Why we like BHP & RIO into recent weakness…

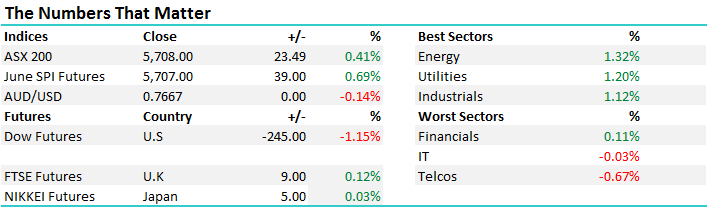

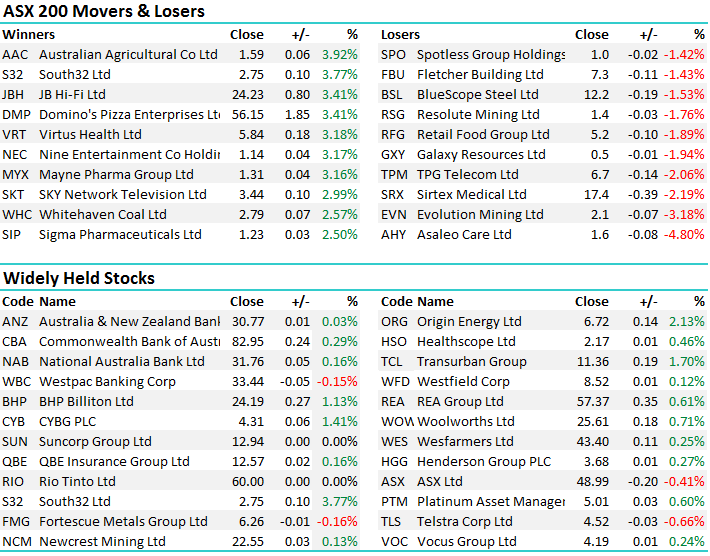

The ASX calmed down today with the market chopping around either side of par for much of the session before a late spurt higher saw the index close on the high of the day. We had a tight range today of +/- 22 points, a high of 5708, a low of 5686 and a close of 5708, up +23pts or +0.41%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

We recorded a quick video today outside our normal weekly update (it will be out in a few days time) and amongst other topics, we talked about how markets are cyclical and being in the right sectors at the tight time, and importantly avoiding the wrong sectors / stocks at the wrong time is very important. Those that owned BHP and RIO in 2014/15 will attest to the pain that can be felt in holding stocks that have headwinds caused by external factors. Importantly though, this isn’t a theme that is ring fenced to commodity companies, all businesses go through periods where external macro-economic factors will have a positive or negative impact on their outcomes – things they simply can’t control.

Interest rates are the most topical discussion point here at the moment and as we’ve suggested on many occasions, different sectors react differently to changing interest rates. Insurance companies benefit, financials benefit (as rates rise initially), resources usually benefit given higher rates often correspond with better economic growth, while companies that have high debt levels struggle. Quasi bond like stocks that are primarily priced off their dividends will come under pressure, retailers will find it tough if rates tighten too much while staples such as Supermarkets do OK given higher rates are often a result of rising inflation. These trends play into the way we approach the market, and importantly, the stocks we buy / sell.

The importance of this shouldn’t be underestimated , particularly in an environment where economic trends are extremely fluid, as they are now. The other side of this discussion is around the markets positioning to these themes. Markets are forward looking, not backwards looking and this is where our service really shines. We’re about making assessments of the future, not regurgitating the trends of the past. Yes, we certainly use historical trends as a guide, and look at what happened ‘last time’, but we then apply our own thinking / knowledge / experience / networks to come up with a best guess of the future. That may sound a little flippant, however a best guess is all that anyone can deliver – it’s just that every ones ‘best’ is different with some more accurate than others.

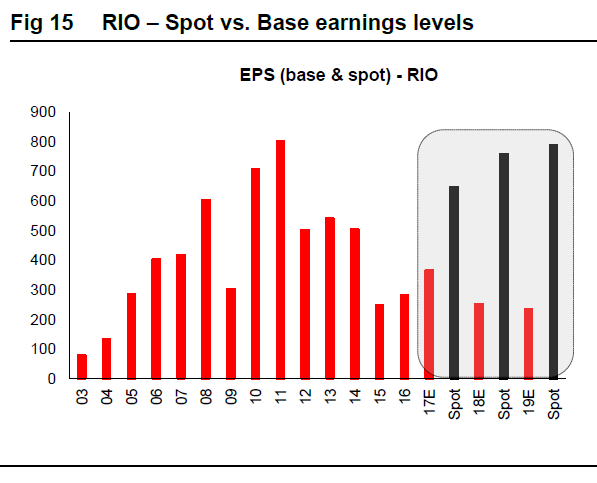

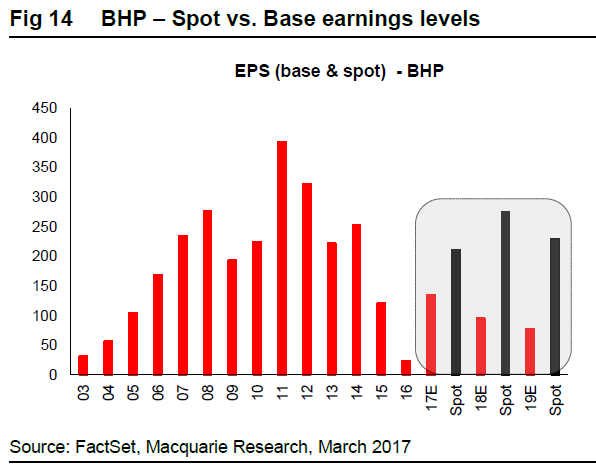

We touched on the concept of investor positioning in this morning’s report, suggesting that the high proportion of fund managers that believe the market is expensive, is actually a bullish sign – they’re looking to buy the dips and have high cash levels and therefore a protracted market rout is unlikely. Looking at the two charts below from Macquarie Research is interesting as it highlights how the market is positioned in terms of the major resource stocks – which we own. We know commodity prices have been strong, and we know that almost everyone in the market including the resource companies themselves believe commodity prices have run too hard too fast.

Using Iron Ore as an example, Fortescue’s CEO Nev Power who we met with early last week thinks Iron Ore should trade between $40-$60 a tonne. At the moment it’s close to $90. If the market thinks that Iron Ore should be at $40-$60 analysts price that in their models. If it’s a known known, as in, the market is positioned for it then it doesn’t come as a surprise – it’s baked into the cake.

At Market Matters we’re often described as contrarian investors however we take a different view. We simply try to look at how the market is positioned, and think about the consequence if what the market is positioned for does not play out. By doing that, we get good risk / reward opportunities.

In terms of RIO and BHP below, if Iron Ore stays firmer than the market thinks, or doesn’t drop as far as what is being priced, the miners are in for some big upgrades to earnings and share prices should follow.

This chart shows the difference between earnings expectations using Macquarie’s forecasted Iron Ore price (in Red) versus the Spot Iron Ore price in black. Clearly, if prices stay firm, or even fall less than is currently expected, share prices should rally.

RIO Tinto (RIO) Daily Chart

BHP (BHP) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here