BIG 82pt range today as the ASX comes under pressure

What Mattered Today

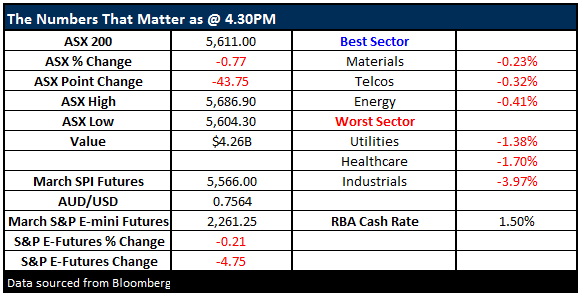

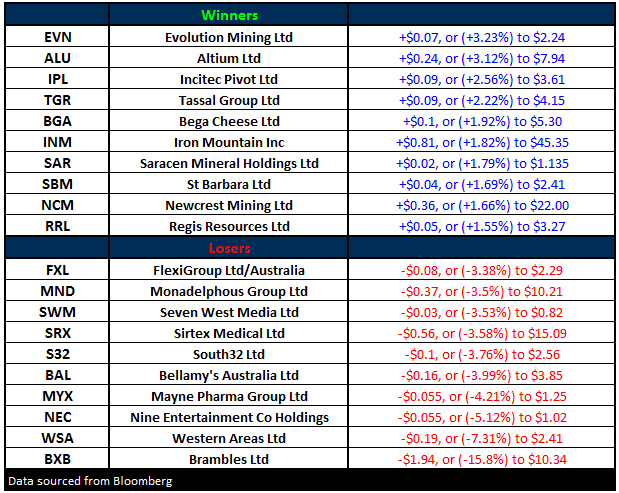

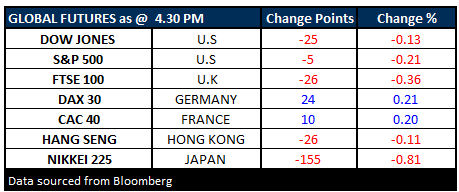

Whether it be the realisation that Trump is now the US President, Berejiklian is now NSW Premier or that Brambles, McGrath + Village Roadshow all downgraded earnings, early optimism in the market was short lived and we saw a decent turnaround & sell off from the early highs. Futures were pricing a rise of around +20pts on the open and we saw that play out early with the market up +32pts at the best before selling kicked in and stocks were sold. It seemed to be FUTURES led early on but a lack of any bounce for much of the day highlighted the obvious void of any real appetite to BUY the weakness in stocks. We talk a lot about seasonality in these notes and we’re in a short term period of seasonal weakness now which typically plays out from around mid-January till early February - ahead of reporting season.

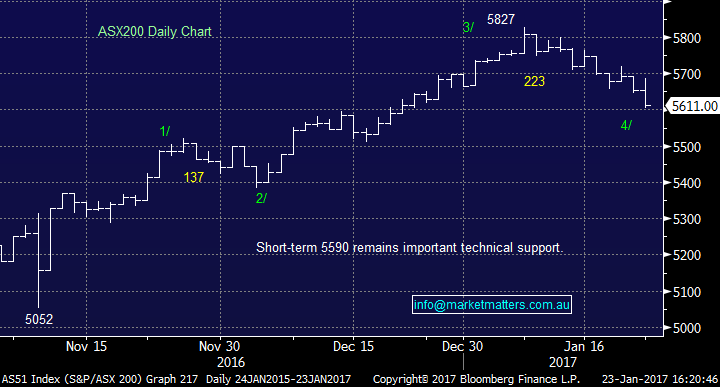

We had a BIG range today of +/- 82 points, a high of 5686, a low of 5604 and a close of 5611, off -43pts or -0.77%. Volume was OK at $4.26bn for stocks… Continue to look for 5590 as key technical support for the ASX 200 in the near term.

ASX 200 Intra-Day Chart

ASX 200 daily chart

Brambles; downgraded earnings expectations today and the stock got whacked by 15.8% to close at $10.34. They now see revenue growth of ~5% and underlying earnings growth ~3% which is down from revenue growth between 7% - 9% and Underlying earnings between 9% - 11%. Another growth stock priced on a high multiple that simply hasn’t delivered on growth – the issue seems to be from their North American pallets business which is interesting, as they sight ‘US retailer destocking which impacted volumes and resulted in increased transport and plant costs associated with higher-than-expected pallet returns’. So, retailers are holding less inventory to reduce costs in an environment where the top line is hard to grow. Brambles has always been a good indicator of broader economic undertones in the US and clearly this is a negative update and we saw other US exposed stocks come off on the back of it. BXB will provide updated full-year guidance as part of their half year result announcement on 20 February 2017.

Brambles (BXB) Daily Chart

McGrath; a few sharks circling the tank at McGrath with the company downgrading earnings (again) it would seem and dropping to a low today of 71c before closing at 81c, which is a long way from the $2.10 listing price. They hadn’t given guidance before so calling it a downgrade is a bit of a stretch, but they did sight Analyst Research saying that they’re more or less on the money for the 1H but a too high for the 2H. Listing volumes are extremely low and they haven’t turned as yet + they also confirmed the departure of 36 agents from company owned offices…All seems pretty tough for MEA at the moment. Deep value? Maybe. MEA relies more on volumes than price so all this talk of a strong housing mkt means little to them. Panic selling, lots of stock coming on line and turnover the key. Very similar to IBs and Brokers that do well in a volatile market given increased transactions.

McGrath (MEA) Daily Chart

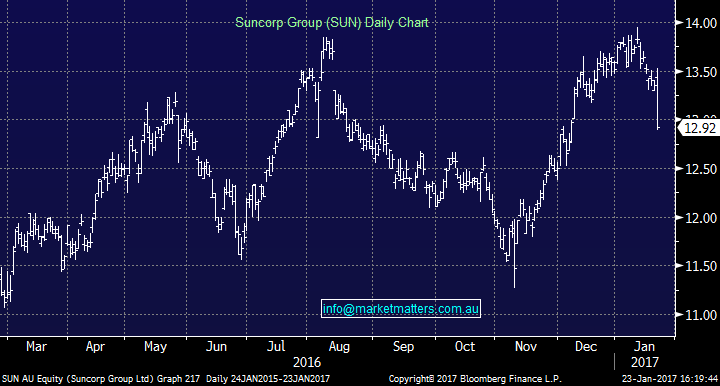

Suncorp; another to disappointment today saying that it expects to exceed its 1H17 natural hazard allowance of $310m by $40m, which equates to about a ~2% downgrades for FY17 but has no impact on later years.

Suncorp (SUN) Daily Chart

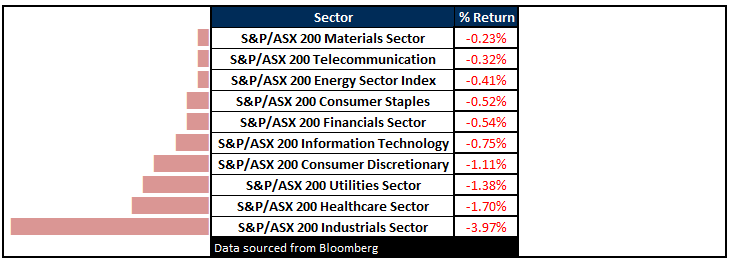

Sectors

ASX 200 Movers

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here