Crown punt falls short!

What Mattered Today

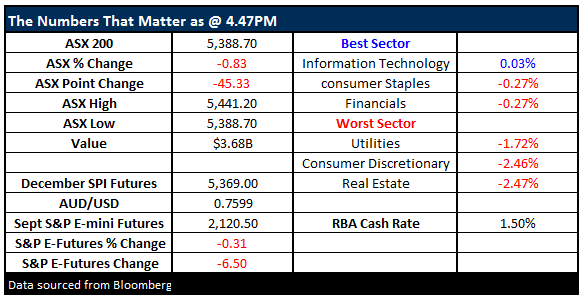

Stand up - stand up….but no one did today and the market sold off on low volume with the index trading at its highest point around 11.30am before a slow and steady grind lower into the close – with the index finishing on its lows. We had a range today of +/- 53 points, a high of 5441, a low of 5388 and a close of 5388, off -45pts or -0.83%. Volume was weak today which is to be expected given we have a raft of Chinese data out on Wednesday + some reasonable prints from the US as well.

ASX 200 Intra-Day Chart

ASX 200 daily chart

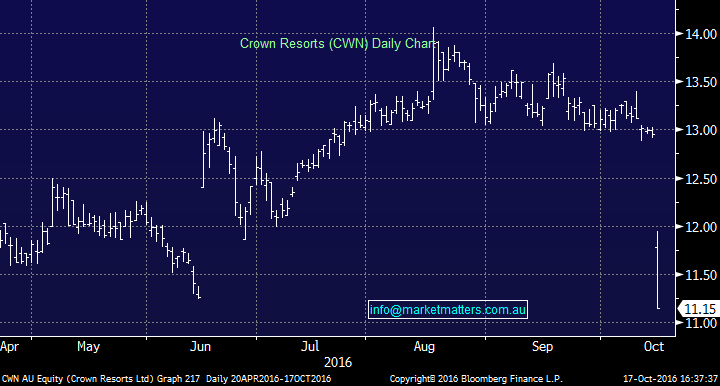

Crown (CWN); It was hard to escape the negativity surrounding the betting stocks today following news that 18 Crown employees had been detained in China following a series of raids at the end of last week. It’s illegal to advertise gambling in mainland China but it’s not illegal to promote tourism - so the casino companies skirt around the legislation and more or less hope that pragmatism prevails. The issue with this approach, and indeed to whole caper of doing business in China, is the playing field can change – as it just has for Crown. What’s known to be questionable is tolerated, and even encouraged until it’s not, then those running what were thought to be legitimate operations find themselves in jail.

Crown (CWN) daily chart

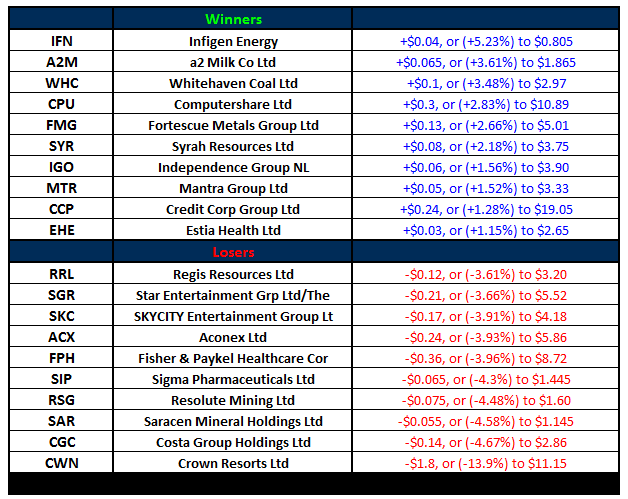

Doing business in China clearly creates opportunities for western enterprise but the risks are greater as well. Today’s news from Crown is a clear example of this. Crown (CWN) shares closed down -13.9% to $11.15 while other operators, who are not directly involved in the raids but do market ‘tourism’ ventures in China also lost ground. Star (SGR) lost -3.66% while Sky City (SKC) fell -3.91%. We also saw ‘Crown exposed stocks’ like Lend Lease (LLC) also came under pressure. LLC was trading at the top of its range, so weakness is not surprising really, however, we now see the stock in no-mans-land. For those keen on LLC look for an entry back in the $12/$12.50 range. We have no interest at this price.

Lend Lease (LLC) daily chart

We’ll cover whether or not there is an opportunity in the gaming stocks in the morning report tomorrow....

Elsewhere, the same sort of themes we’ve been discussing for some time now continued to play out. Sydney Airports (SYD) was down -2.74% while Bendigo (BEN) for instance was off just -0.27% to close at $11.07 – down 3c. Telstra (TLS) was the biggest index weight / detractor taking 2.5 index points from the 200. We still wouldn’t be there and wrote about our views inFridayafternoons note

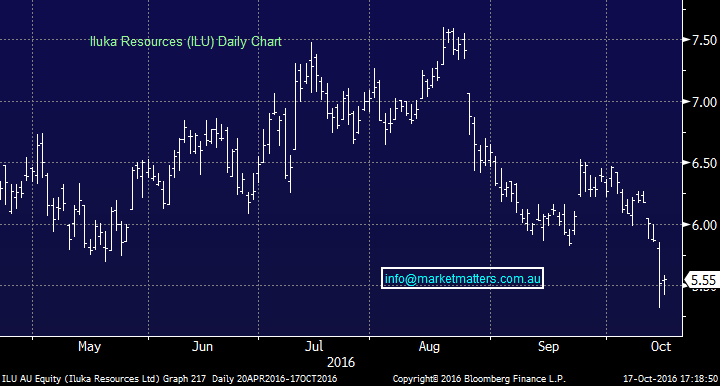

One stock that is starting to look reasonable – but is a longer term turn around play is Iluka (ILU). Last week they reported a weak set of quarterly production numbers, they copped a big downgrade from one broker and looking across the board, they’re fairly well disliked from most analysts. That said, there were some very early signs that things could be turning from a demand perspective which – on a 6 month view could start to flow through an improved earnings outlook. The share price is about a third of what it was 5 years ago and earnings have tracked a similar path. We haven’t been in this stock over that difficult period but now we think there is a clear reason to re-visit.

Of course, ILU is involved in mineral sands exploration. It’s a global producer of zircon and large scale production of titanium dioxide products – things that are used in paints, plastics, papers, tiles, etc – all things that we use in our everyday life, and presumably, demand for these products will increase as the global population grows.

The issue has been on the supply side, with too much product being produced relative to demand. This theme was addressed last year with many of the global producers, Iluka included cutting production. The market is now nearer to equilibrium and as Iluka (and some of their competitors) have recently suggested, trends were starting to show signs of improvement / bottoming out. It’s now on our radar.

Iluka (ILU) Daily Chart

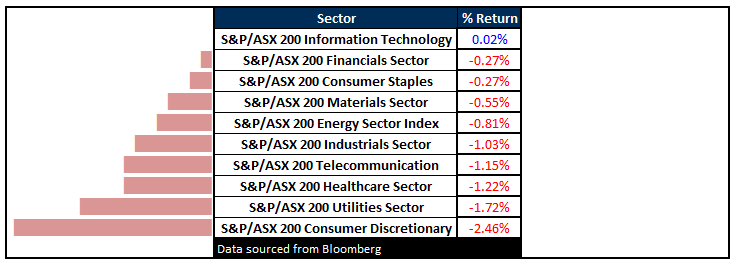

Sectors

ASX 200 Movers

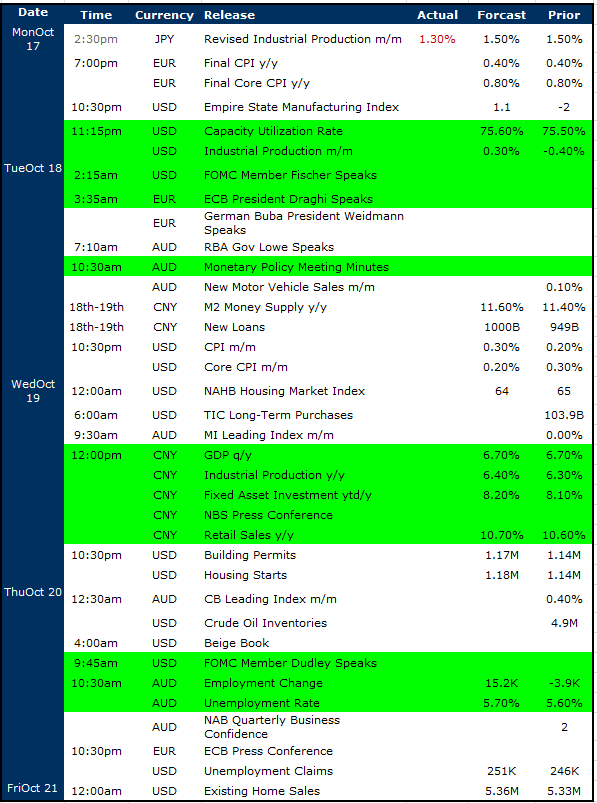

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

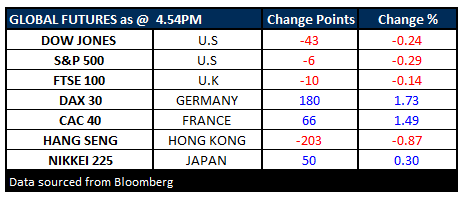

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/10/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here