Retailers run scared of Amazon…

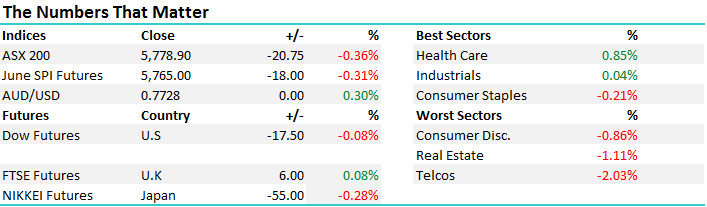

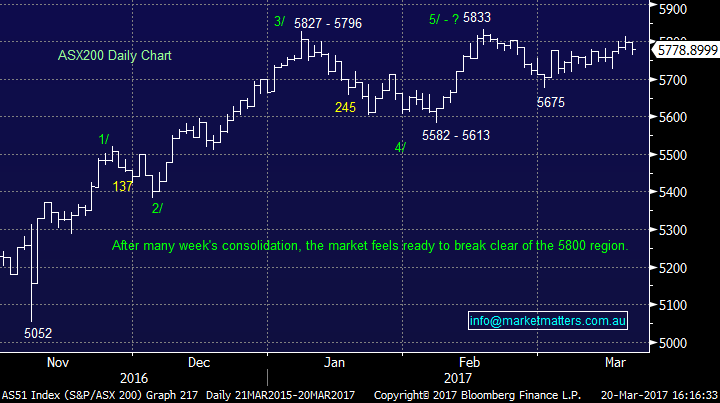

A yawn of a session really to start the week with Healthcare the only sector in the Green....while the Telco’s and the real estate companies were the biggest drag…5800 continues to be very elusive after we closed just a few basis points below it on Friday. Technically, that level needs to be broken on a close basis before a strong move up towards 5900/6000 should play out while on the flipside a break of 5675 would turn us more negative. In our Weekend Report out on Sunday, we suggested that statistically while 5675 holds for the ASX200 Australian stocks should be strong over the next 2-6 weeks but there are two things that may hinder this outlook, at least until April:

- Seasonally March is usually a month where things drift, plus our banks have already satisfied their statistical upside projections for March

- US banks look set for a reasonable pull back which is likely to cap our banks at least for a few weeks, a theme we’ve seen start to play out today

Given the composition of the index, the market will find it very hard to rally if banks are under pressure.

ASX200 Annual Seasonality Chart

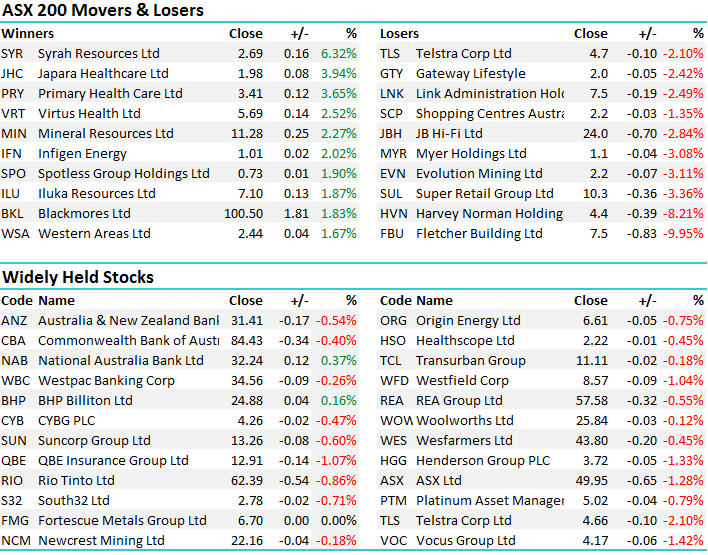

On the market today, we were lower to open and continued to drift trading in a range of +/- 32 points, a high of 5796, a low of 5764 and a close of 5778, down -20pts or -0.36%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

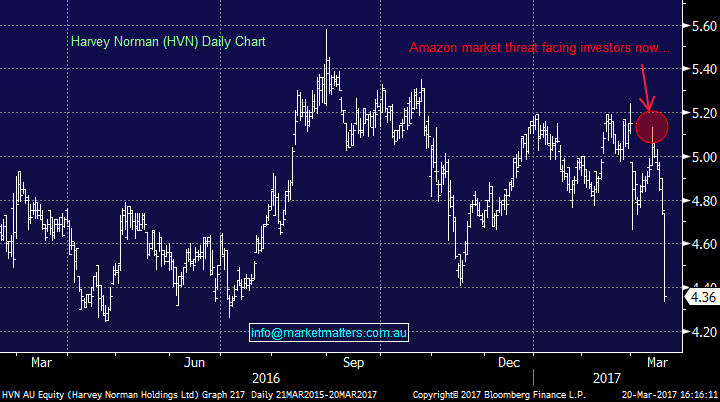

Amazon is coming and will hurt Harvey Norman, Myer, JB Hi- Fi and Super Retail Group the most according to a note out today by Credit Suisse, and the aggression Gerry Harvey has shown in recent times through the media gives more kudos to that claim it would seem. They reckon that when Amazon launches its online shopping service in Australia sometime this year that retailers of electrical and home items, sporting goods, clothing and toys will be hardest hit given these products seem to move the most through the Amazon channels….

Harvey Norman didn’t help the cause today with a Director selling 311,200 shares (transacted on the 15th March) which caused a drop of more than 8% today. We’re fairly high conviction investors at Market Matters and the retail sector at this stage is simply too hard….and interest rates are yet to move higher nor have we seen any mortgage stress as yet! We have no interest in this sector currently

Harvey Norman (HVN) Daily Chart

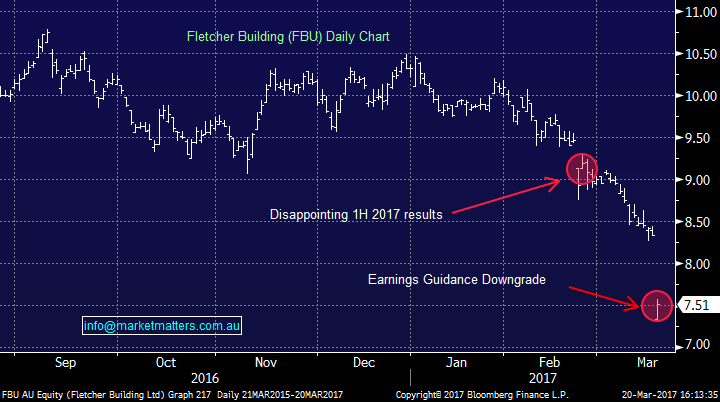

Another stock doing it tough today was Fletcher Building after downgrading earnings….just a month after they reported 1H17 numbers which is rather concerning. One problematic project seems to account for the bulk of the $110m downgrade however they’ve used the opportunity to throw in a few other bits and pieces re-basing earnings expectations…The stock finished almost 10% lower…No interest

Fletcher Building (FBU) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/03/2017. 4.30PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here