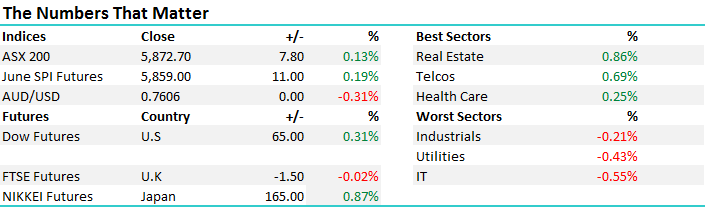

Insurers drop, Challenger soars…

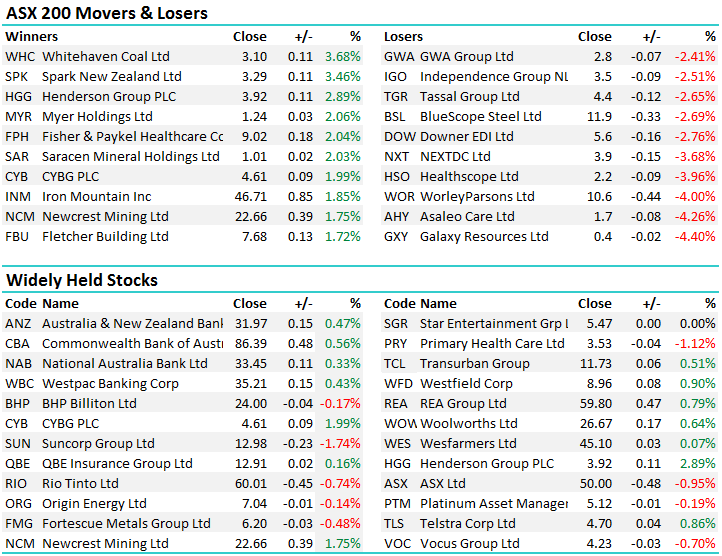

The first day of Q2 for Aussie stocks and the market ticked in and out of positive territory for much of the session after a reasonably weak open. Most pain early was felt by the miners following a weaker than expected manufacturing print from China out on Saturday however they did well to recover and close near enough to their daily highs. RIO probably to most interesting here with strong buying obvious when it ticks under $60.00…we’re long this stock and see higher levels in the near term.

We had a range today on the boarder market of +/-33 points, a high of 5873, a low of 5840 and a close of 5872, up+7pts or +0.13%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

The insurance sector was obviously in focus following the disastrous events in QLD and northern parts of NSW over the past few days with the likelihood of more to come for some areas. IAG and SUN with most exposure to these storms while QBE is also in the mix. From our understanding, SUN has an allowance for ~$620m plus $300m extra re-insurance protection until 30 June 2017 which suggests that the impact from Cyclone Debbie is likely to be zero for them. QBE has a total cap on large hazards of $960m so it’s fairly safe to say the impact to them will be very limited.

IAG seems to be most exposed given they have an allowance of $680m plus an extra $96m re-insurance cover, however their maximum event retention is $140m currently, so Debbie could have an impact here, the level of which could easily be around the $100m mark depending on damage. So, key takeouts here is SUN and QBE should be OK but IAG may have an issue. The other aspect to consider is around re-pricing of cover post such an event which is normally good for earnings.

Suncorp (SUN) Daily Chart

Henderson Group (HGG) had a good session today breaking out of its recent trading range and closing near the highs. Last week they provided an update on the Janus tie up with the combined entity being capped around ~US $5.6 billion. HGG account for around 57% of the merged group and Janus approximately 43%. Interestingly, the Dai-ichi Life Insurance Company, which is Janus’ largest shareholder, intends to further invest in the combined company to increase its ownership to at least 15%. We own HGG

Henderson Group (HGG) Daily Chart

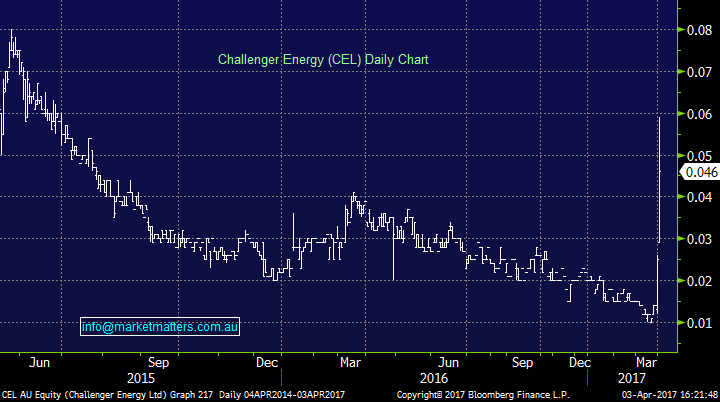

Changing focus to the more speculative area of the market, a small cap energy coy Challenger Energy (CEL) had a cracking session today adding +84%, albeit from a low base. CEL has a very good Shale Gas asset in South Africa that has been held up in political / environmental red tape for a number of years, however rumblings now that the Govt is likely to push the button on shale development in the Karoo Basin prompted volume in the stock and a big uplift in share price. After todays rally, the company is still only capped at ~$17m.

Challenger Energy (CEL) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here