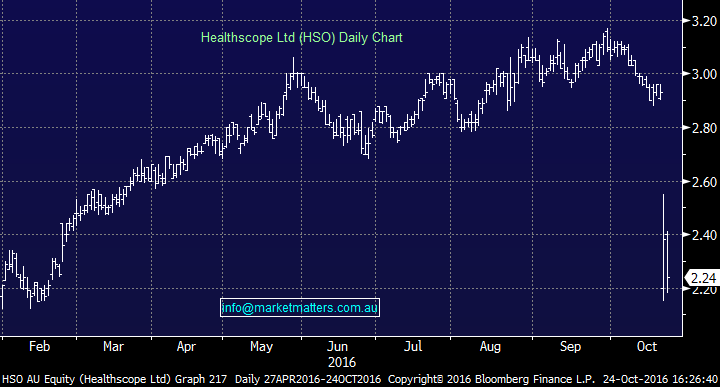

Have we made the right call buying Healthscope (HSO)?

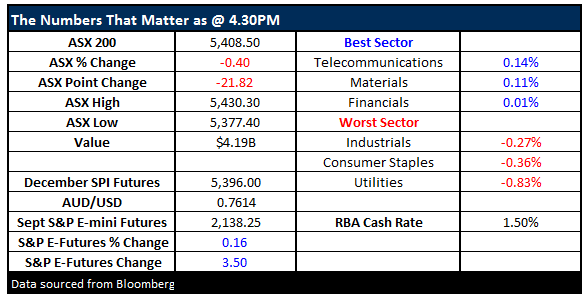

What Mattered Today

Some decent weakness from the outset today with the market copping reasonable lines of selling between 10 -10.30am before grinding higher for the rest of the session. Banks led the recovery which is typical of what we tend to see in October leading up to bank reporting, and importantly, the dividend dates for the big 4. As we wrote this morning, using seasonality as a guide we see another +2% further upside for the sector in October before we look to trim our overweight allocation ahead of the traditionally weak November trading period. NAB reports on Thursday and we’ll write about this before then.

On the other side of the ledger, we bought Healthscope (HSO) on Friday after the 20% plunge with a buy price of $2.33. Today the stock was down again and the obvious question should be asked – have we made the right call? More on that below.

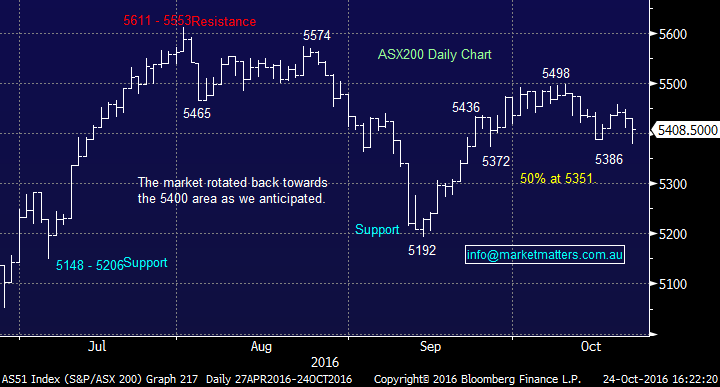

We had a range today of +/- 53 points, a high of 5430, a low of 5377 and a close of 5408, off -21pts or -0.40%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

Healthcare stocks are typically expensive, and when one trips up like HSO did on Friday (which was a pretty average update, to say the least), it tends to be hit hard + drag down the rest of the sector. HSO’s stumble has impacted Ramsay Healthcare (RHC) as it should, given that HSO flagged industry-wide issues – not just company specific ones. HSO’s high this year was $3.17 and it’s now down at $2.24, a drop of -29%. Ramsay had a high this year of $84.08 and closed today at $71.40 – a drop of 15%.

The proportion of the drop between the two is probably about right given RHC has a lot more exposure overseas – whilst HSO is more domestically focussed. As is the case when we see a stock with a surprise downgrade, brokers scramble to downgrade and revise down forecasts – price targets etc and write about why this has all happened, however as investors, we now need to think about the future, and whether or not the investment ‘now’ stacks up from a risk versus return perspective. For what it’s worth, we now have 5 buys, 7 holds and 1 sell with an average price target of $2.65.

To put Friday's announcement into context, the company is using one-quarter of data to re-base market expectations for the year. In simple terms, they said that trends had been volatile, and September was particularly weak. Before this update, the market was looking for 10.2% earnings growth for FY17, and now the company says that ‘if’ the trends of the last quarter continue for the next three, then earnings will be flat year on year. The question remains, does that warrant a 20% slide in the share price?

It might, if – and it’s still an if, Q1 trading is repeated in Q2-Q4. If it doesn’t then the drop is an overreaction and we’ll see a decent bounce from the stock. The company reckons that it’s negative publicity around affordability and consumer confidence that has caused people to hold back from having ‘elective surgery’. We know how fickle the consumer is and trends like this change, so it’s difficult to see how one weak quarter will flow through for the remainder of the year – however it’s possible, and maybe even probable but it’s far from certain which seems to be the way the market has taken it.

Another more simplistic way to think about this could be to picture someone with a bung knee needing elective surgery. You can hobble around for a time – a month, maybe two but sooner or later you’ll need to actually pony up and have the procedure. In our view, although the near term might be somewhat cloudy we continue to think that the core industry drivers are intact – the company has some very good projects nearing completion, the balance sheet is sound, and of course, November/December is a very seasonally strong period for the healthcare sector – following a weak October. A theme we’ve spoken about in numerous reports recently.

So in answer to the original question headlined in this email, at this stage, we’re comfortable with our decision to BUY HSO around $2.33 on Friday, particularly given we sold out of a profitable position around $2.80 back in May this year.

Healthscope (HSO) Daily Chart

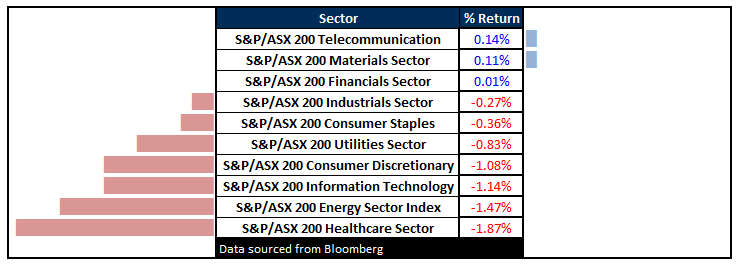

Sectors

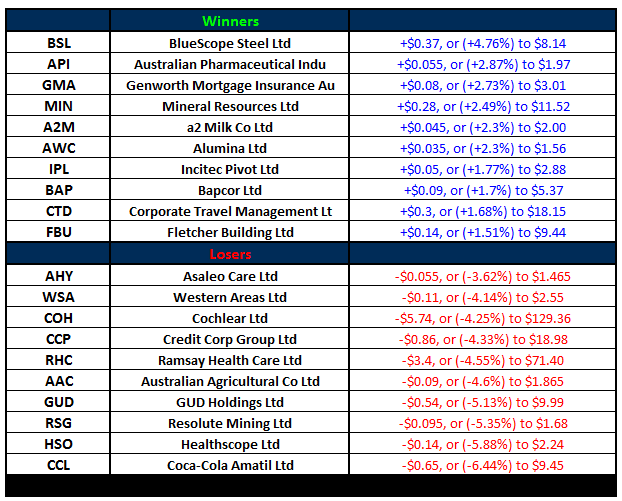

ASX 200 Movers

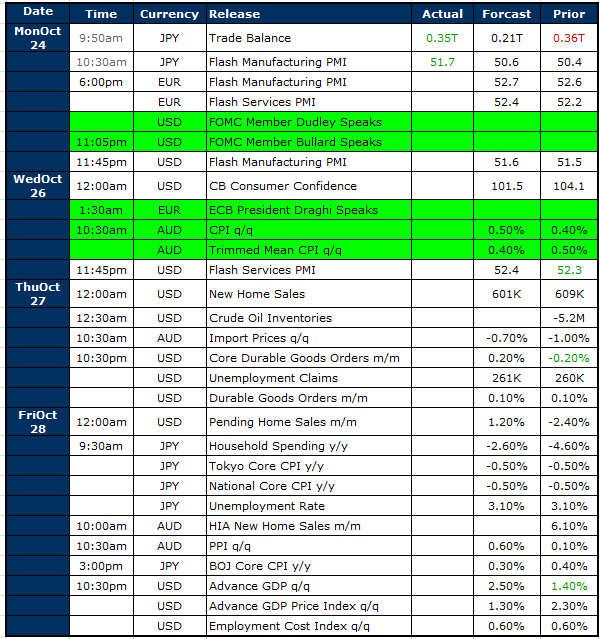

Select Economic Data - Stuff that really Matters in Green

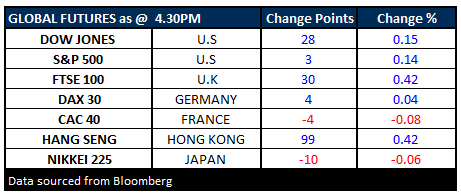

What Matters Overseas

FUTURES higer….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/10/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here