Today’s focus – BHP production + China growth

What Mattered Today

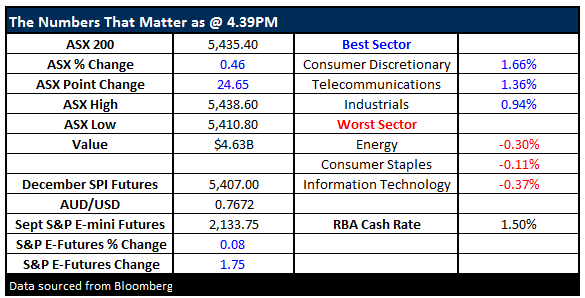

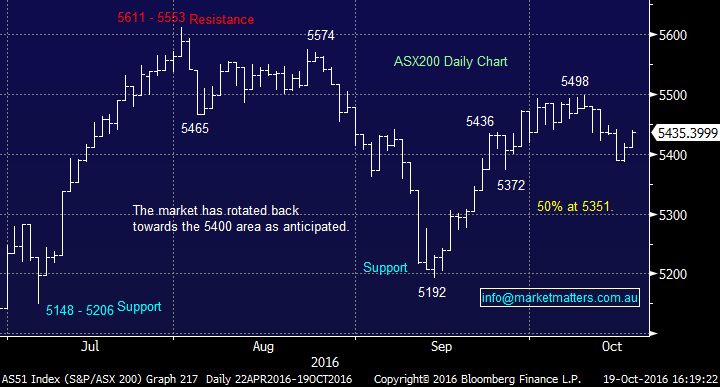

BHP came out with Q1 production numbers before market open today which were a mixed bag, and enough to prompt some early weakness before buying stepped in around 11am. A strong hour up until midday then a holding pattern for the remainder of the day. On the market today we had a range of +/- 24 points, a high of 5438, a low of 5412 and a close of 5435, up +24pts or +0.45%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

BHP; Production was a tad light on overall, with specific weakness in Copper and Coal while Iron Ore and Petroleum were on the money. They maintained FY17 production guidance but with a caveat around Olympic Dam which was impacted by a power outage. All up the result was ok and early weakness in the share price was met with buying mid-morning. The stock came back to $22 early on before finishing down -0.75% to $22.47.

Those looking for a silver lining in the result could site weather related issues which were the reasons offered by the coy for the misses in Copper and Coal. We’re 50/50 BHP at this stage thinking that a higher $US may provide a headwind for the stock in the near term.

BHP (BHP) Daily Chart

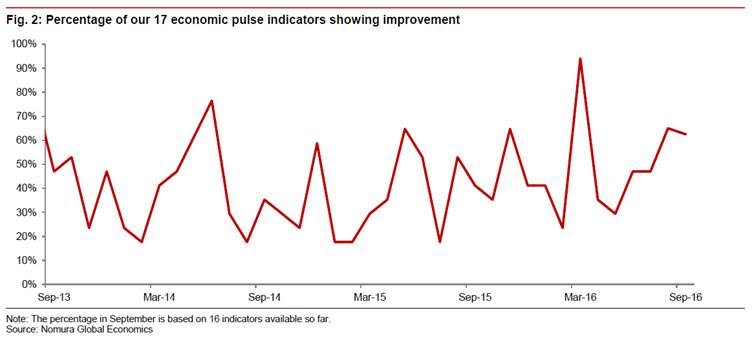

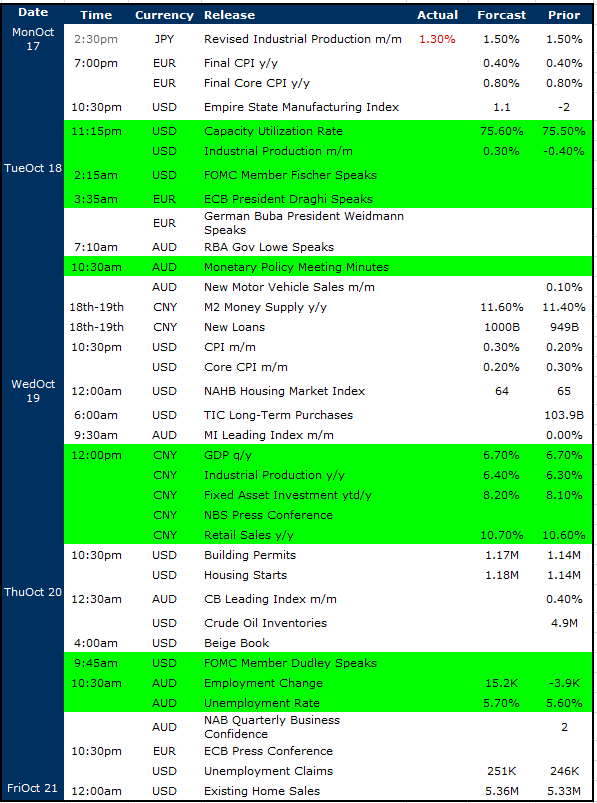

We had a dump of Chinese data at 1pm headlined by GDP which was in line (6.7%), Retail sales were as expected as was fixed asset investment. Nomura put out a comprehensive data set on China today which culminated in a nice chart which tracks the pulse of the Chinese economy. It seems to be doing better than this time last year and momentum in economic indicators seem reasonable. Commodity markets are probably telling us this but good to see in another format as well.

Gold stocks saw some love and we’re now starting to pick through this space again given the gold price has stabilised post the big decline from above $1300 an ounce. Evolution (EVN) put on +3.23%, Newcrest (NCM) added +3.27% and Independence Group (IGO) added +5.70% to close at $4.08. A volatile beast that we currently hold in the MM portfolio.

Gold Daily Chart

Vocus (VOC)….some reasonable strength coming into the stock today and although early signs, it seems the selling pressure is starting to subside. The stock put on +4.58% today to close at $5.94 and is now +13% from the recent low of $5.25. We still think the stock can rally further from here, although note the AGM at the end of November will provide more insight into the actual impact on earnings – if any from the recent debacle. If they confirm previously guided eanings, the stock should rally.

Vocus (VOC) Daily Chart

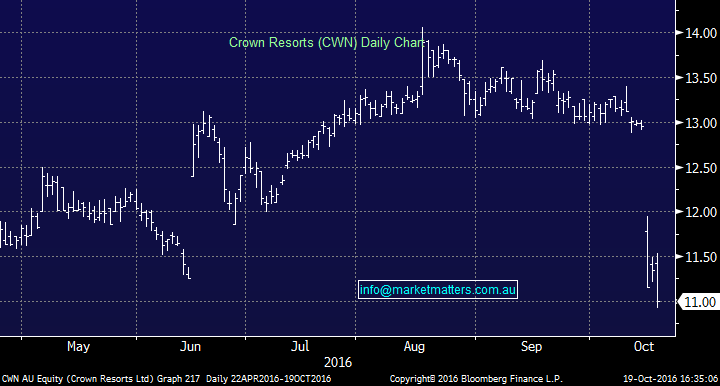

The casino stocks were still under pressure today – and we remain of the view that Crown (CWN) and Star (SGR) could easily come under further pressure in the short term. Our experience suggests these types of events linger, and create weakness for longer than most expect. That seems to be the right stance at the moment and we remain comfortable with it. Simply all too hard at this point.

The Star (SGR) Daily Chart

Crown (CWN) Daily Chart

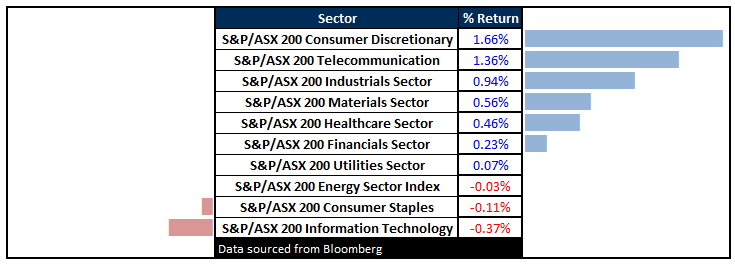

Sectors

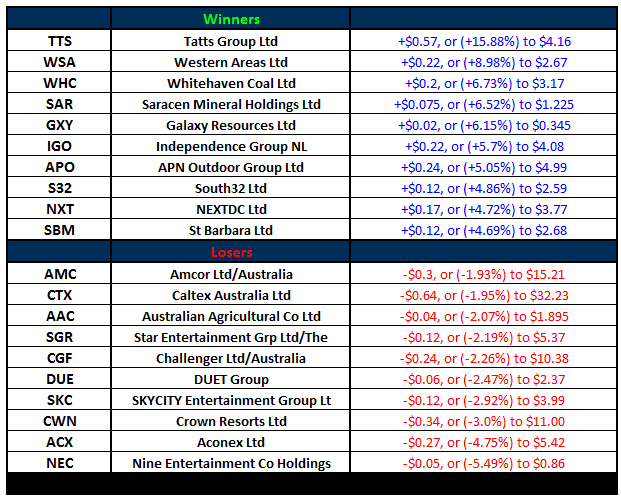

ASX 200 Movers

Select Economic Data - Stuff that really Matters in Green

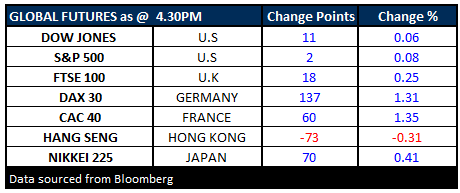

What Matters Overseas

Over 100 companies reporting in the US tonight with the main draw cards being Morgan Stanley, Ebay and American Express. Fed member Dudley speaks which will put focus on interest rate expectations in the US – and thus the $US

FUTURES mixed….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/10/2016. 5:00PM. Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters.

The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position. The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions.

You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product. The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate.

Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here