Trump addresses Congress – some great one-liners!

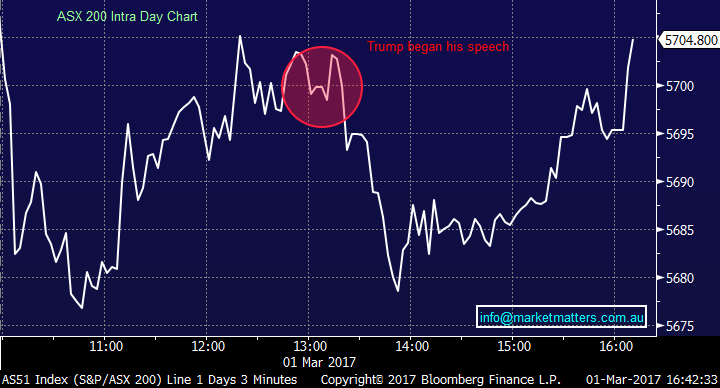

Today was always going to be about Trump and his first address to the United States Congress as President, and the overall performance from the market was fairly subdued in aggregate, however there was ebbs and flows throughout our session. US Futures stayed marginally higher throughout the day with very little movement while our market opened lower, rallied ahead of the speech, took a hit soon after he started and bottomed out as he ended…

Not sure what to make of the market’s reaction in Australia - seems like traders here couldn’t quite work it out, however Mr Trump hit all the high notes as expected promising "historic tax reform", a $US1 trillion infrastructure plan, paid family leave and the biggest increase in military spending in history. He called it a "new chapter of American greatness" and had some great one liners in the hour long missive.

He called on the country to be "empowered by our aspirations, not burdened by our fears" and "inspired by the future, not bound by failures of the past….along with a host of other highly aspirational lines. He ended with "I am asking everyone watching tonight to seize this moment, believe in yourselves, believe in your future and believe, once more, in America”.

Obviously we’ll get the market’s reaction in the US tonight, however look towards the bond markets rather than the equity markets to see what the weight of money made of his address. Gold in Asia was up a tad, but nothing really telling, the $US firmed against most currencies, but again, nothing significant. US 10 year bond yields were up last night to 2.41% and another move higher tonight is the most likely reaction. That would suggest the market is positioning for higher growth, higher inflation & higher interest rates on the believe that his pre-election policies / plans will actually happen.

That obviously has implications for how we should position our portfolio. Higher exposure to growth in the near term (think resources) which have pulled back over the course of February (we highlighted our ideal entry points in this morning’s note), while sectors negativity correlated to higher interest rates should underperform, and we should avoid them, even though they look attractive from a price perspective now. We have a high allocation to financials in a board sense across our portfolio (including banks, diversified financials, insurers) and these are stocks in one way or another will benefit from higher growth, higher inflation and higher interest rates.

So if resources do well and financials do well, Australia should do well which would be supportive of our call at the start of 2017 that the Aussie market will outperform overseas markets for the first time in years. This view is particularly relevant in the near term, given our expectation that the ASX 200 will trade up to 6000 before we should term cautious. One final impulsive leg up fuelled by optimism around ‘Make America Great Again’ then a deeper correction will play out. That is our current road map for now.

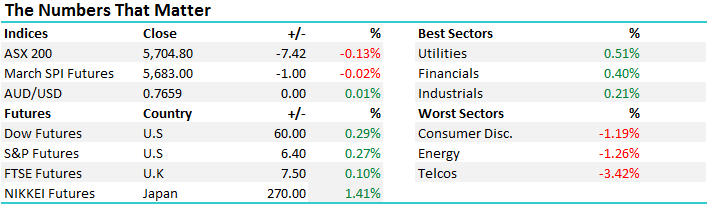

Anyway, on our market today we had a range of +/- 31 points, a high of 5706, a low of 5675 and a close of 5704, down -7pts or -0.13%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 1/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here