Defensive stocks lead the ASX higher

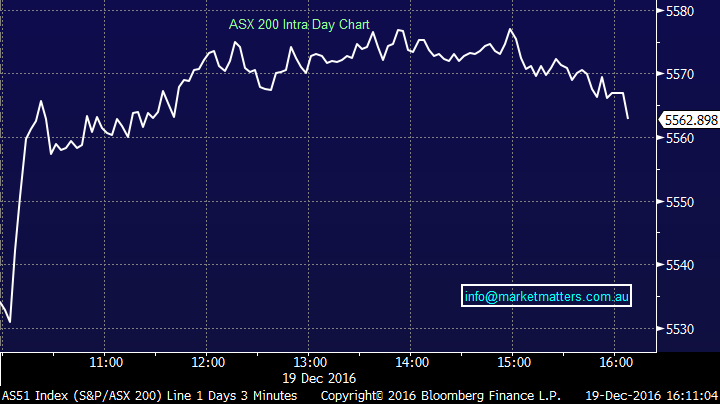

What Mattered Today

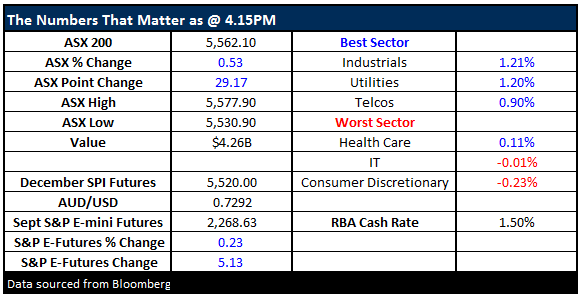

A reasonable session to start the week with the market trading higher into the close, largely on the back of some decent buying amongst the more defensive yield type stocks like Transurban (TCL), Sydney Airports (SYD) and APA Group (APA) - all being up around ~2%. The yield names were higher in the States on Friday but we also saw the Mid Year Economic and Fiscal Outlook which was fairly downbeat, but probably a shade better than some thought it would be which prompted buying of Aussie bonds thus pushing down yields – which makes higher yield stocks more appealing….Here’s a chart of Transurban which we have in the portfolio…

Transurban (TCL) Daily Chart

Staying on MYEFO for second, Treasury retained their target of FY21 as the estimated threshold for the return to budget surplus. However, over the four-year forward estimates to FY20, a cumulative $AU10.3bn has been added to the deficit compared to the Budget.

The underlying cash balance improved slightly for FY 17 to -$AU36.5bn (-2.1% of GDP) from -$AU37.1bn in the Budget, on the back of lower operating cash payments. That said, the FY17 deficit is wider than previously expected at -$AU28.7bn (-1.6% of GDP) compared to -$AU26.1bn in the Budget. This was because forecasts for wage and salary receipts as well as GST receipts have all been lowered, as a result of weak inflation and wage price growth. (source Citi). This prompted the ratings agencies to confirm Australia’s AAA rating for now however it’s likely we may lose it in time. Do we really care – or should we??

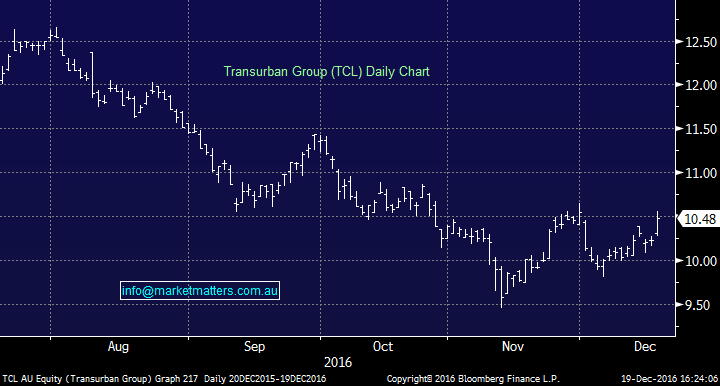

The other interesting trend that caught our attention came from run up in the $US and subsequent buying of US exposed stocks. Clearly, the $US has been very strong in recent months and now trades above 102 for the dollar index, which is understandable when we consider that it’s now a ‘high yielding currency’!!!. Yes, believe it not, the overnight rate for USD rose to 0.66%, which puts it as the third highest central bank yield in the G10 behind Australia and NZ and therefore it is considered ‘high yield’!. This obviously put some life into those $US earners on the ASX with QBE the main beneficiary rebounding +1.37% to $12.59…We own QBE from lower levels and see this as a good play for now.

QBE Insurance (QBE) Daily Chart

Elsewhere, Fortescue (FMG) was down another 4.76% after dropping 5.7% last week after saying it JV with Vale may not happen while shares in Seven West Media (SWM) fell around 8% on news the now CEO had a fling with a staffer and some fairly dubious payment arrangements seemed to have prevailed as a result.

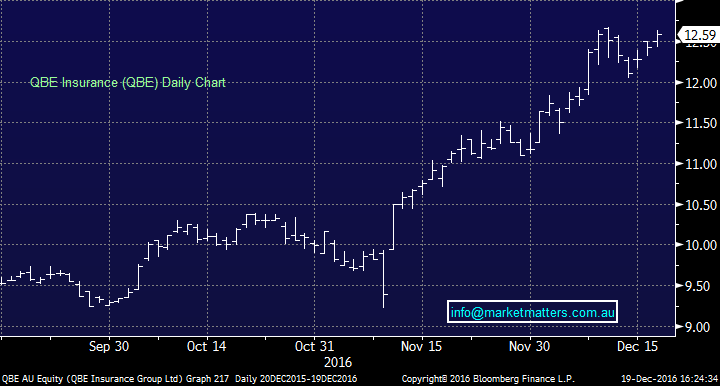

For the ASX, we had a range today of +/- 47 points, a high of 5578 a low of 5531 and a close of 5562, up +29pts or +0.53%. Volume has started to dry up with 22% below average going through the bourse.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

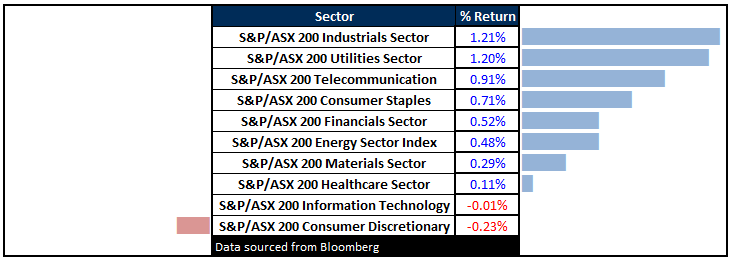

Sectors

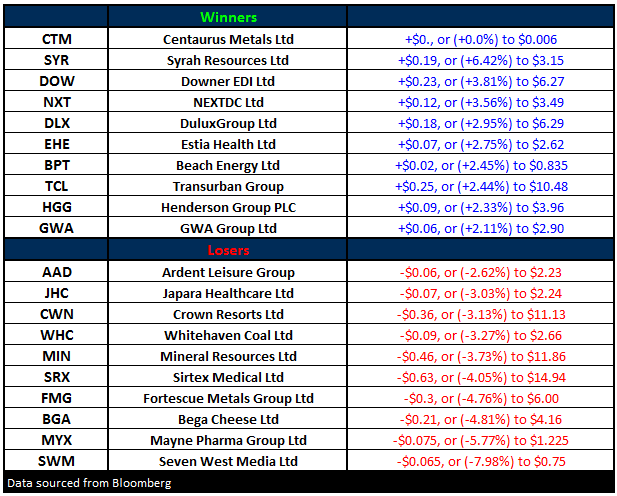

ASX 200 Movers

What Matters Overseas

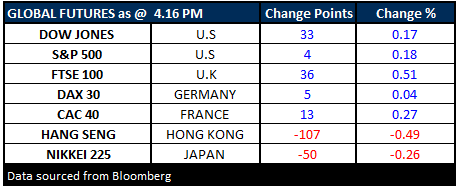

FUTURES mixed….

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/12/2016. 4.35PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here