ASX tests 5400

What Mattered Today

Monday morning kicked off with the results from the Italian referendum where the Italian people voted ‘no’ to making what seemed like necessary constitutional reform and that in turn saw the Italian Prime Minister Matteo Renzi resign. The polls (and even the betting agencies) got this one right and the margin was reasonably large – suggesting a good consensus. Italian and other European Futures markets were extremely weak early on before a solid recovery played out from the intra session lows – we saw a similar theme in currency markets with the Euro weakest early before a reasonable recovery.

What does all this mean and should we be concerned?

The no vote means the status quo is maintained and is supportive of the wider euro government stability, however it weakens Italy and importantly, the proposed reforms would have helped economic growth at a time when Italy and the broader region continues to struggle. Still, the weakness in the euro, particularly versus the $US should provide a tailwind for growth in the near term, just as the strength in the $US should start to work against Trump & Co. All up, todays result increases slightly the degree of uncertainty in Europe given the resignation for Renzi, but it does not spell doom. Growth remains the key and at the moment, it continues to be illusive (but prospects improving)

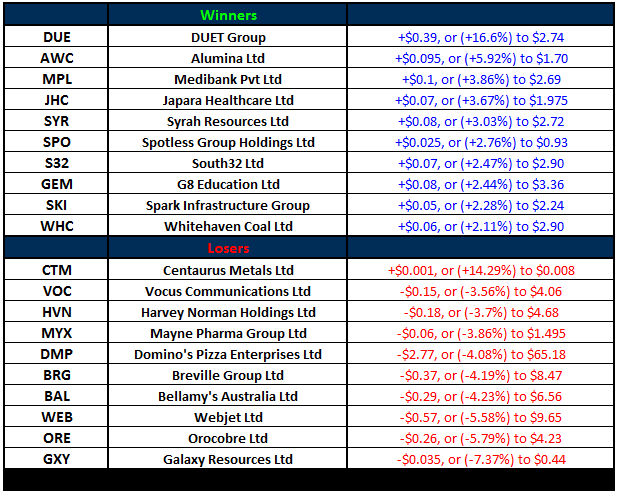

Elsewhere, we saw more corporate activity with a bid lobbed in for Duet Group (DUE) courtesy of a $7.3bn bid from Hong Kong billionaire Li Ka-Shing representing A$3 a share versus Fridays close of $2.35 – an interesting move given the big rally in Bond yields over the past few weeks + importantly, Li Ka-Shing is a well-respected global infrastructure investor and a bid lobbed here suggests some (pretty well regarding guys) are seeing value in these beaten down infrastructure stocks. Before the move DUE had dropped ~14% which was reasonable given the rout in some of the other names however given the stock closed today at $2.74 – there is likely some risk here that it won’t proceed.

Duet Group (DUE) Daily Chart

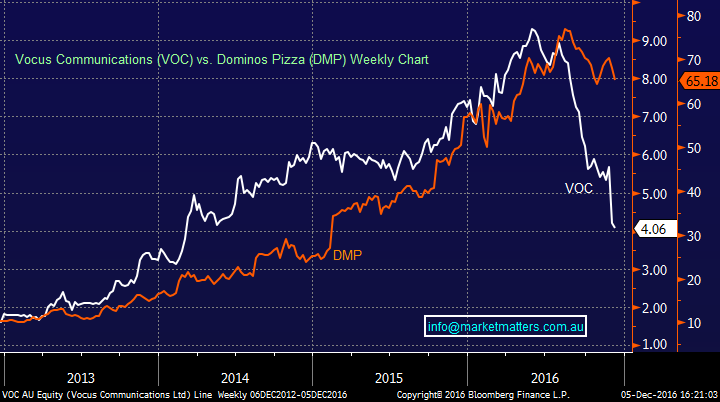

Domino’s (DMP) was down around 4% today and we’re starting to see a major topping pattern play out in the stock…Dominos is a stock that could really disappoint on one set of ‘less good’ numbers – don’t get me wrong, it’s a great success story - has done exceptionally well over a number of years (was doing sales of $263m in FY12 versus $930m in FY16) but trades on a massive multiple (70x). Growth has been strong however it needs to be to justify its current pricing.

Vocus was also a market success story, with exceptional growth, sublime margins and a huge runway for the future. Both stocks ran hard from 2013 to early 2016 and since then Vocus has fallen from grace…will DMP be next? DMP is a well owned stock, is loved by many which presents a clear risk.

The question is, what multiple should DMP trade on? Why should we pay such an elevated multiple? Good growth I hear, dominant market position, overseas expansion, it’s a ‘tech company’ others might suggest. I get it but the bigger it gets, the less nimble and innovative it will become and the harder it will be to grow. The tech B/S is fair but overplayed and the competitive edge it has from its delivery network is now being challenged by a group 20 somethings on push bikes delivering food from any restaurant…For just $4 someone will ride up the hill from Manly to Fairlight with my Noodles strapped to his back, and then I don’t need to eat crumby pizza!

Another Vocus – maybe!

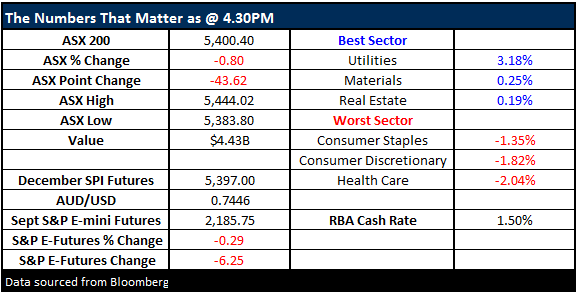

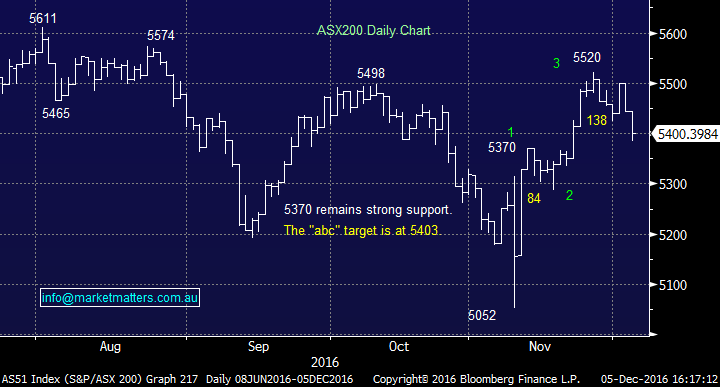

We had a range today of +/- 60 points, a high of 5444, a low of 5384 and a close of 5403, off -43pts or -0.80%. Volume was still weak – about 20% below the 20 day average…Energy was sold early but recovered – Crude Oil down a tad in Asian trade BUT Iron Ore was up around 4% at time of writing.

ASX 200 Intra-Day Chart

ASX 200 daily chart

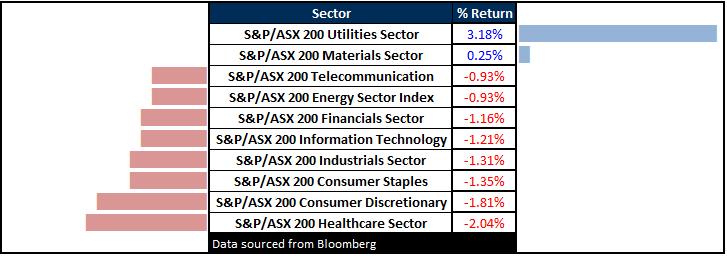

Sectors

ASX 200 Movers

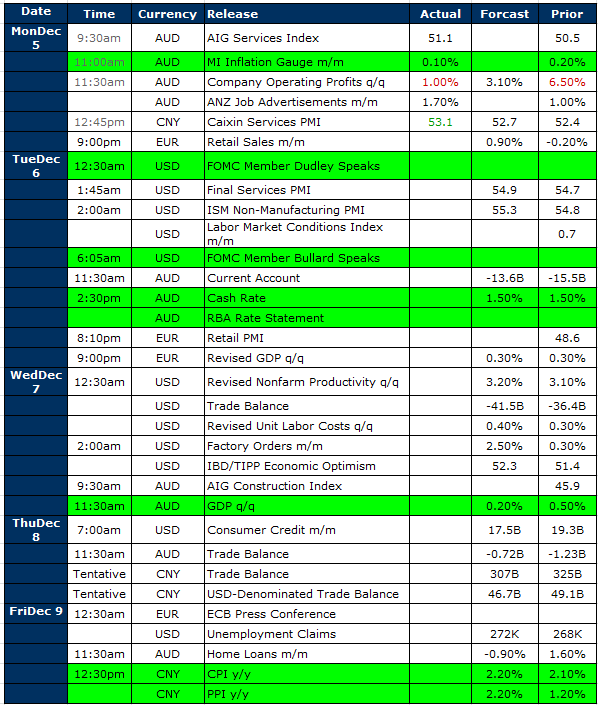

Select Economic Data - Stuff that really Matters in Green

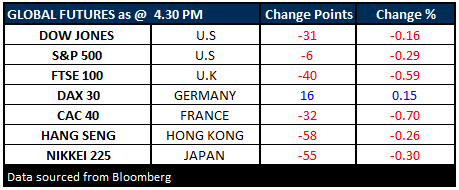

What Matters Overseas

FUTURES lower although they’ve traded a long way off the lows from earlier this morning….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/12/2016. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here