High PE stocks – should we avoid them?

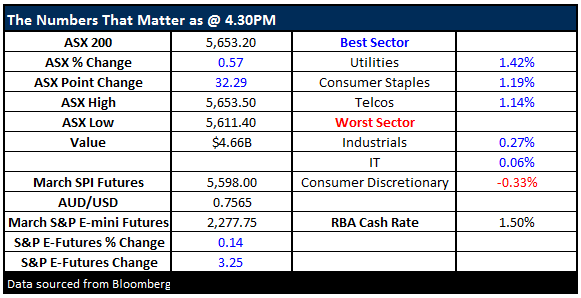

What Mattered Today

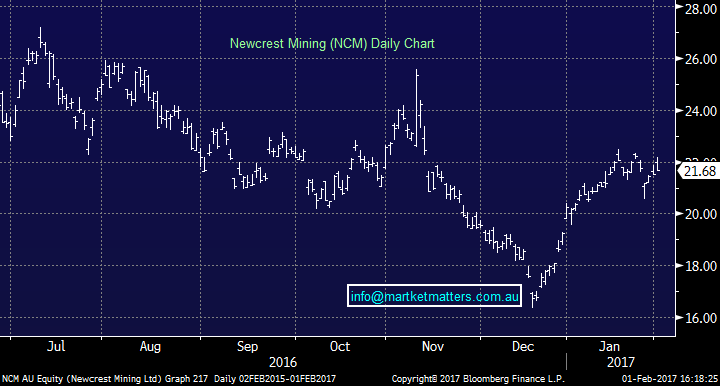

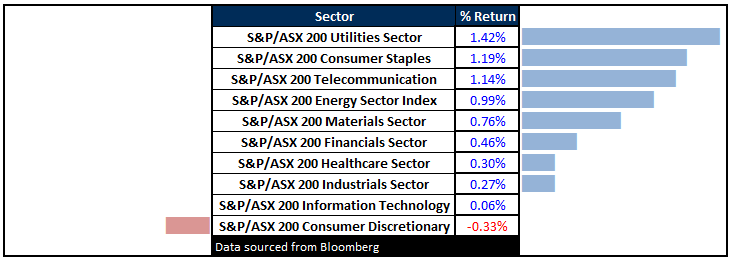

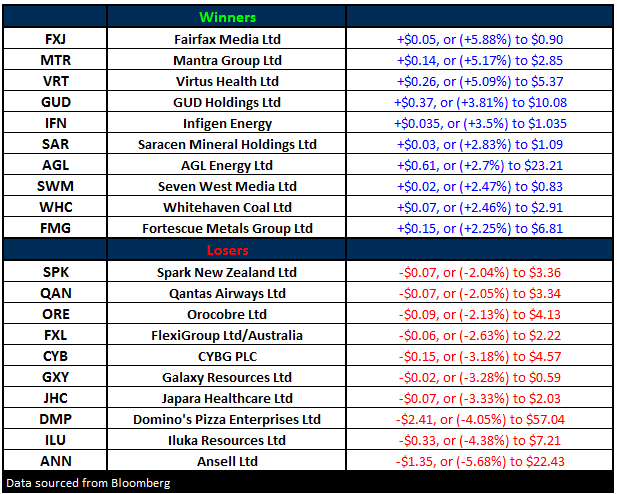

Some buyers emerged today to snap the ASX out of its 2 day slump with most love being directed into the ‘Defensive Sectors’ with the Utilities, Consumer Staples and Telco’s topping the leader board. The Gold stocks were interesting and even though they finished higher, the price action here suggests we’ll see lower prices before we get a sustained run up again…The $US was very weak overnight, breaking through the 100 level and that put a good bid under GOLD which cracked up through $1200 , finishing +$15 higher at $1208. You would have thought that the likes of Newcrest, Evolution, Regis etc would have put on more than they did today + their best was seen in the morning with selling ticking in throughout the day. We own Newcrest, and will either look to add to that holding into weakness or buy Regis / Evolution on a pullback.

US Dollar Index Daily Chart – breaks through 100 (bearish short term)

Newcrest (NCM) Daily Chart

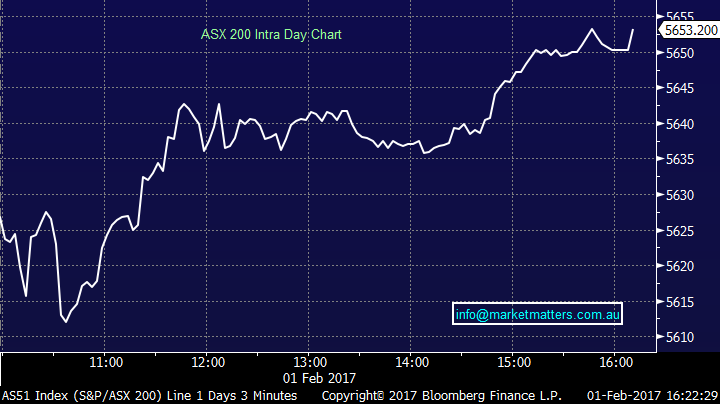

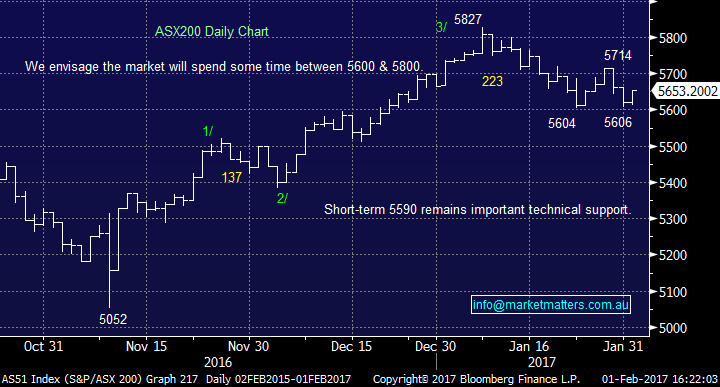

Looking more broadly, we had a range today of +/- 42 points, a high of 5653, a low of 5611 and a close of 5653, up +32pts or +0.52%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

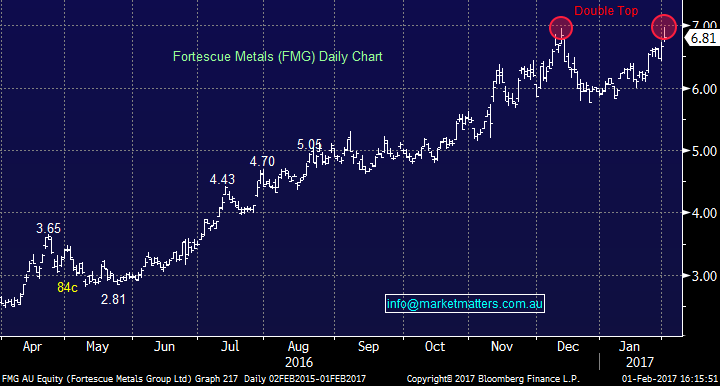

Fortescue Metals (FMG) approached $7 today but pulled back in the afternoon following very strong production numbers yesterday. No doubt this has been a corker running up from sub $1.50 - and we owned it for a period from those levels but even when you listen to Nev Power, FMG’s exceptionally good / impressive CEO, he thinks Iron Ore should be between US$40-60 /tonne – not above ~US$80 as it is now. The earnings momentum in this business now is very strong and because of that it’s hard to stand in front of it, however keep FMG in mind when considering our discussion about high PE stocks, and our reference to resources. Double top is bearish. We simply can’t be involved at these prices

Fortescue Metals (FMG) Daily Chart

Elsewhere, Oz Forex (OFX) copped a battering today dropping ~24% on another downgrade and they also appointed a new CEO. Clearly this business has many headwinds and it will take a long time for it to get back on it’s feet. Importantly though, the business model is not broken and there will be a level that OFX represents value. One to keep on the radar after a very tough few years.

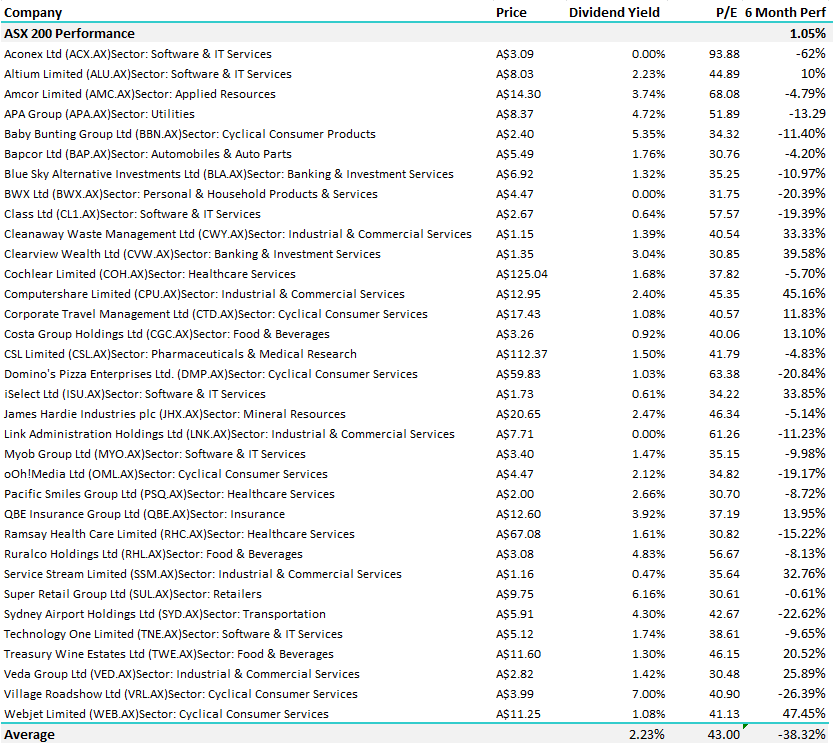

We talked about high PE stocks this morning with the view to being very cautious around that part of the market. That said, there were still a number of them that are on our radar and indeed a few that we currently own. There’s no sugar coating it, this part of the market has been smacked in the last 6 months with the return of the companies listed below being -38% during that period. The average PE for these stocks is 43x forward which compares to the ASX 200 in aggregate which sits on around 15.5x forward.

Not all high PE stocks are the same though, and the basis for the high PE should be understood. For instance, Ramsay Healthcare (RHC) is a high PE stock but they’ve got a long history of not only growth but predictability / certainty of earnings. Aconex (ACX) on the other hand, has a great product which they are monetising, and there is little doubt that they will do well over time, however as with any newer company that is priced for unabated strong growth, hiccups can happen and there is very little certainty in their earnings. Altium (ALU) is a similar sort of story. QBE is a different beast, but still on a high PE. They have many external factors impacting their earnings and the market is now seeing those factors turn in QBE’s favour, hence the share price gets bid up well ahead of actual change in earnings – if the external conditions change or earnings fail to materialise, then the stock gets re-rated back down.

Resource companies are a similar story, the time to buy them is when they are on very high PE’s and the time to sell them is when they are on very low PE’s. That might sound strange but the external environment that drives future earnings will turn a lot quicker than the actual earnings themselves – and share prices are all about the future. Once the economics become obvious in earnings / dividends etc then new production has probably started and commodity prices are likely nearing a peak. So, looking at PE’s and using them as a guide is one thing, but having an understanding of underlying earnings that supports (or doesn’t) the ‘E’ of the equation is very important. We’re not against buying high PE stocks, it just means if they falter, then drops are very BIG as we’ve been witnessing lately.

Prices as at 31/1/2017 – Source Reuters

Sectors

ASX 200 Movers

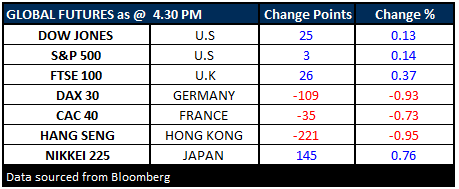

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here