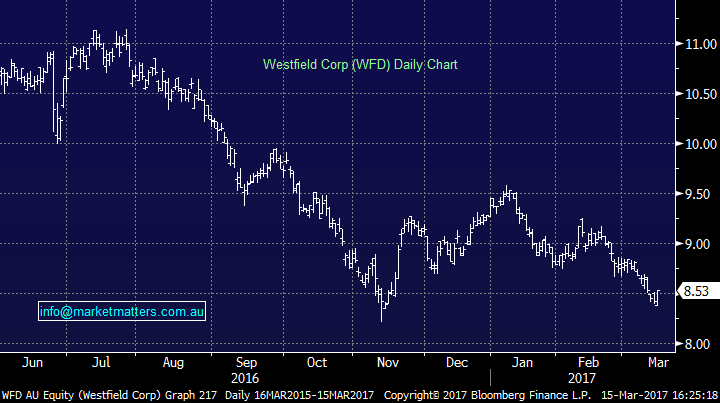

US rate hike, Ramsay Healthcare & Cannabis stocks

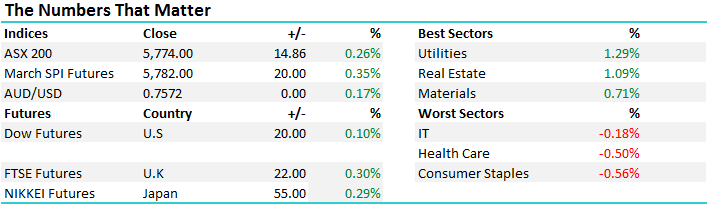

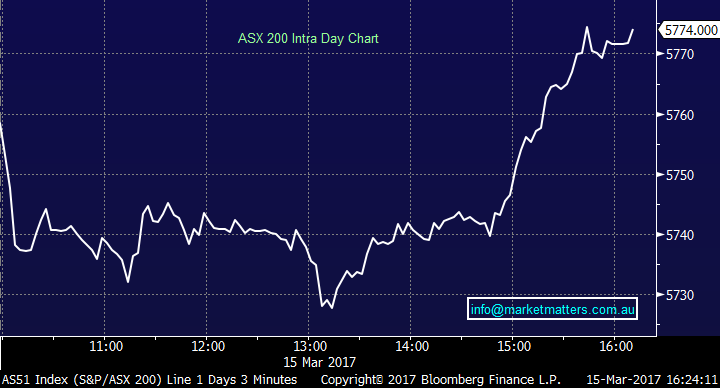

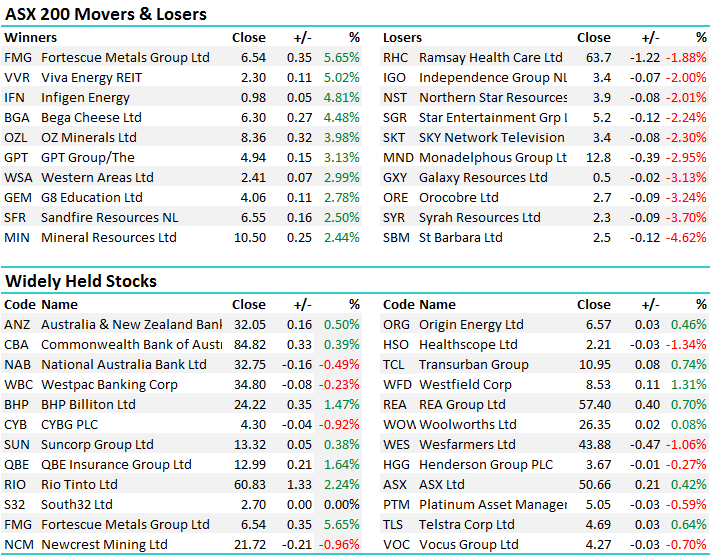

A choppy session for the ASX today with the market opening in the red and trading down to a 1pm low before buying kicked in and a decent rally played out into the close of trade. We had a range today of +/- 47 points, a high of 5774, a low of 5727 and a close of 5774, up +15pts or +0.26%. The 5800 level is clearly now in play and as we’ve suggested recently, a break of 5800 and we could see 5900 in short succession. Interesting to see the best sectors being the utilities and real estate stocks ahead of what is very likely to be an interest rate hike in the U.S early tomorrow morning our time….more on that below.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

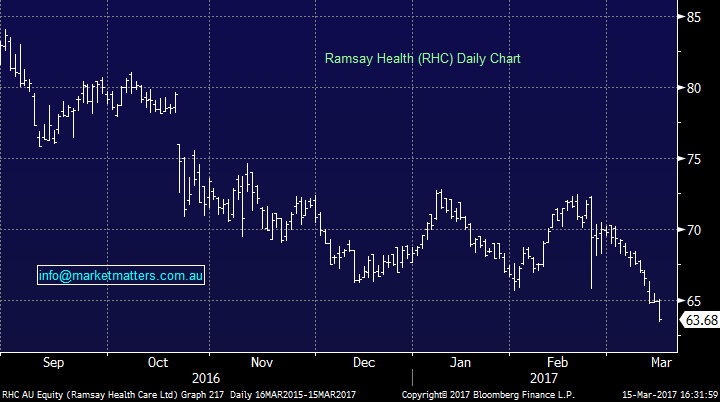

Three areas we wanted to focus on this afternoon; 1. positioning ahead the of the FOMC meeting and likely announcement of an interest rate hike in the US at 5am tomorrow morning 2. Ramsay Healthcare (RHC), which was down another 1.88% today to close at $63.68 & 3. Cannabis stocks listed on the ASX, particularly SCU which rocketed to a high today of $1.08 after trading at just 3c yesterday morning, before closing at 37c. A wild ride to say the least.

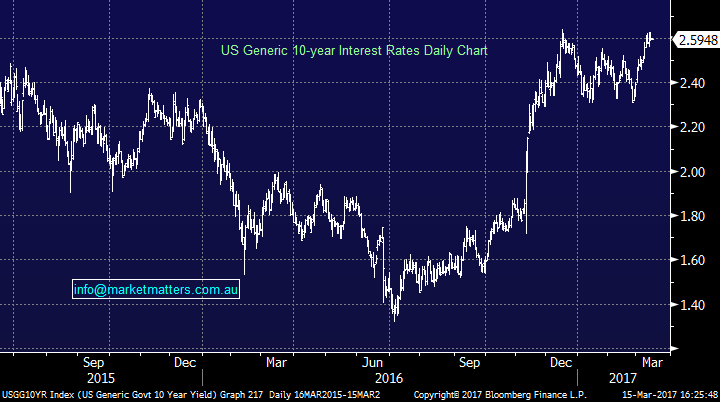

1. The market is clearly positioned for a rate hike in the US tomorrow morning our time and the focus will be more on the associated commentary than anything else. Will they allude to 4 hikes or keep the market focussed on 3? It seems to us that this is more likely than not one of those buy the rumour sell the fact type scenarios and we saw that start to play out in the market today with the strong performance from utilities and real estate stocks – normally sectors that would struggle in a higher interest rate environment. So if interest rates are going higher, presumably the $US goes higher, Bond yields go higher and those stocks / sectors that are negatively correlated to those trends would struggle, however its seems we’ve already seen the positioning play out ahead of time, which is fairly normal.

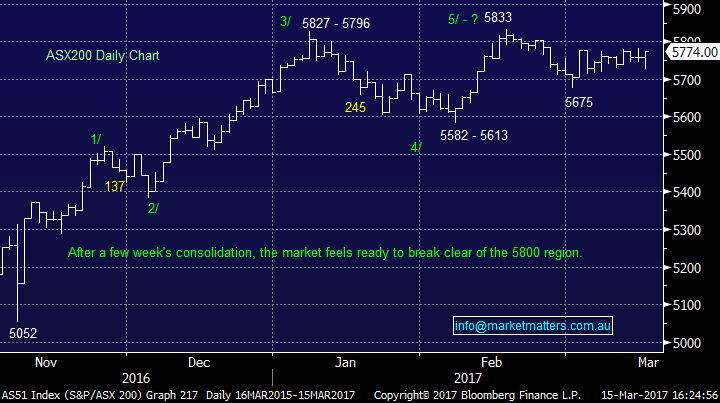

As we wrote in the weekend report, the next big move in the $US in our view will be down even though the fed is hiking rates – the market is simply too long the $US. Rate hikes are now priced into the market and if we don’t see the 3 / 4 that are now baked in, then the higher interest rate trade will unwind. Looking at Westfield (WFD) and the US 10 year Treasury as examples here. Both of these are approaching an interesting juncture. Is this a low in WFD and a high in US bond yields? More colour on this tomorrow morning.

Westfield (WFD) Daily Chart

US 10 Year Treasury Yield Daily Chart

2. Ramsay Healthcare (RHC) was down another -1.88% today to close at $63.68, after trading as high $84.08 in September last year. We allocated 4% of our portfolio to RHC around $69.03 recently and although the stock has gone ex-dividend since, our purchase is still underwater. A few things are at play here. Firstly, their results recently were solid and in line with expectations with all divisions performing well. They reported growth in 1H17 ‘core’ earnings of 13% and upgraded FY17 guidance from 10-12% to 12-14% - the market liked it, however the unexpected announcement that long standing (and very well regarded) CEO Chris Rex was to retire caught the market by surprise.

He has then sold 1/3 of his personal holdings in the company (to pay tax!!!) which was then followed by the sale of shares (around 1 / 3) by the CFO. Thirdly, shares held by the estate of the late Paul Ramsay is also a seller reportedly of around $500 million worth of stock partly to fund a new think tank chaired by former prime minister John Howard. All up, big names selling stock is not a good look, but more importantly from an institutional standpoint, if there is a big line of stock likely to become available as a ‘block trade’ why would they tick around on market? RHC is a difficult stock to trade in large lines and institutions are more likely to hold fire if a block is about to become available – they may even reduce weightings to make room. The key takeout here, is that these are likely to be short term issues impacting the share price and we remain comfortable with our 4% allocation at this stage, with the room to increase to 7.5% if further weakness prevails.

Ramsay Healthcare (RHC) Daily Chart

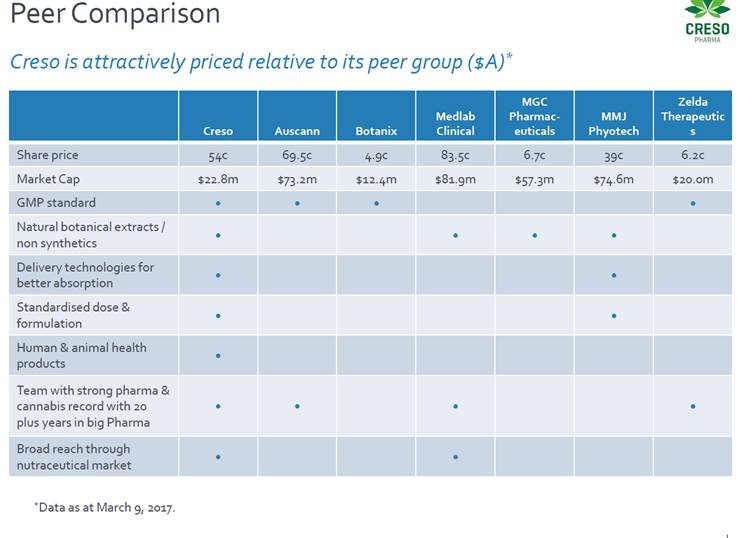

3. Cannabis stocks are firing at the moment with some massive moves in the sector – SCU for instance was up more than 8000% at one stage…not sure if stocks like this can be taken seriously given it was on one announcement surrounding a very well regarded ‘weed man’ taking an advisory position to explore options, but when there’s smoke….clearly there is fire! Probably not an area that Market Matters will venture however for the brave, here’s a quick rundown of the sector sourced from Creso Pharma

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here