Resource stocks lead the charge today…

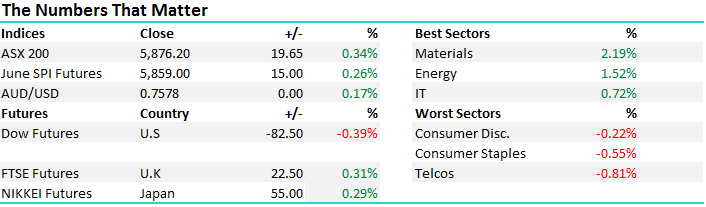

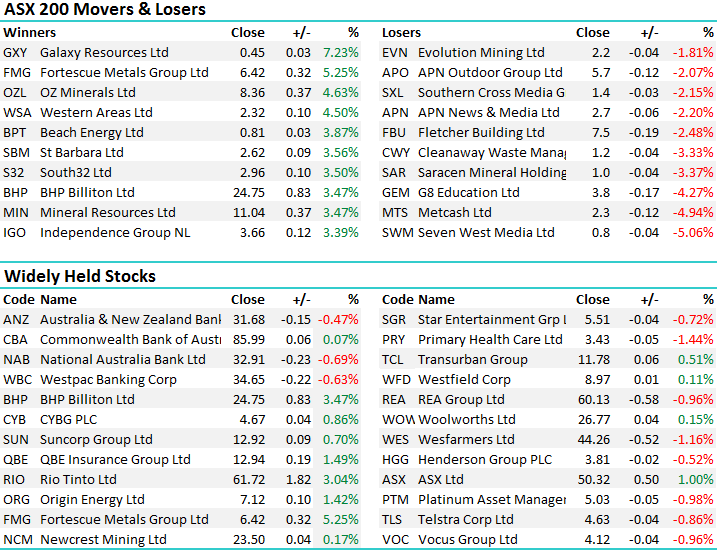

A good day for some sectors of the Aussie market today with resources clearly the place that saw most love as foreshadowed in this morning’s AM report. BHP added +3.47% to close at $24.7, RIO put on +3.04% to close at $61.72, Oz Minerals (OZL) had another stormer adding an impressive +4.63% to $8.36 after we bought yesterday morning at $7.78 while the banks were used as funding vehicles today…CBA up by +6c at $85.99 underperforming the market – which was indicative of the broader banking space.

We talk often about being in the right sectors at the right times and todays trade illustrates that fairly well. Different sectors see money at different times and getting that right is key, however the rise of passive funds that track money flow, which is pretty much what a lot of ETFs do, extenuates that theme. Think about a resource ETF for instance that tracks a basket of global resource stocks – funds will flow in and out of that which lead to buying or selling of underlying shares, largely in the bigger cap stocks like BHP, RIO, Oz etc.

Anyway, we thought this morning that resources were primed for a move higher and it’s pleasing to see it actually happen. BHP sub $24 and RIO sub $60 was clearly attractive and we’re long those stocks accordingly.

BHP Billiton (BHP) Daily Chart

Oz Minerals (OSL) Daily Chart

On the broader market today, it was actually weaker than we thought, largely given the underperformance in the banking space and the mkt clearly finds it hard to rally when banks lag. A 2pm low played out and a decent move higher into the close….another example of ‘buy weakness’ which has typical here as well as in the US of late. We had a range today of +/- 35 points, a high of 5881, a low of 5846 and close of 5876, up +19pts or +0.33%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

The insurance stocks have had a tough time in the last week which in understandable given ‘Debbie’ however as is often the case, the market frets about what ‘could be’ and when some clarity prevails we see stocks bounce. As we suggested yesterday , IAG was most at risk from a financial standpoint and today they said that cost is currently expected to be $140m with 4300 claims made to date. That will likely prompt a cut to earnings for FY17 by around 14% however no change to outer years, and again as suggested yesterday, it might be a small positive for the sector as rates will likely increase on the back of it!

SUN – has allowance of $622m plus $300m extra reinsurance to 30 June 2017, so impact likely to be zero.

QBE – has total cap on large hazards of $960m, so we assume limited to that, and no impact likely either.

Technically, QBE has been hitting its head on $13.30 in a tight range for the past few weeks – a break of that level would be bullish targeting at least $14

QBE Insurance (QBE) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here