Another day another downgrade!

What Mattered Today

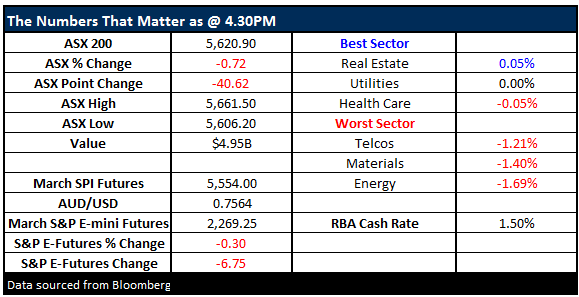

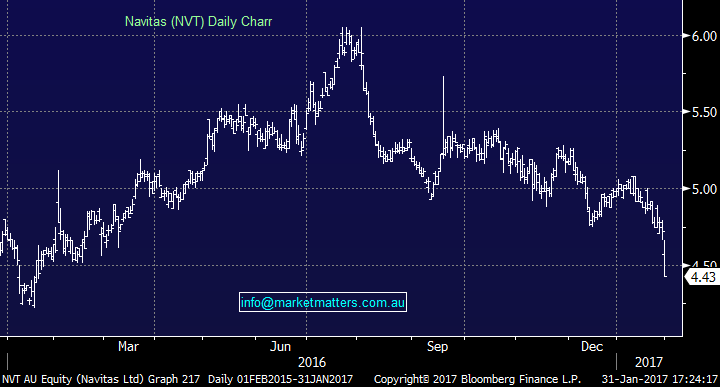

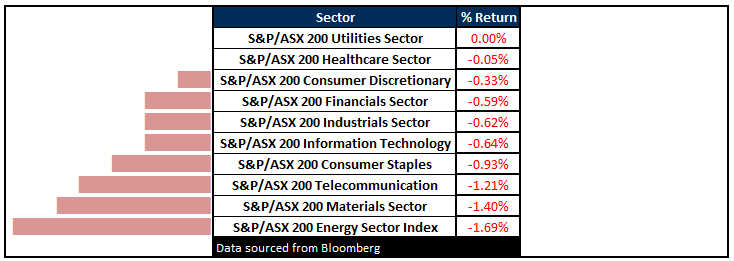

Another weak session locally to end the month with the material and energy sectors feeling most pain while there was buying in the Real Estate & Healthcare stocks…We wrote the following in the Weekend Report on Sunday and it’s starting to play out by the look….Cyclicals have been doing exceptionally well over the past few months with resources the main standout. We discussed BHP two weeks ago calling a move the $28.00 which was satisfied ($27.96), however we believe that a reversal of recent trends may be around the corner - a pullback in cyclicals and a bounce in defensives seems close at hand. Importantly though, this will be a BUYING opportunity for cyclicals and a SELLING opportunity for defensives.

BHP Daily Chart

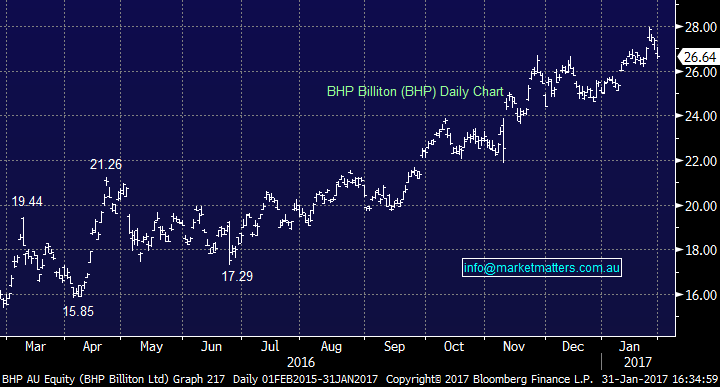

We called the ASX 200 down to 5650 and that happened yesterday and today we saw it below that level to 5620 on the close. 5590/5600 remains a key support area and if we see a move into that zone tomorrow morning following a weak session in the US tonight, that looks like a reasonable BUYING area. As we’ve written numerous times of late, selling strength when optimism is high will be the key this year while buying when the majority turn negative will be the challenge. That will continue to be our mantra until we see signs of a major top later in the year.

We had a range today of +/- 48 points, a high of 5654, a low of 5606 and a close of 5620, off -40pts or -0.72%. For the month & YTD the market is now down -0.79%

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

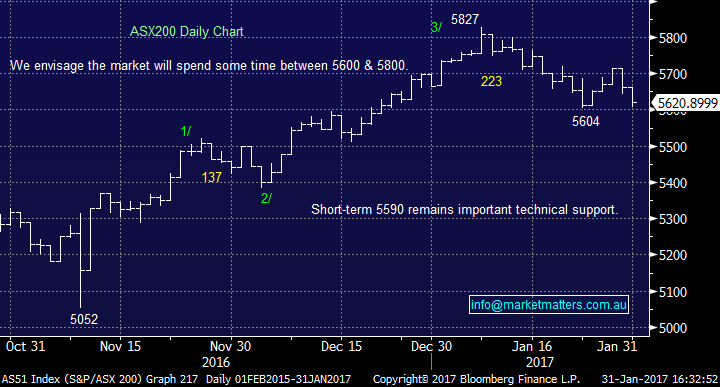

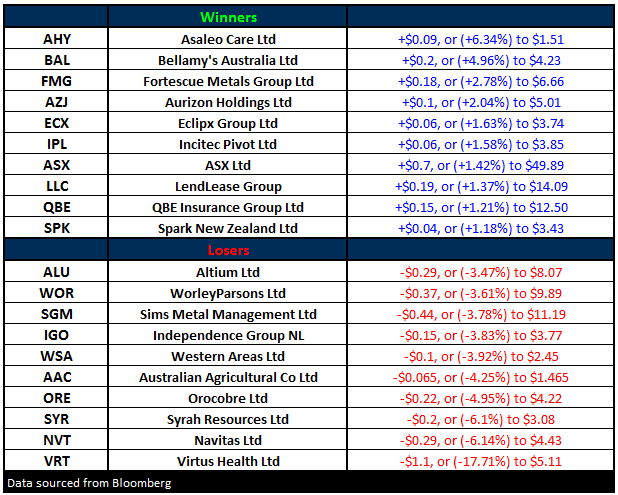

Another day another downgrade this time with Virtus Health (VRT) hit by -17% after they said that fewer people are getting IVF during the first half of FY17. ‘Vitus cycle activity in Australia in this half has decreased by 7.2% on a like for like basis’. Competition in this space is very hot and we’re seeing low cost competition come into the sector + a reduction in Govt subsidies. Education provider Navitas (NVT) was also out with results and the top line number was better than forecast however it was driven by one offs, and the underlying result was a miss. This stock looks terrible on the charts and the trend in earnings now align pretty well with the trend in prices.

Navitas (NVT) Daily Chart

Two production reports for the major miners out today with Iluka (ILU) ever so slightly beating expectations, but the stock was weak early on before recovering to close down -3.08% at $7.54 – although it had run hard into the report. They’ve had a tough few years but now look to be turning the corner with demand starting to improve – one of the resource coys we’d be keen to buy into weakness.

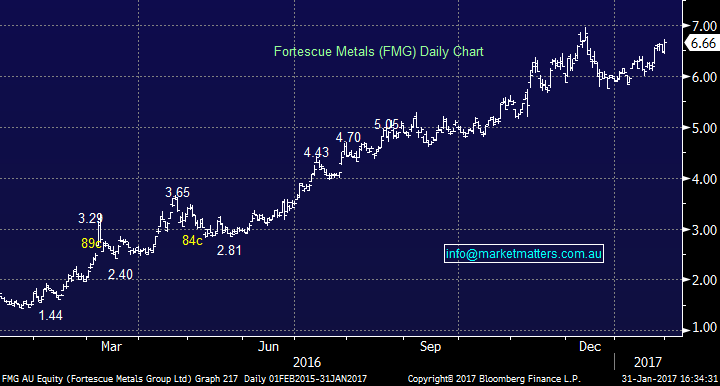

Fortescue (FMG) was also out and delivered another cracker – all metrics were good with sales, revenue, costs, financing etc. trending strongly, and that has been the case for the last 12 quarters. As one Analyst said today, Kudos to the FMG team, they really know how to move dirt efficiently. FMG are ontrack to meet full year guidance of 165-170mt with a C1 costs of $12-13/wmt. They’ve retired well over 2bn of debt since late 2015 – gearing now is around 40%. The main issue with FMG is valuation – it’s run too hard too fast and looks a lot more expensive if Iron Ore tracks lower – as we expect it will over the next 12 months. We’re not buyers here.

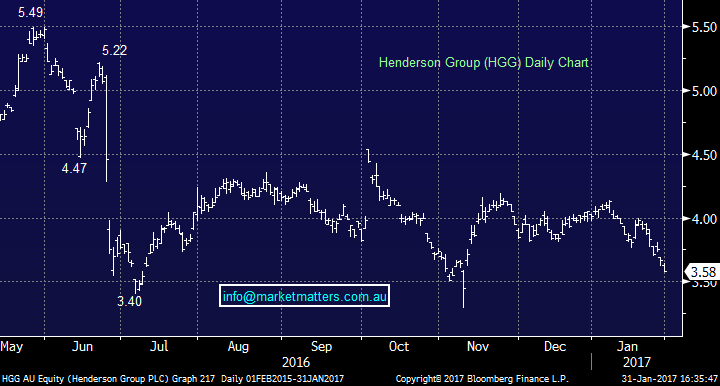

Henderson Group (HGG); We added another 3% to the portfolio today around ~$3.60 inline with recent reports. Obviously the stock has been weak in recent times following the Janus results + equity market weakness however we think value remains at these levels.

Sectors

ASX 200 Movers

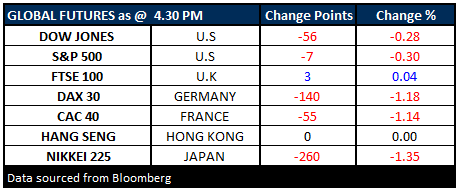

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here