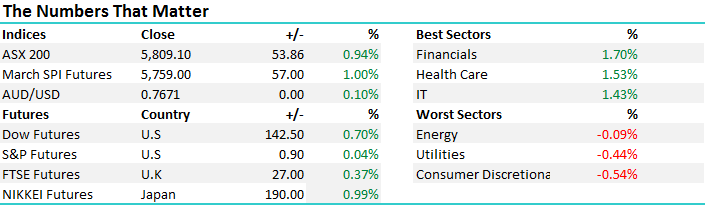

Aussie market punches through 5800 on decent result from CBA – Dominos tanks

CBA set the tone this morning with a good result and that saw the market open strongly before grinding higher throughout the session – punching through 5800 around 12.30pm. We had a range of +/- 51 points, a high of 5817, a low of 5766 and a close of 5809, up +53pts or +0.94%.

Banks clearly the standout accounting for 27pts of the indexes advance today. CBA alone put on +10index points!! Some very big intra-day moves once again with CSL and Cochlear recovering very well from early weakness while Dominos (DMP) was hit hard, as it should be after they missed expectations but upgraded guidance…trying to sugar coat a poor result with a promise that they’ll do better next time. Amateurish and the market saw through it. The stock down -14.36% to $53.56. We have interest in that stock.

ASX 200 Intra-Day Chart

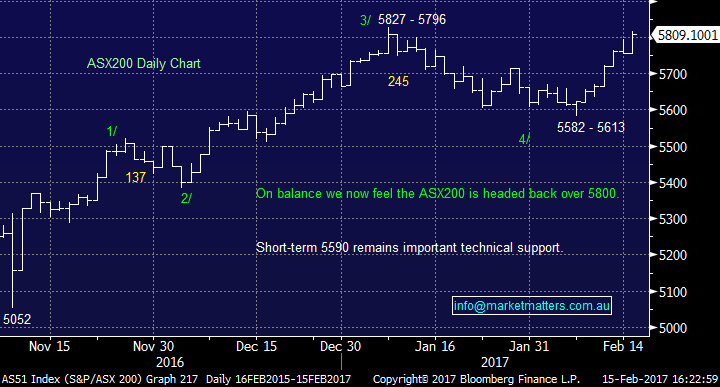

ASX 200 Daily Chart

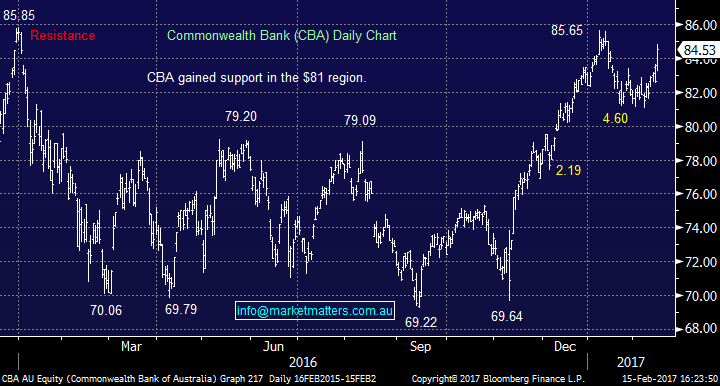

Commonwealth Bank (CBA); Good result this morning. Cash profit of $4,907m (Exp 4821m) , EPS of $2.77 (Exp $2.74) and an interim dividend of $1.99 (ex 22nd Feb) versus Exp $1.98 . Margins down 4 bps but inline with expectations at 2.11%, bad debts lower than forecasts but costs slightly higher. Capital was very strong with CET 1. of 9.9% v 9.6% Exp. The Result includes a one off gain of $397m offset by one off-cost increase $393m due to software write off. All up a very good result from CBA. Shares closed up +2.30% to $84.53. We own CBA

Commonwealth Bank (CBA) Daily Chart

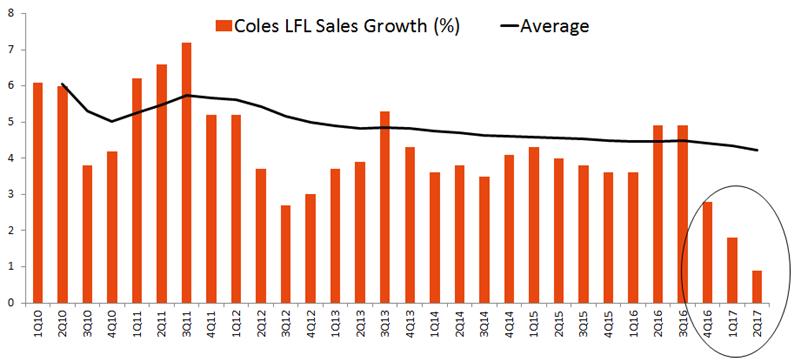

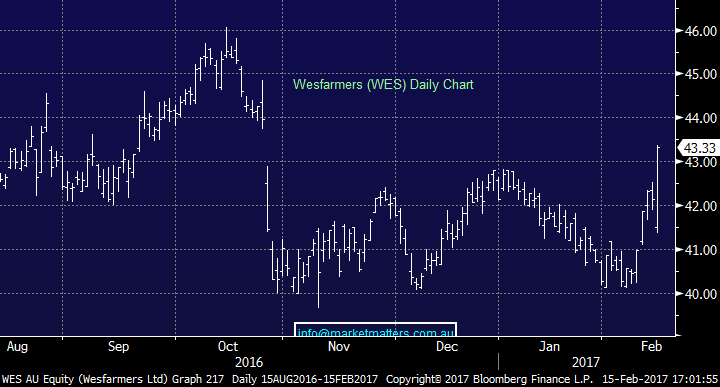

Wesfarmers (WES); Some good and bad in the WES result this morning however the mkt seemed to like it. Cash earnings ahead of consensus expectations at $1,577m (exp $1,500m) which is up +13.2% on this time last year. Most attention on the result should be on the food and liquor business which accounts for 38% of earnings, and margins were lower (1.3%) but within the expected range of 1.0% to 1.5%. Interestingly, price deflation was -0.9% which was a drag as competition hots up in the sector.

Good chart here from Shaw and Partners highlighting the trending like for like sales growth of Coles, which is clearly deteriorating as the BIG behemoth of Woolies turns its ship around and new entrants come into the fray.

Source; Shaw and Partners

Elsewhere in the business, Bunnings which is 30% of group was good but growth is slowing, Officeworks was OK but it’s only 2% of group, Kmart which is 15% of group seems to be improving, Target which brings nothing to the table in terms of earnings was poor again while their Industrial business which is 15% of group was weak (although within this commodities were strong).

So, top line looks ok but composition and trends are a little weak – probably the opposite of what we saw with Suncorp (SUN) recently. Shares closed up 2.85% to $43.33. We don’t own WES

Wesfarmers (WES) Daily Chart

CSL (CSL); A good result from CSL and inline with their pre-announced number ($800m) while they expect to grow that in the range of 18 to 20% (on constant currency) which is pretty much what they had previously guided to recently, however they said that EPS growth will again exceed profit growth which is a result of their share buy back program. CSL closed up +2.9% to $118. We own CSL

CSL Daily Chart

Cochlear (COH); A stock we wrote about this morning looking to BUY around $124. It traded to a low today of $124.20 however only a few shares traded – we hope some subscribers were quick enough to get on board and enjoy the recovery back up to $129.20 before the close. Unfortunately, we weren’t quick enough. COH ended up 0.19% to $129.20

Cochlear (COH) Daily Chart

Earnings spreadsheet back tomorrow – time got away from us this afternoon after a busy day on the desk!

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here