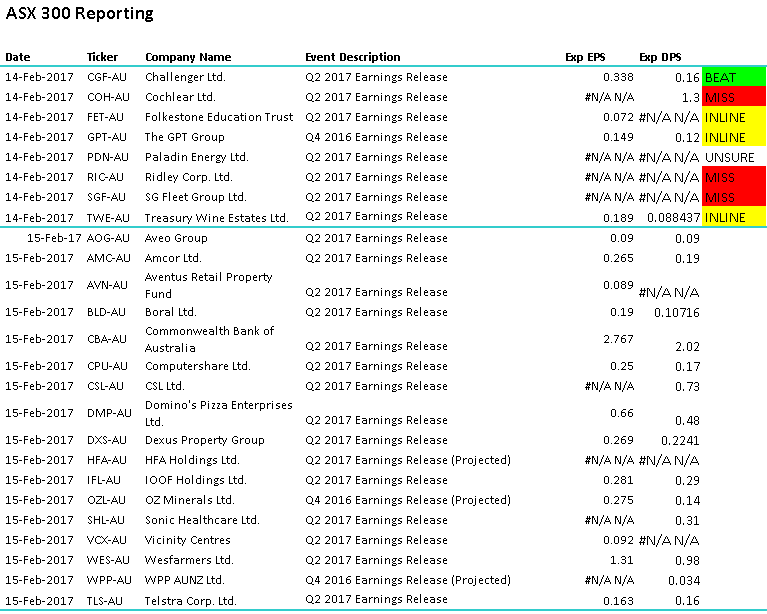

Reversal of fortune for the ASX today – FMG gives sell signal

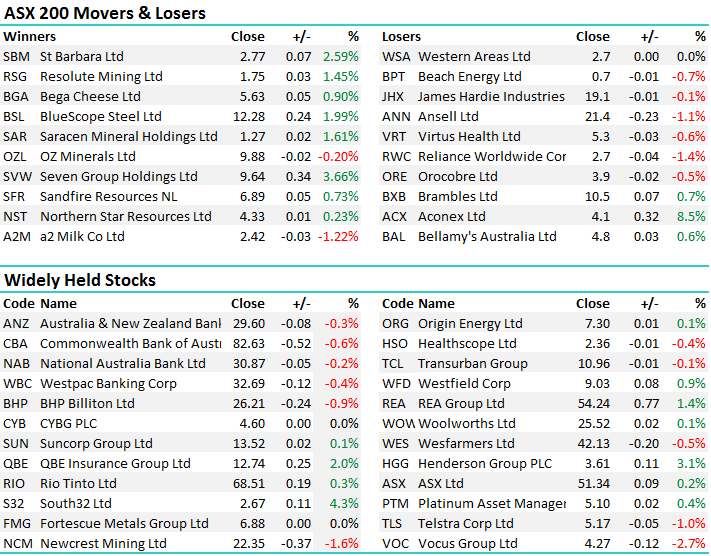

A big move up overnight in commodities especially Iron Ore saw the material stocks gap up on open this morning pushing the market to a high just 5pts shy of the 5800 mark we’ve been targeting in recent weeks. Around 1.30pm selling kicked in and the market tracked lower into the close – with the much loved iron ore stocks from this morning, looking a little bruised and battered by this afternoon. RIO for instance had a high of $69.80 before closing at $68.51 while Fortescue (FMG) traded up to a high $7.06 – it’s highest level since 2011 before giving back its gains to close on it’s daily low of $6.88. Market Matters subscribers received an alert this morning on Fortescue recommending a bearish option position with a $6 downside target. That trade is starting to take shape now with the stock around 12c below our entry price.

Fortescue Metals (FMG) Daily Chart

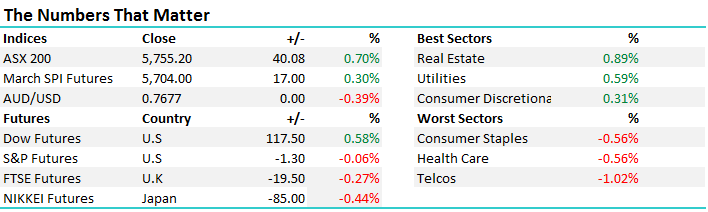

Whether it was weaker company reports, some less upbeat guidance or it’s simply a case of the market running too hot too fast, profits were locked in today, stocks sold and the market finished a long way from the session highs. We had a range today of +/-41 points, a high of 5795, a low of 5754 and a close of 5755, off -5pts or -0.10%. Technically, the 5800 was more or less met today and the decent reversal from the intra-session highs is a short term negative set up, particularly in the commodity space with both RIO and FMG now looking negative…

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

QBE Insurance (QBE) - has been in the headlines again on speculation of a takeover with the stock up another 2% today. We hold QBE in the portfolio as well as Suncorp with both companies benefitting from the murmurs! Where there is smoke there is usually fire so we presume there have actually been talks but nothing has come of it and it’s now being leaked to the press and QBE is arming itself with a defence team. Allianz, the big German insurer is the name floating around. It’s a $100bn market capitalisation company while QBE is $17bn or 17% the size of Allianz, so possible. Allianz are flush with cash at the moment with press reports of around $12bn in excess capital looking for a home….It seems we should continue to hold QBE

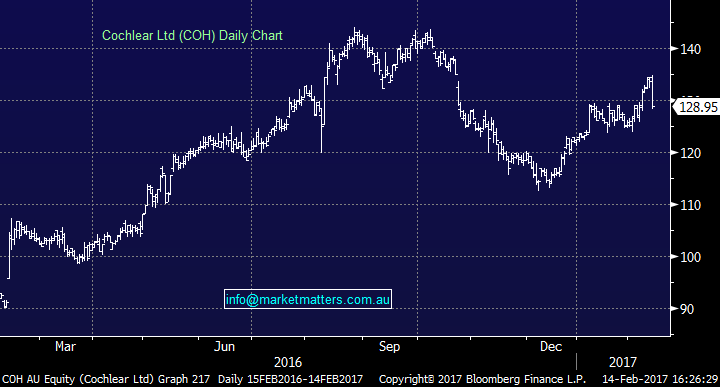

In terms of results today there were some of the more well owned stocks that reported and most of them finished lower by the end, however not before we saw some massive intra day swings play out.

Treasury Wine (TWE); delivered a very good set of numbers today and the stock was up smalls initially however their guidance for the second half which suggested slowing growth seemed to be the catalyst for some selling to kick in. Fund managers love this stock and the mkt is very long here. A similar story was JBH yesterday where the numbers were very strong, above consensus overall however when the stock is very well owned there is simply not enough new buyers to soak up the profit takers and the stock drops. TWE ended the day down 4.71% at $11.33 – down from the high of $11.91

Treasury Wines (TWE) Daily Chart

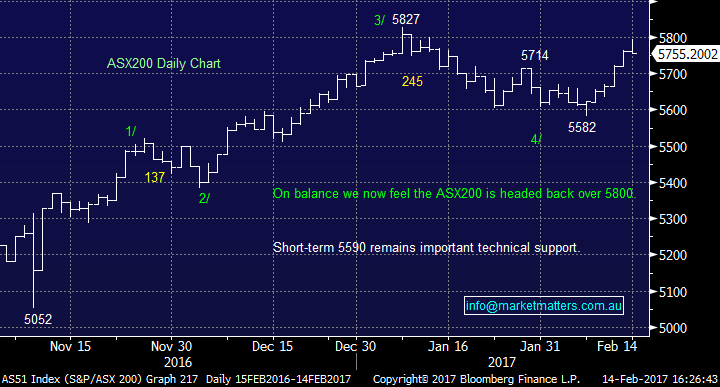

Cochlear (COH); Another much loved stock and a good result today but the stock was sold off by -3.59% - why? They reaffirmed full year guidance for $210 to $225 however the market consensus sits at $223m for the full year – which is the top of the guided range implying that there is some risk around consensus and we might see some ‘trimming’ by analysts as a result. Top line revenue was up 4% but 8% in constant currency terms which highlights the impact of the higher Australian dollar. All divisions were performing well however as we continually say, when everyone is positive a stock and there is even a hint/smell of less good news then profit taking is only natural and in this type of market, deep pullbacks can eventuate. We like COH but will be patient here for some more pain to play out. Shares closed at $128.95, a drop of 3.59%.

Cochlear (COH) Daily Chart

Challenger Group Financial (CGF); Another good result here and this continues to be a very good story for the longer term. Annuity sales over $1bn for the third consecutive QTR and the outlook remains good. The issue here, and the reason why the stock fell off it’s perch today is around capital. When CGF writes an annuity they need to hold capital against it – a lot more than banks would for a housing loan for instance. They said today they have PCA of 1.39x however their target range is 1.3x-1.6x – so they need to issue new capital which will likely be in the form of a Hybrid security then probably an equity raise at some point. This is simply part of their growing pains and will always be an issue for CGF.

Elsewhere, property stocks GPT and Folkstone Education (FET) both delivered inline results, and both were up on the day – Folkstone the best of the 2 adding more than 3%

Good to see Henderson Group (HGG) putting on +3.1% today

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/02/2017. 5.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here