Vocus tops the leader board on ‘less bad’ result!

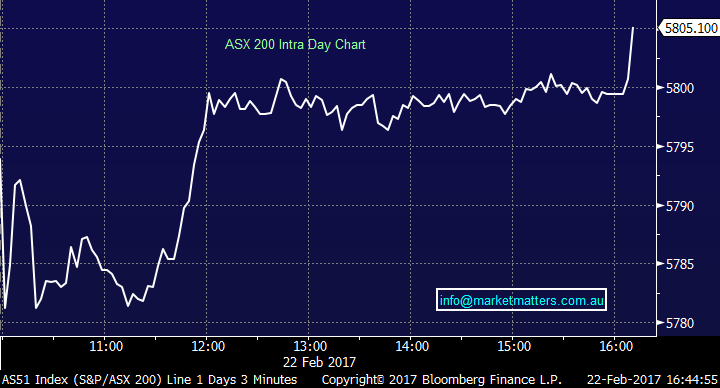

CBA traded ex-dividend today for $1.99 fully franked which took 12 index points from the market however we still managed to finish in the black. A reasonably soft open to trade this morning before buying stepped in around 11.30 pushing the index higher into the close. We had a range of +/- 25 points, a high of 5805, a low of 5780 and a close of 5805, up+14pts or +0.24%. The market continues to oscillate around that 5800 level which we expect will continue for a while with natural buying being offset by the distribution of dividends…

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

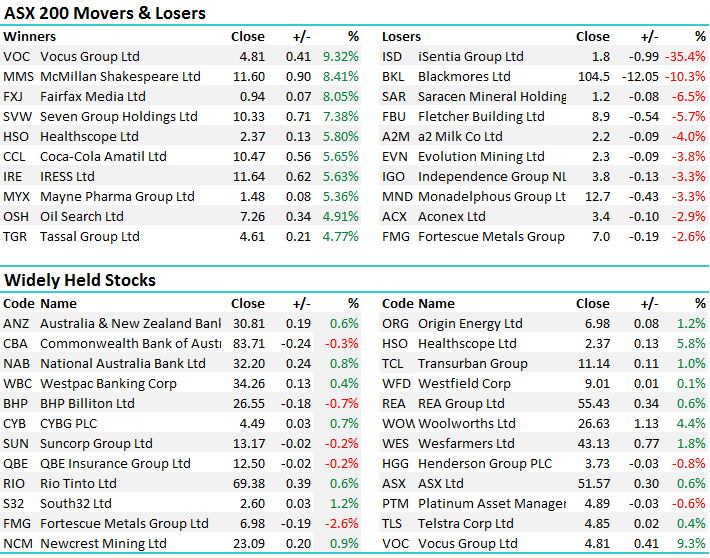

A BIG day for the MM portfolio with reports coming from 3 companies we have exposure to. We own Vocus (VOC) and this has been our one very difficult positions over the past 6 months or so and it was nice to see a decent result out today, and the stock put on +9.32% to close at $4.81, the best performing stock on the ASX 200. This dragged up TPG (TPM) which we have a shorter term bullish trading position on with that stock up +4.01% to $6.49 .

Elsewhere, Healthscope (HSO) which we own rallied 5.80% to finish at $2.37 after providing a better full year outlook than they did a few months ago. Fortescue (FMG) also reported a very good set of results this morning, beating on most metrics (as was the case with both RIO and BHP) and they were strong early but tapered off throughout the day, finishing down -2.65% to $6.98 after being as high as $7.27. We have a bearish options positon on Fortescue with a $6.00 target.

Importantly, we don’t have any exposure to some of the weaker links today with the much loved Isentia (ISD) down another 35% after missing expectations by around 17% and downgrading guidance, with Content Marketing, which has been the thorn in their side now for a while expected to make a FY17 loss of $3.0m.We have no interest here …Blackmores (BKL) was also weak down another -10% to $104.53

In terms of repositioning today, we tweaked the portfolio by reducing our weighting in CBA this morning by 3% (ex-dividend) and up weighted our existing ANZ holding by the same amount to collect the dividend in May. Our cash level remains at 20.5%.

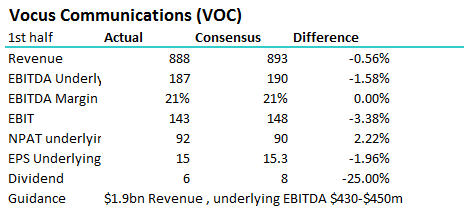

Vocus Communications (VOC); This was a good result despite the numbers being a tad below consensus in terms of earnings / dividends etc as shown in the chart below, and the conference call was more upbeat that we’ve heard in recent times. They re-affirmed guidance for full year earnings of $430-$450m which was always expected, however there were concerns in the market that the first half number would be weak, and they’d be placing a lot of (unfounded optimism) on the second half. There was an earnings skew for 2H 17 but at a level that gives validity to their full year guidance. Margins were also in line with consensus and they talked about numerous opportunities that could turn the dial on earnings for the 2nd half.

We often speak about looking at a particular result in the context of where the share price is at, and this trend was once again on show today. The market is very long resources and share prices have risen strongly, pre-empting the good results that we’ve seen. FMG another example here with a good result but with everyone already long, it was no enough to prompt new buying. Vocus is on the other end of the spectrum, being universally hated for the last 6 months, grappling with acquisitions, staff departures and the integration of some very complicated businesses. Although we don’t want to sound too optimistic, and clearly there are many challenges facing this business, the tide seems to have turned. We will likely use this recent strength to reduce our weighting in the stock back to more palatable levels in the not too distant future, but are more comfortable holders now. We own Vocus (VOC)

Vocus Communications (VOC)) Daily Chart

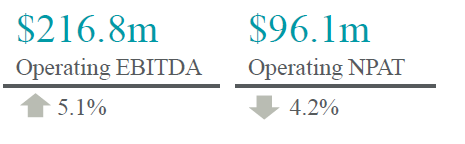

Healthscope (HSO); It was all about the outlook statement for HSO after they came out earlier in the year and spooked the market by saying that they may have ‘no growth’ if trends at that time were to persist. Today they put that to bed for now by saying that earnings growth would likely be the same in the 2H as they were in the 1H, implying growth of around 5%. We own Healthscope (HSO)

More on results in the morning report tomorrow

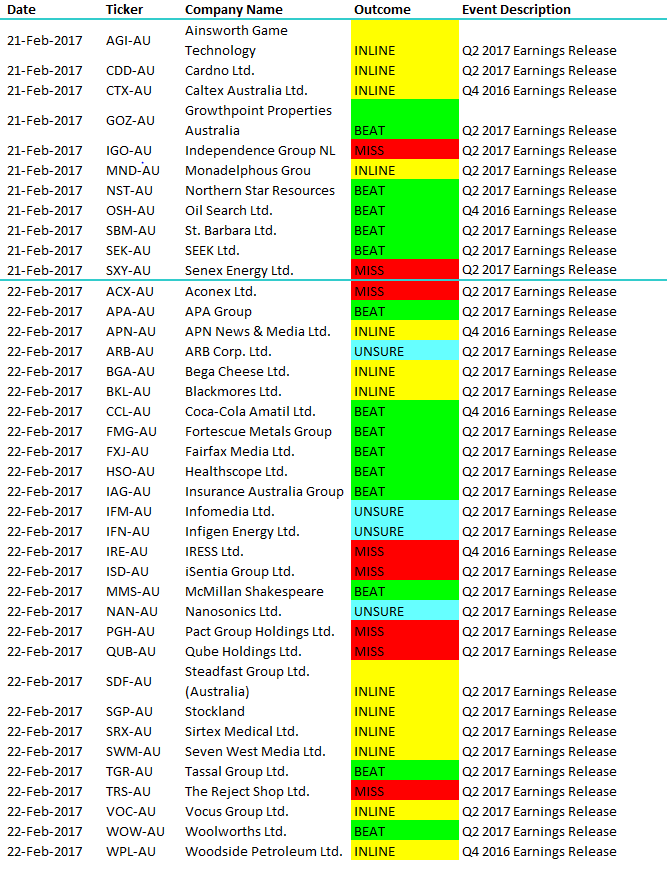

Results – yesterday & today

Growth stocks once again in the firing line today…ISD, BKL, A2M, ACX etc all weak

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/02/2017. 6.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here