Market cools after a good run

What Mattered Today

The market cooled off slightly today after a pretty frantic few sessions for Aussie stocks - with things now quieting down for Thanksgiving in the US. No trade tonight then a half day on Friday should see the markets limp into the weekend. For the week, the ASX is up +2.35% - a very good move, and we continue to see upside in the local market into early December, albeit after a few quiet days from here.

The market dropped to a low of 5052 on the afternoon of the US election, before hitting a high today of 5503…A rally of +8.9%....After the BREXIT, the ASX 200 had a low of 5051 on the 28th June before rallying +560pts to trade at 5611 by the 1st August – a rally of +11%. It seems pretty clear from these moves that short term market spats can be very good buying opportunities – and more importantly, they often provide that ‘shake out’ that many investors need.

As we wrote this morning, we expect the current rally will continue to well over 5500 prior to a 100-point pullback in early/mid December, a 2016 high well over the August 5611 high feels a strong possibility. That’s how the seasonal footprint tends to play out, and although it may sound bullish cash levels from domestic and international funds remain high.

Commonwealth Bank (CBA) is now at an interesting juncture, having traded up from the bottom of the range to now be at the top… Clearly a very good run up in price in a short period of time. We sold out of ANZ a few weeks ago, after sighting it an the best performing bank from the July lows, but continued to hold CBA (before selling half last week). When a bank underperforms, and specifically when it’s CBA, it will generally play catch up – and that has clearly played out in this instance– we’ll put some stats around this in future notes however for now, we’re still holding our 6% position in CBA.

Commonwealth Bank (CBA) Daily Chart

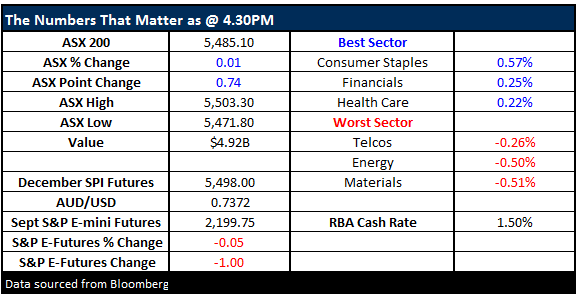

On the market today, we had a range of +/- 32 points, a high of 5503, a low of 5471 and a close of 5485, flat on the session. Volume was OK at $4.92B although that will drop off tomorrow

ASX 200 Intra-Day Chart

ASX 200 daily chart

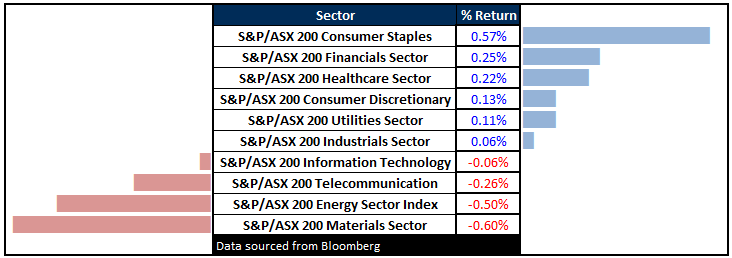

Sectors

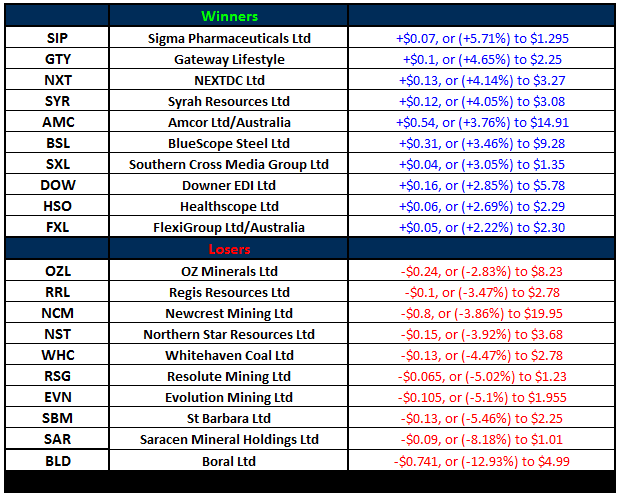

ASX 200 Movers

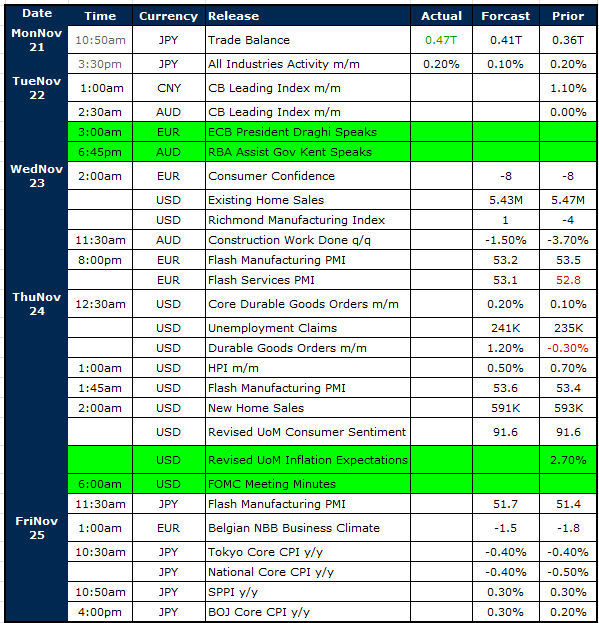

Select Economic Data - Stuff that really Matters in Green

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/11/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions.

You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here

Market Matters Afternoon Report Wednesday 23rd November 2016