Mantra (MTR) – climbing the wall of worry…

What Mattered Today

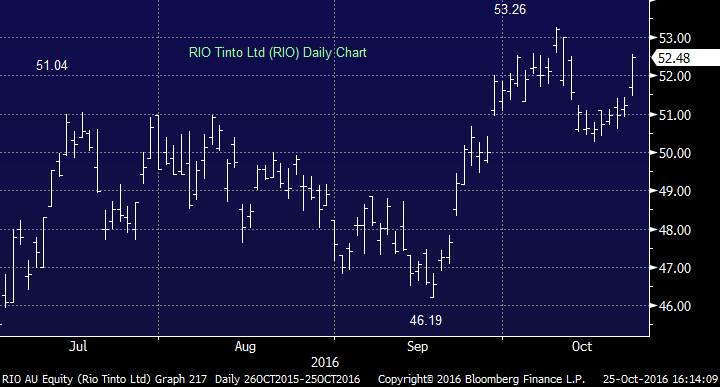

An interesting session today from a sector perspective with the names that have struggled recently copping some well overdue buying with the likes of Stockland (SGP) up +2.70, Scentre Group (SCG) up 1.39% and Mirvac (MGR) up 0.97% after delivering an operational update and reaffirming earnings guidance. Resources were pretty well bid, particularly the high beta plays like Fortescue Metals (FMG) – which broke out to new highs today adding +6.46% and Rio Tinto (RIO) which put on +2.44%. Iron Ore was up strongly in China intra-day and that put a BIG bid underneath the Iron Ore names. So much for ‘oversupply’ putting massive pressure on prices in 2016 as the market was positioning for….!

Rio Tinto (RIO) Daily Chart

It’s interesting to think about seasonality here given we’ve been banging on about it within the banking sector. As we know, banks perform well in October but poorly in November hence we’ll be reducing exposure there into strength. Energy prices, on the other hand, are entering a seasonally weak period from the end of October through to early December and this is worth considering in terms of allocating capital to the energy plays. We hold Origin (ORG) which we remain comfortable with but will be reluctant to increase exposure any further until later in the year.

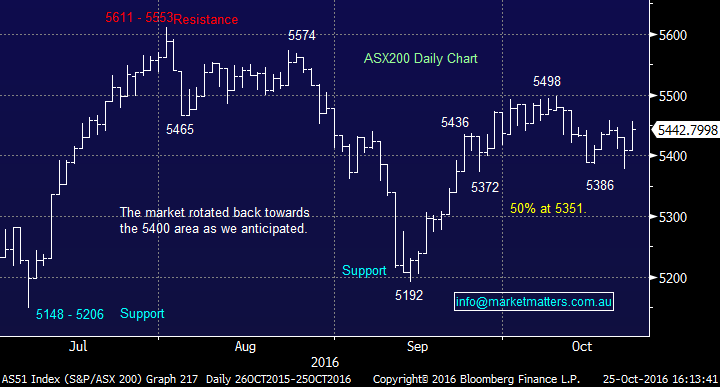

We had a range today of +/- 48 points, a high of 5455, a low of 5407 and a close of 5442, up 34pts or +0.63%.

ASX 200 Intra-Day Chart

ASX 200 daily chart

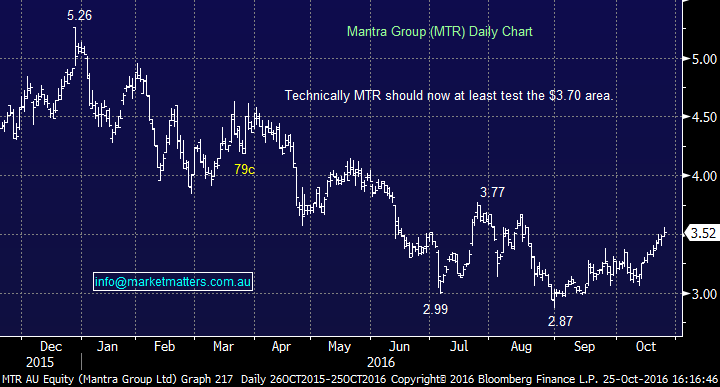

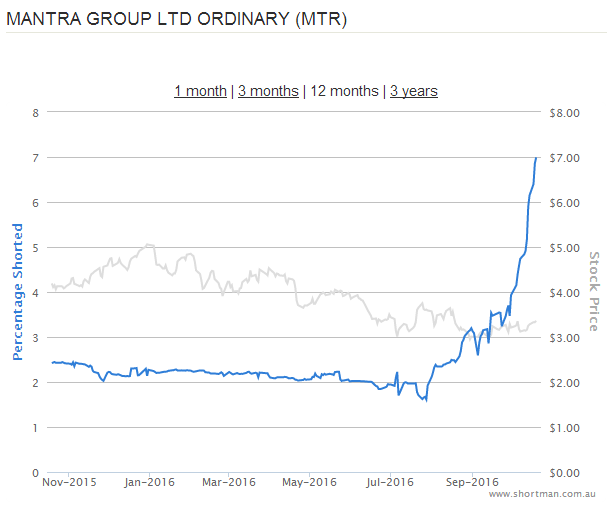

Elsewhere, we’ve got a position in Mantra (MTR) which is starting to look interesting – not because it’s beginning to move higher but more so because it’s doing it in the face of rising short positions and negative news flow relating to Chinese Tourism. In the last week or so we’ve had the Crown news which in theory should be a negative headwind for Australian tourism stocks – including Mantra, while we’ve also got a significant short position which has been built up since September. We now see over 20m shares short sold in a stock that traded 3 million shares today. Poor news + selling volume from shorts yet the stock goes up. It suggests that the legitimate buying volume is solid and if we see some type of catalyst that prompts short covering, this stocks could really motor.

Mantra (MTR) Daily Chart

Mantra (MTR) Short Position

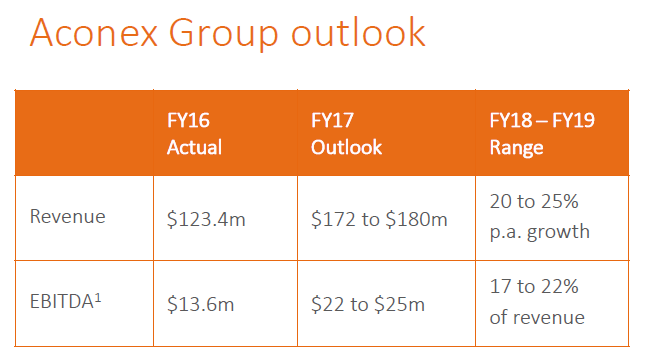

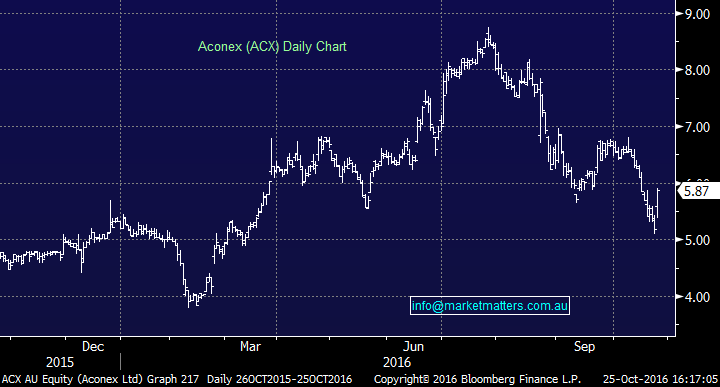

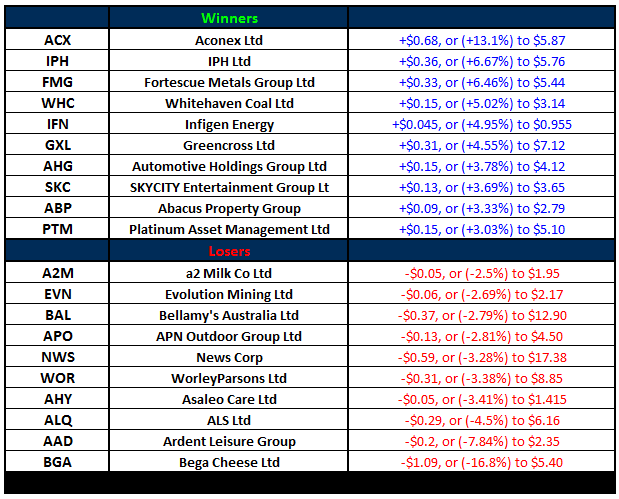

Aconex (ACX) had their AGM today and topped the leader board by adding +13.1% . This is a stock we’ve written about in the past but haven’t bought (yet). They’re a very interesting tech growth stock with a cloud-based platform used in running, managing and delivering large-scale construction and engineering projects. They’ve got the who’s who in the sector as clients, have a big pathway of future growth and are only in their infancy. The issue is around valuation and whether or not earnings will grow quickly enough to justify the price. The slide on ‘outlook’ seems to have gotten the market excited. One to watch.

Aconex (ACX) Daily Chart

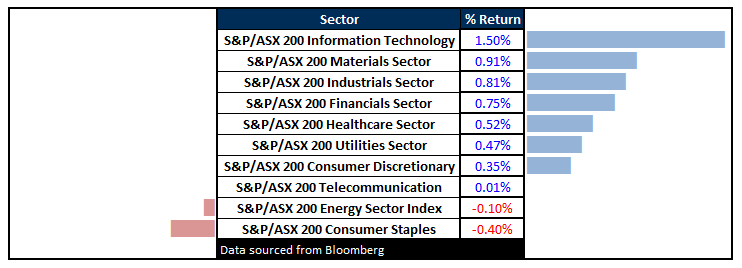

Sectors

ASX 200 Movers

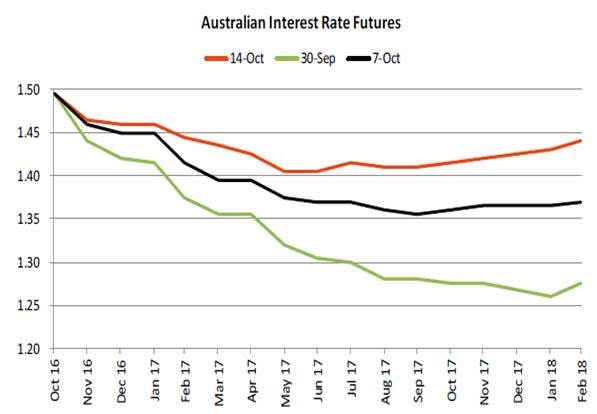

Inflation data is out tomorrow in Australia and this is being touted as the driver for any further interest rate moves by the RBA. 0.4% expected for the quarter but we think the risk is to the upside given the movement in commodity prices of late. A weak number (anything sub 0.3%) may get the RBA thinking about a cut on Melbourne Cup day following the soggy employment data last week however it would still remain unlikely in our view. Market pricing has now moved, and it seems we’re now done – no more cuts to rates and for those thinking about locking in a mortgage, then now might be the time…

Source; Shaw and Partners

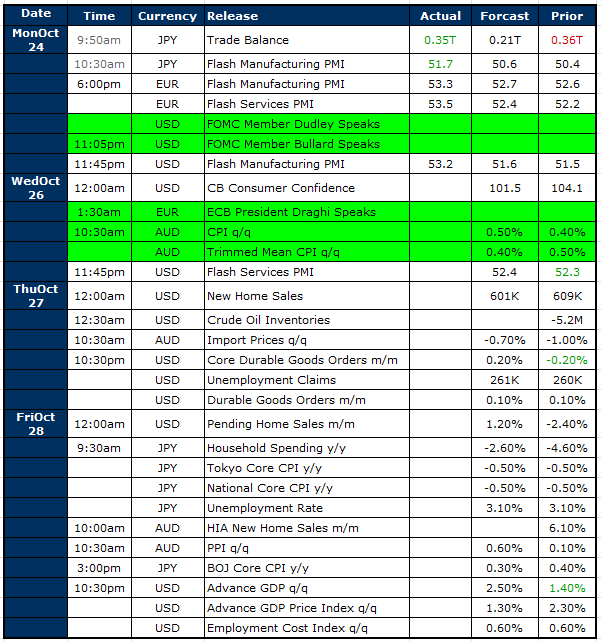

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

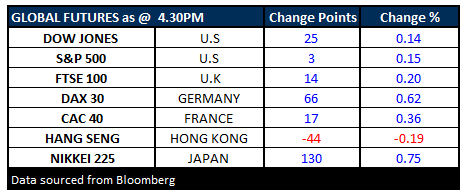

FUTURES higher….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/10/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here