Market whacked – Wesfarmers trips up (finally)

Mattered Today

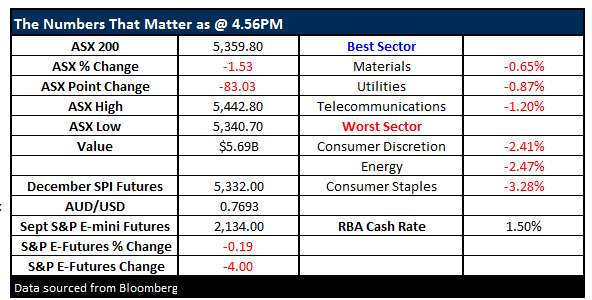

The sleeping giant of volatility erupted today with the market selling off early then copping wave after wave of pressure throughout the session – with the index down -102pts at the lows. One slight semblance of a silver lining came with the index trading below key 5350 support before rallying to close above it. We’d flagged this 5350 region as our trigger point to turn more neutral the market and clearly, today’s action puts us on high alert. For those with cash, we’re more cautious here given the weakness that is typical in November – better to hold onto some $$$ for now in our view.

We now look for some type of meaningful bounce from 5350 support for us to maintain current positioning. A clear break below on a close basis will turn us more neutral / negative and we’d likely increase cash levels above the 9% we currently hold in our portfolio.

The range today was BIG printing +/- 102 points, a high of 5442, a low of 5340 and a close of 5359, off -83pts or -1.52%. It was a big volume day as well with more than $6bn going through the bourse…

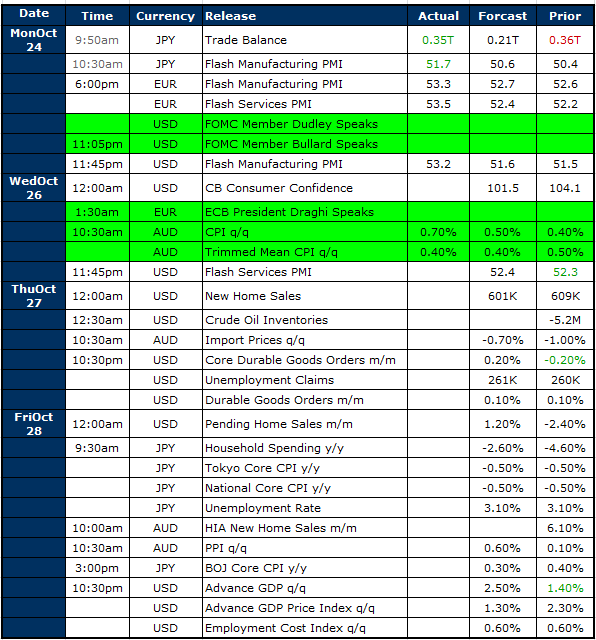

Inflation data dropped at 11.30am – which the market was pretty keen to see to determine the likely path of local interest rates. It was higher than expected – printing 0.7% for the headline v 0.5% while the trimmed mean – which takes out the bigger one off items to try and give a better reflection of underlying trends printed 0.4% v 0.4% expected. Anyway, it seems to us – and we spoke about this in yesterday’s webinar, that we’ve seen the low for Aussie interest rates.

ASX 200 Intra-Day Chart

ASX 200 daily

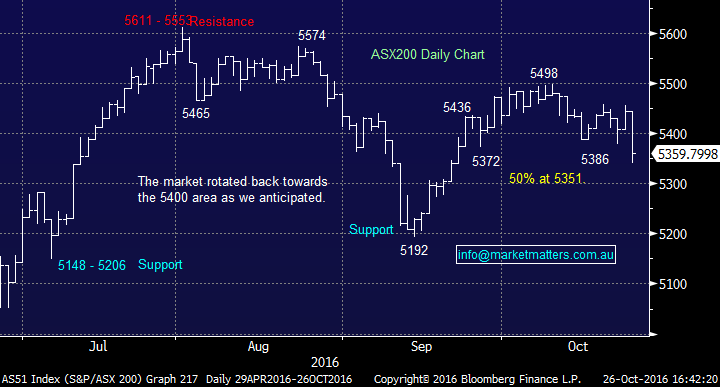

Wesfarmers (WES) was smashed from the get go today after reporting weaker than expected Q1 sales numbers – which seemed to rattle the market. The stock closed down -5.71% to $41.45 which seems fair given the numbers were weak – and after years of outperformance, it now seems Coles is under some renewed pressure. Brad Banducci over at Woolies must be having a quiet chuckle today with the market cross hairs moving from WOW to WES – for the short term at least.

Here're some notes taken from the conference call…

5 key points from the investor teleconference:

1. Coles – WES noted ALL competition has stepped up (as expected) in Supermarkets but that Coles’ headline growth is still well ahead of the market. Apart from WOW, Aldi opened more stores in WA, independents increased marketing spend on “lower prices”, consumer confidence under renewed pressure, etc. WES will continue to invest in pricing and servicing – will not get caught up in short-term initiatives the competition is indulging in (such as the competition’s intensified loyalty plan).

2. Liquor – LiquorMarket still early days (1st store trial in Ringwood) and no response as to whether this new incarnation will replace the under-performing First Choice outlets (getting smashed by WOW’s Dan Murphy’s).

3. Target – WES noted the removal of Toy sales had a significant impact on poor Target results, stripping out $75m in sales. Why does it? 6-months of holding stock and extended lay-buys not positive Reduced SKUs by 40% on last September. Resetting the model – fashion focus at lower prices vs. Kmart who will be everyday low prices. Takes time to turnaround Target as stock is ordered 9 months in advance.

4. Petrol – why not get out of it like WOW considering? Impacts of competitor openings and unabated regulatory changes all negative for comp volume going forward, but will still be profitable despite change in terms in Viva/Coles alliance.

5. Resources – will be EBIT breakeven in 1H17 (vs $310m loss in FY16) with export met coal sales volumes at Curragh reaffirmed at 8.0 to 8.5mt in FY17.

Wesfarmers (WES) Daily Chart

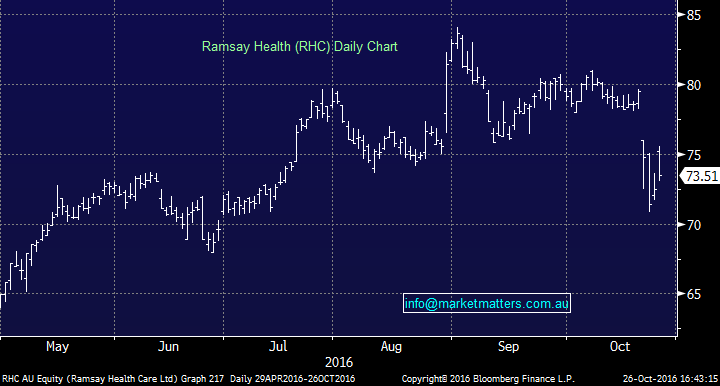

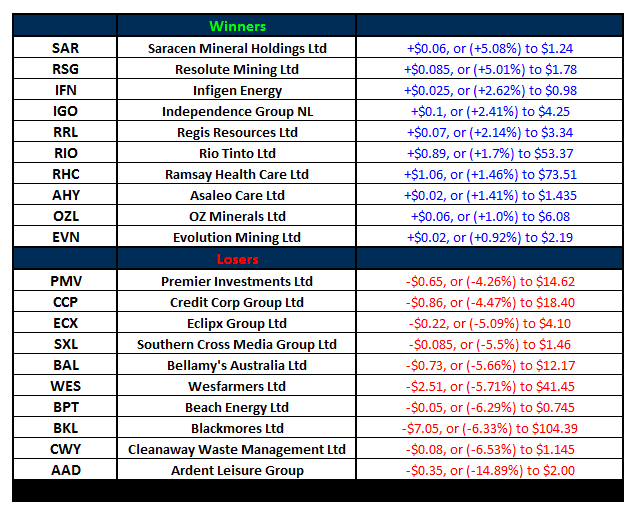

Ramsay Healthcare (RHC) came out today and re-affirmed previous guidance following the update from Healthscope on Friday – which saw BIG selling of HSO and some overflow hit RHC. Ramsay bounced +1.46% today to close at $73.51 BUT still remains a decent way from the recent highs above $80. Healthscope on the other hand was down another -1.32% today to close at $2.25 – we’re in from $2.33 and one hopes that we haven’t gotten on the wrong horse here! HSO trades on 21 times with ‘possibly’ no growth this year while RHC trades on 34 times and said today they’ll still grow earnings by 10-12% in FY17…We still think HSO is better play just here but some indigestion is clearly obvious.

Source; internet

Ramsay Healthcare (RHC) Daily Chart

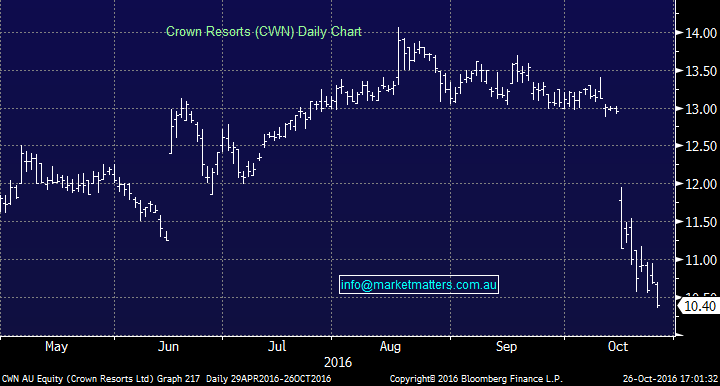

China focussed plays were also hit hard – Bellamy’s -6%, Blackmores -6.75% - no respite for the Casino guys either with Crown (CWN) plumbing new lows again today. It dropped -14% on the day of the announced arrests and we said to stand clear. It closed that day at $11.15 and closed today at $10.40 – another 6.7% lower and we’ve only seen one slight anaemic type bounce in the interim. We have no interest in Crown however Star (SGR) is starting to look interesting under $5.00 – closed today at $4.96 – down 1.97%.

Crown (CWN) daily chart

It wasn’t all doom and gloom today with a few stocks seeing some reasonable buying. Fortescue (FMG) was up again – ditto for Rio Tinto (RIO) with Iron Ore up another +1.40% for Chinese futures ensuring there was some love for that sector. Independence Group (IGO) – the Nickel / Gold miner we hold in our portfolio was also higher – adding +2.41% to close at $4.25 after releasing a pleasing Sep Quarter production report which ticked most of the right boxes. Revenue was a tad light but that was more a timing issue while operationally, IGO kicked some good goals which gives us confidence in the stock.

Independence Group (IGO) daily chart

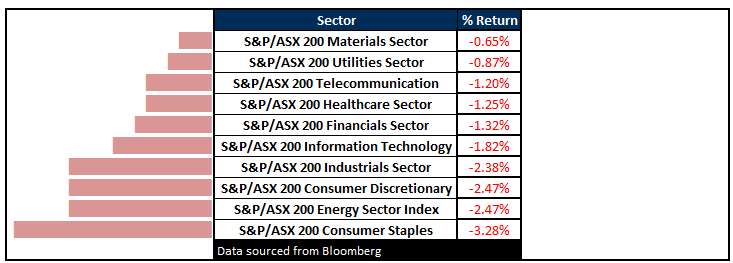

Sectors

ASX 200 Movers

Select Economic Data - Stuff that really Matters in Green

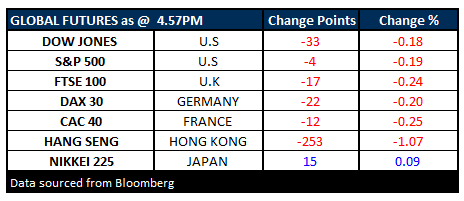

What Matters Overseas

FUTURES lower….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/10/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here