RBA leaves rates unchanged – resource stocks look interesting again

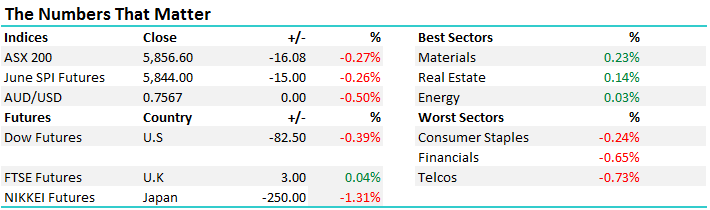

A decent open but an early sell off had traders on the back foot early today before another choppy session played out, with the market closing marginally lower. We had a range of +/- 25 points, a high of 5874, a low of 5849 and a close of 5856, off -16pts or -0.27%

ASX 200 Daily Chart

The RBA kept rates unchanged at 1.5% today at their April meeting which was as per expectations. They suggested that conditions in the global economy had improved over recent months with both global trade and industrial production moving higher. They touched on improving labour markets globally and importantly they expect above-trend growth in a number of advanced economies, but as always, the caveat of ‘uncertainties remain’ was also there.

In terms of the Australian housing market it’s clearly hot in some parts with Sydney house prices up 18.9% in the 12 months to 31st March, while Melbourne has put on 15.9%. other parts of the country are less stoic with the average capital city dwelling up by 12.9% - still a pretty good effort.

Most of the attention though in the statement was around the crackdown on lending standards which has been playing out over the past few months. They say that growth in household borrowing, largely to purchase housing, continues to outpace growth in household income, and it’s up to the banks to reinforce strong lending standards. Investor loans + interest only borrowers are in the cross hairs and they’ve already felt the brunt of out of cycle rate hikes. Clearly more arduous lending standards will impact loan growth however the banks are re-pricing existing mortgages therefore we see upside to banks earnings in the near term overall. This fits with our seasonal view of banks higher in April before we see lower loan growth figures which should see bank investors start to get a bout of nerves!

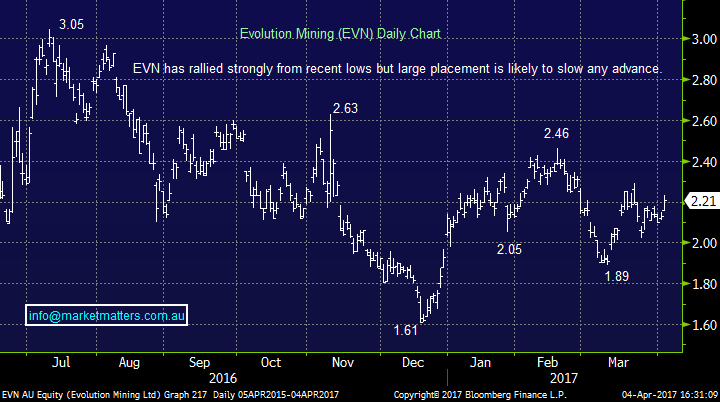

Resource stocks are looking interesting here after a pullback from 2017 highs of varying magnitude as shown here.

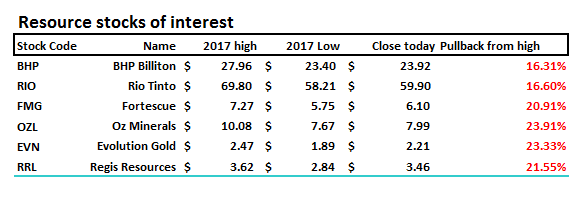

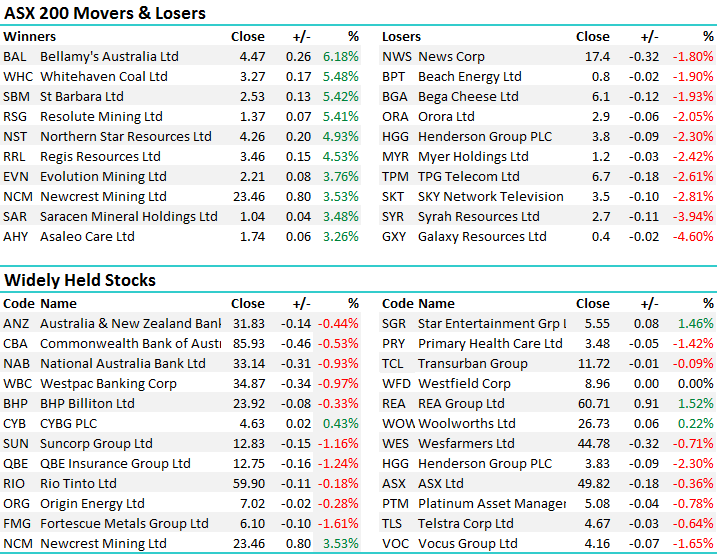

The market loved resources at the back end of 2016 leading into February reporting where the results were great, but the sector was too well owned. Since then we’ve seen mixed Chinese growth data, a short term bounce in the $US, some weakness in the Iron Ore price and subsequent selling of resource stocks. The question now is whether or not we see another leg down or the short term low is in place. We favour the latter scenario and we’ll look to detail our view in the morning note tomorrow…Golds were particularly strong today with the likes of Regis (RRL) up by +4.53% and Evolution (EVN) up by +3.76%.

Evolution Mining (EVN) Daily Chart

We bought some Oz Minerals (OZL) this morning and the stock had a good move throughout the day to finish up by +2.70% at $7.99. The Australian based Copper and Gold company has some very good growth prospects in the coming years and the recent sell down from ~$10 to now trade sub $8 following a weaker Copper price and higher $US presnts an opportunity. We’ve taken a short term trade in OZL.

Oz Minerals (OZL) Daily Chart

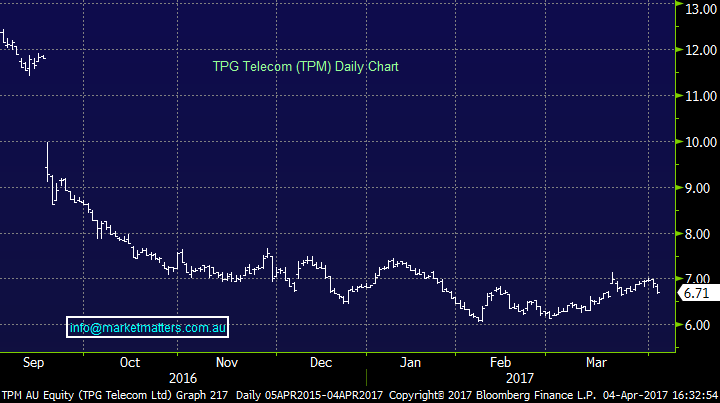

And finally, the spectrum auction was conducted today with Vodafone, Optus and TPG the likely bidders. Optus and Vodafone to beef out their existing mobile networks while TPG needs it to build its own. The outcome may be out tomorrow and it will give good insight into the longer term plans of TPG. Building your own mobile network is expensive and would likely require a cap raise at some stage….TPG closed down -2.61% at $6.71

TPG Telecom (TPM) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here