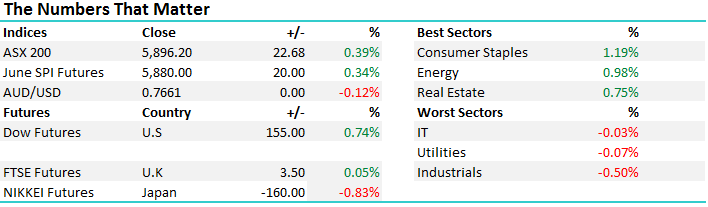

Market flirts with 5900 but falls short (just)

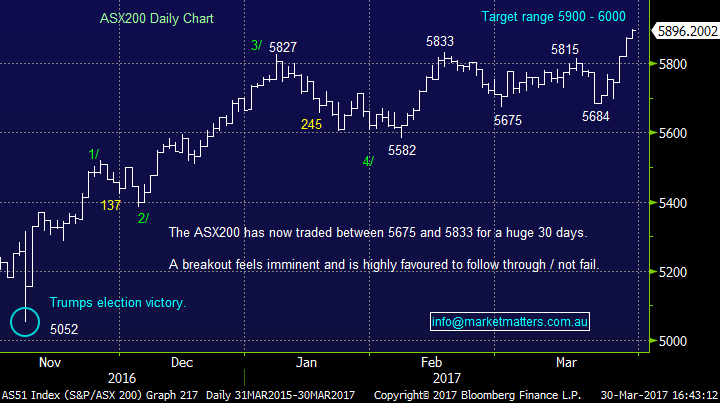

Another decent session for Aussie stocks with the market grinding higher for a third straight day, although with some reduced momentum. Since the most recent low 8 days ago of 5681, the market has put on +215pts or +3.78% in a run led mainly by the banks, while the resources have played a supporting role…1 day left in March and the index is up by +3.2% after closing out the month of Feb at 5712.

So from an index point of view, we’ve clearly had a good rally this month and that comes off a decent February as well where the market put on +1.62% and Monday kicks off April which as we’ve written at length is the most bullish month for Aussie Equities with an average gain of ~1.60% - we’re clearly in a sweet spot right now but don’t get too comfortable. The old mantra of sell in May and go away has validity with May being the weakest month of the year. At the moment, we’re well invested in sectors that are benefit from the market’s recent rally however we will be sellers rather than buyers into this strength. The AM report today talked about ‘not chasing’ the mkt and at this stage, we think that’s wise.

As suggested above, banks have been the cornerstone of this recent rally but they’re now starting to look reasonably expensive. More on this below + coverage of Bank of QLD’s result today.

Today the market chopped around more than we’ve seen in the last few sessions and the short term momentum is clearly waning somewhat. Some short term consolidation before a push up towards 6000 seems likely. We had a range today of +/- 24 points, a high of 5899, a low of 5875 and a close of 5896, up +22pts or +0.39%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

BANKS; BOQ reported numbers this morning that on the face of it, were slightly below markets expectations – about a 2% miss on cash earnings, a 5% miss on earnings per share, dividend was inline, capital was inline. The stock was off early however the CEO did a good job on the conference call to talk up future prospects. The first half result was impacted by weak loan growth but they reckon in the 2H17 that will all change, and they gave some upbeat guidance here.

We thought about taking a position in BOQ this morning however we’ve already got good exposure to the sector and the quality of the result today was a little soft. We’ve got the CEO & CFO in on the 3rd April so will get some deeper first hand insight then. The stock goes ex-divi on the 20th April and is the cheapest in the sector. For those looking for a play on the banks, that don’t hold positions in CBA, NAB and ANZ as we do, then BOQ looks the most compelling prospect in a sector that’s been pretty hot in recent times.

Bank of QLD (BOQ) Daily Chart

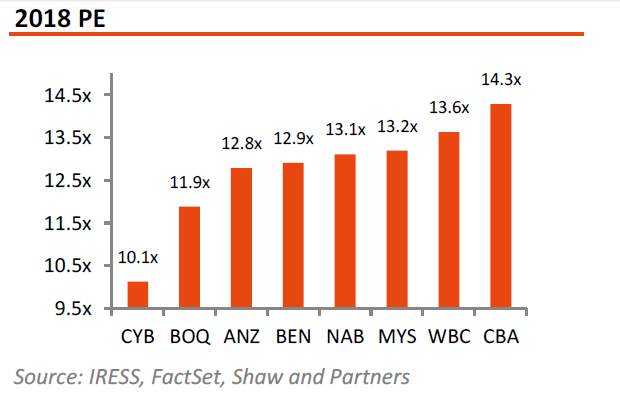

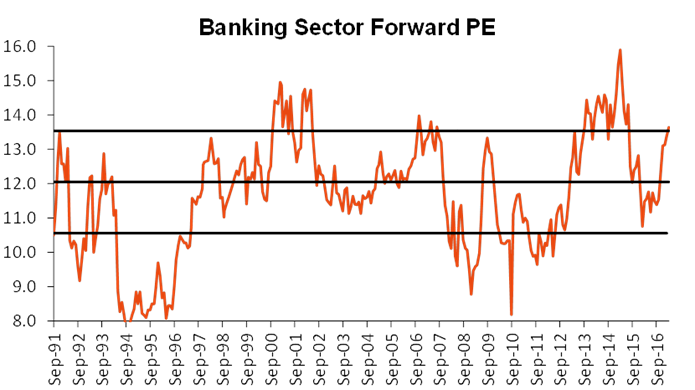

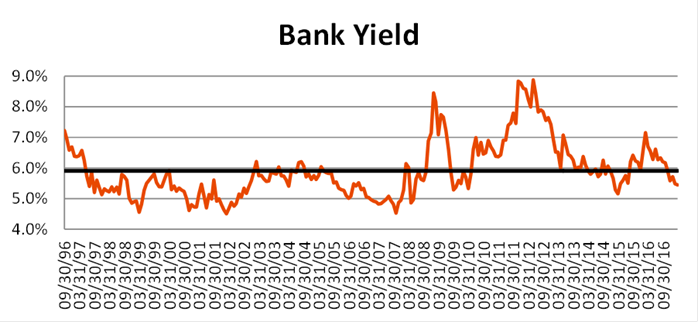

Staying on the bank theme, Shaw Research put a few interesting charts on the sector recently which we’ve borrowed here, essentially highlighting a sector that’s no longer cheap but probably has some room for higher levels into the seasonally strong period of April.

Chart 1 – looking at PE of the various banks – CYB super cheap but no dividend and exposed solely to the UK

…as a sector it’s trading about 12% expensive with a forward PE of 13.6x versus long term average 12x – so a bit rich but not at extremes….

And in terms of yield, it’s about 8% expensive given the sector typically trades on 5.9% yield and is currently at 5.4% - still not extreme though.

So, the takeout clearly is that banks aren’t cheap here, yet they’re not exceptionally expensive. A very similar spot to where we find the broader market in. We remain bullish in the short term however we’ll have one finger on the sell button as these valuations are stretched further. CBA will likely be the bank we’ll cut towards the end of April, locking in a +25% profit nearer to $90 for the Market Matters portfolio.

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/03/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here