AGM’s driving stocks in a quiet market

A volatile open for index options expiry today – the usual shenanigans early on before a low was put in place around 11am, a high just after 2pm and a slide into the close.

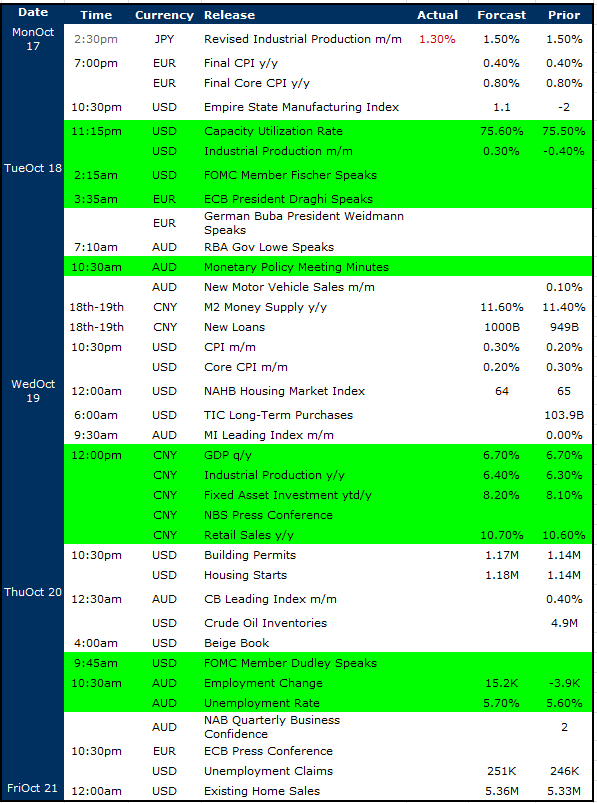

Employment data was out during early trade and was weak on a headline level – with an overall loss of 9.8k jobs v an expectation of +15.2k gain, however that was probably sugar coated by a decline in the actual unemployment rate to 5.6% v 5.7% expected. Lower than expected participation the cause which suggests weakness while the composition was also soft.

There was a 53,000 loss of full-time jobs offset by a 43,200 gain in part-time jobs - so some swings and roundabouts for the RBA to think about and we’ve had a very slight uptick in the expectation for a Melbourne Cup rate cut in Oz – with the market pricing a 19% chance. We doubt this print alone will have a big bearing on current RBA thinking but it does go in the basket of weakness. Q3 inflation the main game still and that is due out next Wednesday.

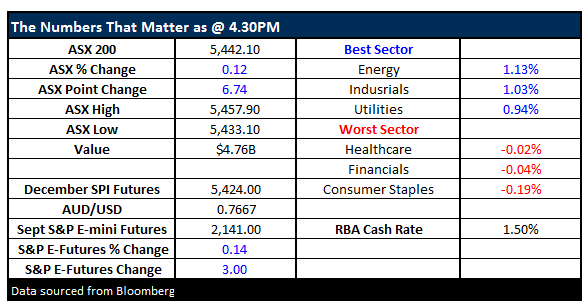

On the market today we had a range of +/- 24 points, a high of 5457, a low of 5433 and a close of 5442, up +6pts or +0.12%.

ASX 200 Intra-Day Chart

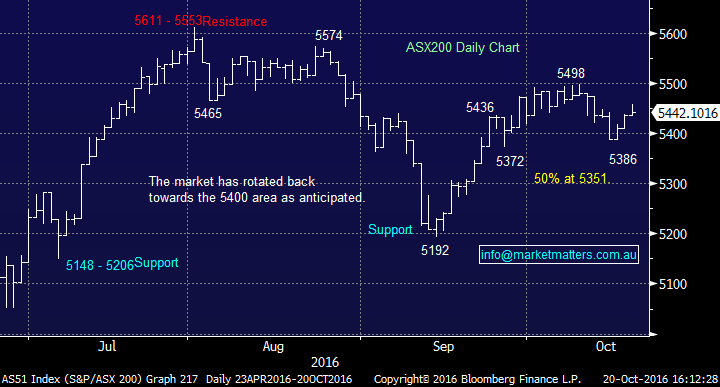

ASX 200 daily

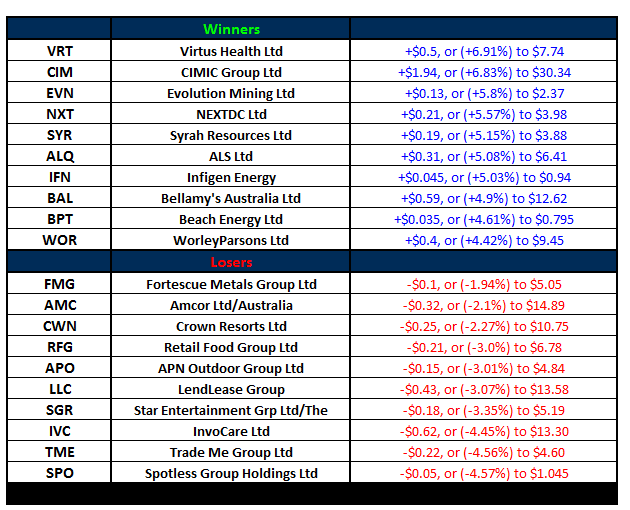

AGM’s today dominated the news flow while those companies that gave poor updates yesterday continued to cop it on the chin today (the Reject Shop for example). Rio Tinto (RIO) gave Q3 production numbers as did Fortescue Metals (FMG) – RIO finished up and FMG down.

Lend Lease (LLC) AGM; nothing really knew from their AGM today and the stock remains on track, although sentiment is clearly against it with concerns around an impending oversupply of units in Oz while their exposure to Crown through Barangaroo also has them in the sites of sellers. Compounding the issue – and someone would be packing up their desk this afternoon for doing it – there was an additional attachment on the initial release that implied that the margins of their apartment were 6% - not the 15% that they had originally guided to. It’s not the case however it was just another reason to sell LLC today. Stock closed down -3.07% to $13.58. Seems to be headed back down to the bottom of the range in our view.

Rio Tinto (RIO) Q3 production; . Iron ore and copper were both sluggish but the company explained the issues reasonable well – iron ore on port and rail maintenance and copper on lower grade at Escondida – and we saw a similar trend in BHP earlier in the week, however it seems that RIO has had a well-timed run of met coal production (up 21% QoQ) – given the big run up in prices. Guidance was lowered a touch but the mkt was expecting that. We’ve traded RIO on the upside recently through an option position and will continue to look for opportunities on the long side.

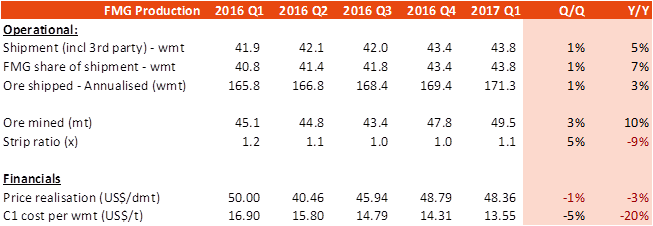

Fortescue Metals (FMG) Sep QTR production; Another very good result from FMG with the coy delivering strength both operationally and financially. Below is a good chart thanks to Shaw and Partners showing key components of today’s announcement. Beware though, these numbers are good however the stock has run hard leading into them. We expect FMG to cool off here and bide time…

Source; Shaw and Partners

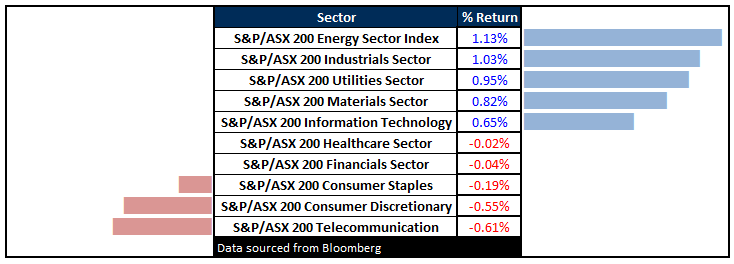

Sectors

ASX 200 Movers

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

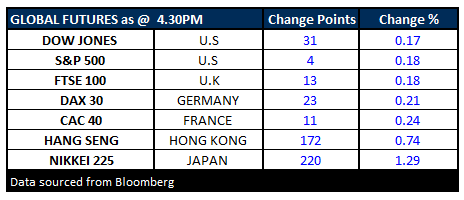

FUTURES higher….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/10/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here