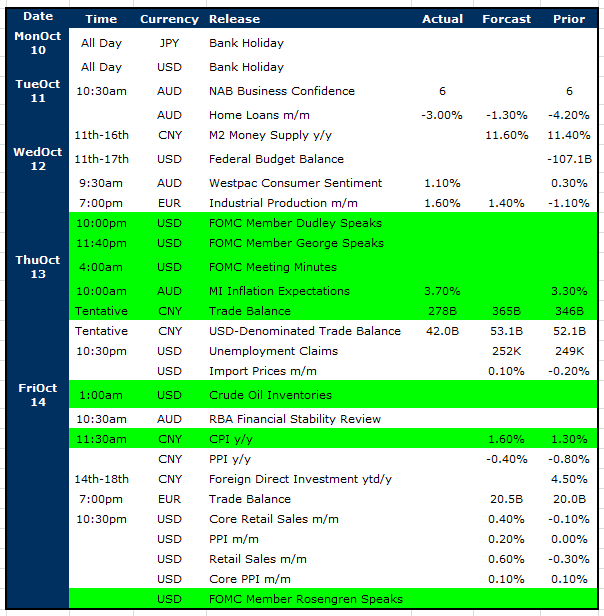

Select Economic Data - Stuff that really Matters in Green

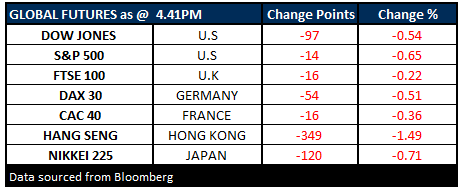

What Matters Overseas

FUTURES down….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here