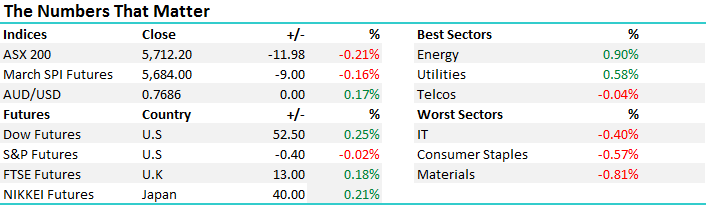

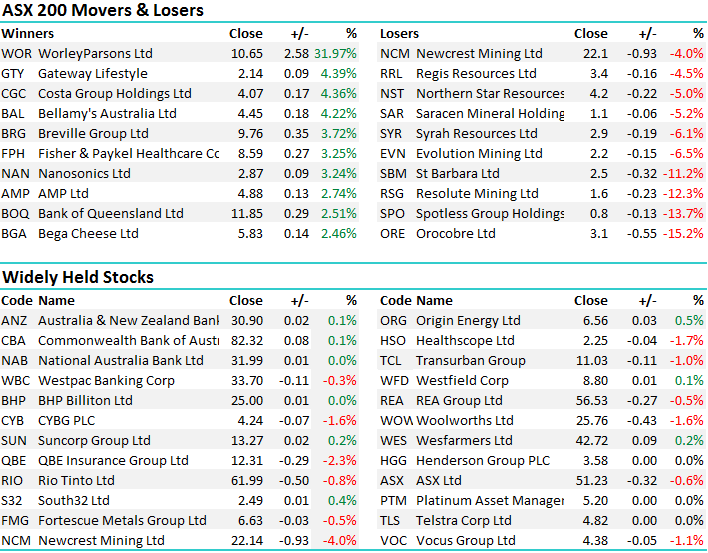

Market turns negative in afternoon trade…closes down to end the month

A higher open again this morning and a reasonable move north till lunchtime before sellers took hold and pushed the market lower into the close. We had a range today of +/- 43 points, a high of 5755, a low of 5712 and a close of 5712, off -12pts or -0.21%.

ASX 200 Daily Chart

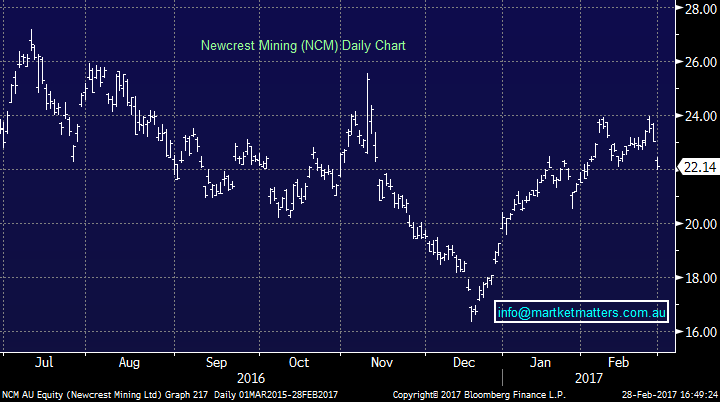

Resources the main drag, particularly GOLD names which were down sharply today despite the gold price staying reasonably firm (good SELL CALL ON NCM!!) , however the broader suite of commodities also came under pressure after a ‘dead cat bounce’ yesterday. We continue to see lower levels for the miners so be patient here in the short term however our targeted levels may be reached sooner than many think. We currently have 23% in cash and we plan to allocate a portion of this into the sector in coming days/weeks.

Newcrest Mining (NCM) Daily Chart

Obviously the end of month today and always, the short month of Feb seems to creep up on us…It’s been a very interesting month obviously in terms of reporting but also around sector performances. In terms of reporting we saw more beats than misses on both EPS and revenue which is obviously positive, but more so given expectations were high leading in. The upgrades have come from resources (alone) with the banks and industrials (ex banks) showing flat to negative earnings revisions. Despite this theme, the price action based on the results has been negative towards the resources (which are providing the growth) and more positive towards the industrials, which have seen no growth / upgrades in aggregate.

This trend is clearly shown in the monthly performance table below for the various sectors and this is a good lesson on how markets overshoot. Clearly, too much optimism was built into resources while too much pessimism was priced in the defensive plays like Real estate, Health and Staples and they’ve snapped back this month. We think this is a short term theme and the growth drivers (resources) will come back into vogue in the not too distant future (more on that below), however it’s a very good lessen around positioning, and having a more dynamic portfolio as opposed to a static one. It’s no necessarily about trading, or being traders, it’s around taking opportunities when they present themselves and being ahead of the game, rather than behind it as so many are…

Source; Bloomberg

…and in terms of stocks for the month of Feb, highly valued growth stocks that missed expectations were clearly savaged and this was another clear takeout from the month.

Source; Bloomberg

We penned an article that got picked up in livewire recently titled ‘Is it time to buy banks or resources’…We think it’s worth re-printing here given it sets out our road map for the two major sectors on the ASX

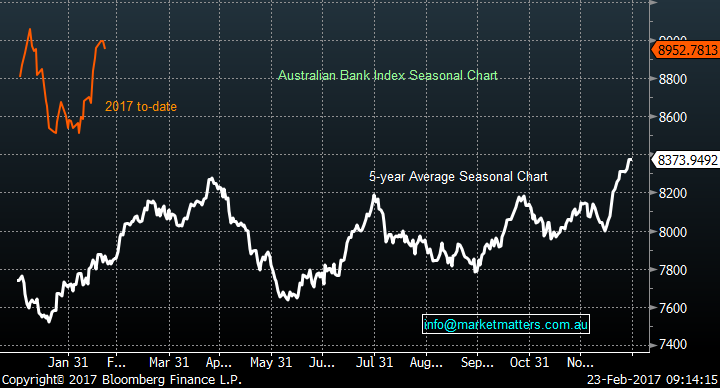

Our banking / financial sector dominates the local market to the degree that we are often heard to say in the office "it cannot get up without the banks" - the big 4 banks make up around 26% of the ASX200. Let’s compare 2017 so far to an average year for our banking sector on a seasonal basis:

1. The January fall and rally into the end of February fits into normal seasonal patterns, albeit in a relatively extreme manner this year.

2. There is often a 1-2-week pullback in banks around now before rallying nicely through to late March.

3. Historically good buying in the 1st week of April and a significant sell at the end of the month.

Hence, unlike the resources, we are not negative our banks at current levels but we do think logic dictates being patient with further buying for now. This week, we simply tweaked our exposure to the sector, rather than adding to it, by reducing CBA (ex-dividend) by 3% and adding those funds into ANZ.

Australian Banks Seasonal Performance

Resources

After last night's trading in the US, BHP is looking to open down ~70c (2.7%) at $25.83 which is a large fall with no significant moves in commodities, or US stocks. As we mentioned earlier the market feels very ready to take profits on stocks which have run hard since the US election. Putting this in perspective for coming weeks:

1. We are targeting a pullback in BHP to challenge the $24 area i.e. almost 10% below yesterday's $26.55 close. We are likely buyers of BHP under $24.50.

2. We remain short FMG targeting a move to at least $6, well over 10% lower. We are likely buyers of FMG under $6.

If these 2 corrections unfold in these large big cap resource stocks, it's hard to imagine the ASX200 powering over 5800 in the short-term.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here