Not a lot to hang ones hat on today…!

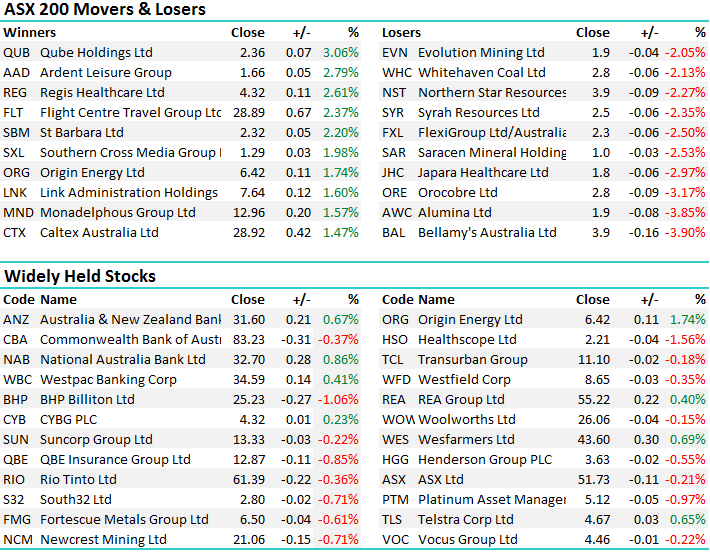

The market chopped around today with no clear trends from a sector perspective. Banks were mostly higher but CBA was the exception with some obvious rotation out of CBA into the others that will go ex-divi in May….CBA just went Ex-Divi for $1.99 in Feb. BHP trades ex-div for 52.16cps tomorrow and if taken from todays close, BHP should be trading around $24.70 tomorrow – an +11% correction from recent highs set on Jan 25.

RIO has also come back from a high of $69.80 to close at $61.39 today, a drop of -12% from the highs, however it did go ex on the 23rd Feb. Golds continued to be under pressure today as we foreshadowed in the AM report, however there was some tentative buying into weakness. Accumulating Gold on the back foot makes sense to us here…

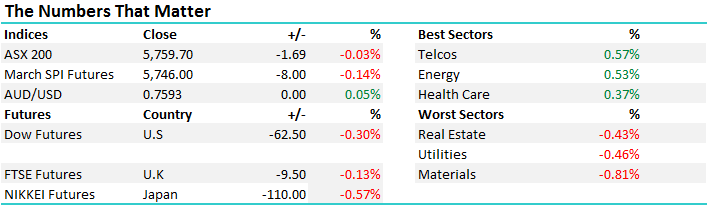

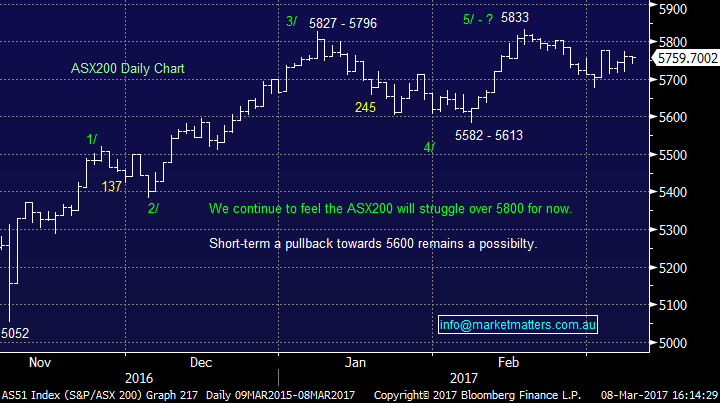

On the market today, we had an early sell off but recovered most of it to finish a tick in the red - a tight range today of +/- 22 points, a high of 5760, a low of 5738 and a close of 5759, up -1pts or -0.03%, which is pretty typical of trading in March.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Not a lot happening markets wise today however a few things caught our eye…

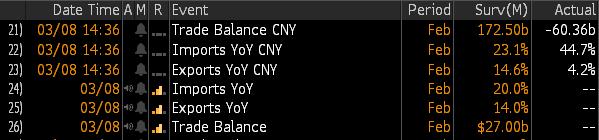

1. Chinese Trade data out today and it was interesting to say the least – seems every man and dog in China imported something in Feb which saw a massive miss in terms of the trade balance. Exports pretty much inline but imports were massive. Not sure if this is to do with re-stocking / stockspiling etc that we’ve seen in Iron Ore, Copper, Coal etc over the past few months but clearly a very BIG number on the imports side.

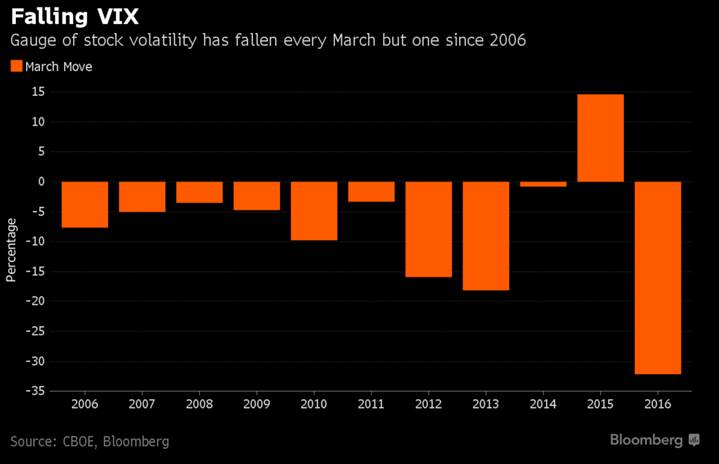

2. Volatility continues to be crunched but that’s fairly typical of this time of year. Volatility in March has fallen 9 out of the last 10 years, and we look on track to make it 10/11. Low volatility = high complacency which is clearly a risk….or for those in the options market it’s cheap to buy options / volatility but that will require patience given the trends in the chart below

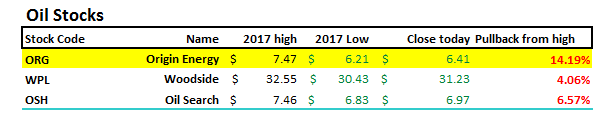

3. More weakness in the Oil price overnight and the energy sector was the weakest link in the U.S, however we saw buying here today….Origin (ORG) +11c or +1.74% to $6.42 the standout…although most of the sector saw some buying, ORG is clearly the standout in terms of it pullback from recent highs coming back by 14%....One to keep on the radar again after we sold our last trache around $7.00

4. Gold was hit today and stocks fell on the back of it, however there were some tentative signs of buying post the morning gap lower. As suggested above we continue to think that buying gold stocks on the back foot makes sense, however we’re clearly seeing some of the speculative money that piled into Gold ETFs and other speculative vehicles start to unwind.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/03/2017. 6.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here