Telstra – has it turned the corner?

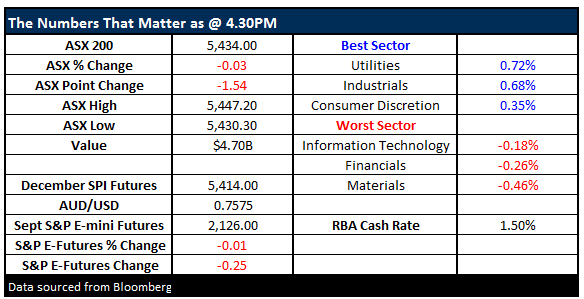

What Mattered Today

A fairly lacklustre end to the week with the index limping into what’s going to be a cracking weekend for Sydney siders…Summer has finally arrived by the look of it.

Source: bom.gov.au

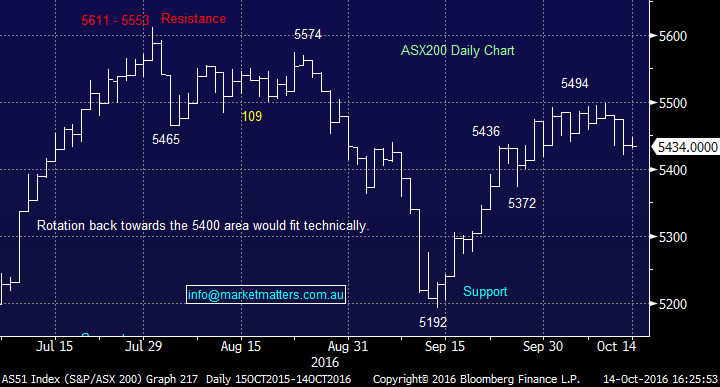

We had a range today of +/- 17 points, a high of 5447, a low of 5430 and a close of 5434, off -1pt or -0.03%. An extremely tight range while volume was low and the restaurants in the city were full – which is probably where most action was seen today.

ASX 200 Intra-Day Chart

ASX 200 daily chart

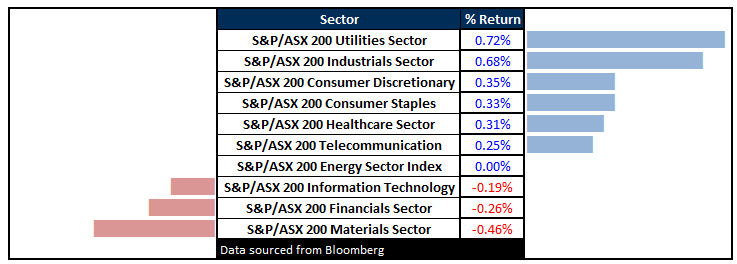

For the week we’ve seen the index fall by around 0.5% - which is the first drop in the last four. It seemed to be risk off with Materials down around 1%, Energy gave back some of its recent gains losing -1.50% and the financial space drifted nearly -1% lower. Still, there were some reasonable spots with the much maligned ‘telco sector’ seeing some love with Telstra (TLS) actually up on the week – finding some obvious support around the $5.00 mark. This of course comes on the back of a -6.3% drop the prior week for the sector so in context, only a slight recovery.

Telstra (TLS) Daily Chart

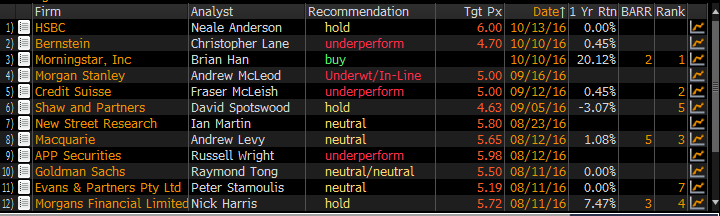

Telstra (TLS); At current prices TLS trades on a forecast yield of 6.1% plus franking (8.7% gross) based on 31cps forecasted dividend – which is likely to stay flat until at least FY19 on our numbers. The stock is not overly expensive trading on 14.2 times expected FY17 earnings, so about a 15% discount to the market. Surely with these metrics TLS should be a BUY here??

The risk as we’ve been highlighting in recent times stems from the artificially inflated earnings courtesy of the one-off NBN payments. Although the BIG one off payments seem impressive, it will come down to Telstra’s ability to reinvest those payments, given they lose $2bn-$3bn of re-occurring earnings over the next 3-3.5 years. That said, it seems this is now a very well known-known with the market having digested this over the last few months – hence the weakness in the stock. The reason we say this is that when the market is collectively positioned a certain way as it is with TLS (shown by analysts’ views below) it sets the scene for strong counter trend moves. At some point, TLS will rally hard and we’ll be looking to get set for this when it happens.

Source; Bloomberg

We’ve been negative TLS for some time and have written about a $4.70 downside target – which seems plausible from here. We’ve obviously seen a big leg down from $5.85 to $4.95, a small bounce to $5.20 and a probable failure at that level. It actually looks similar to Sydney Airports (SYD) and Transurban (TCL) we’ve written of in recent notes and we think these have further to fall – however, we should now be looking for some type of panic low, where the market gets too bearish these stocks. We’re not there yet but worth starting to think about.

In terms of TLS relative to the market, the underperformance is fairly stark… They’ll be an opportunity here at some point.

Telstra (TLS) v the ASX 200 over the past year

Sectors

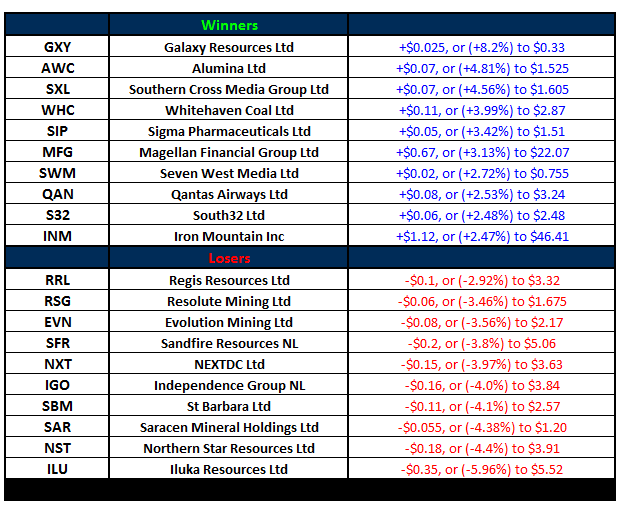

ASX 200 Movers

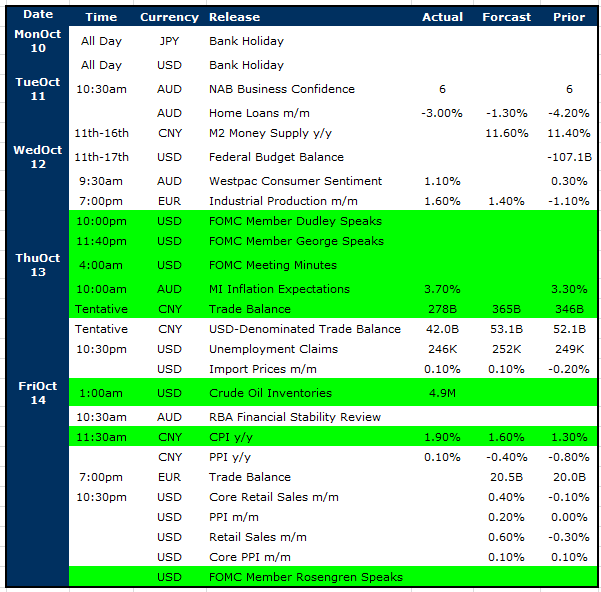

Select Economic Data - Stuff that really Matters in Green

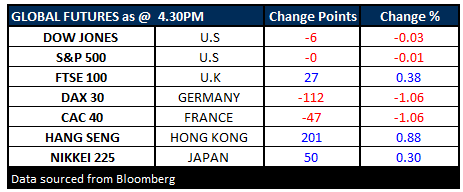

What Matters Overseas

FUTURES mixed….

Have a great Weekend

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here