Telco’s & Gold lead market south

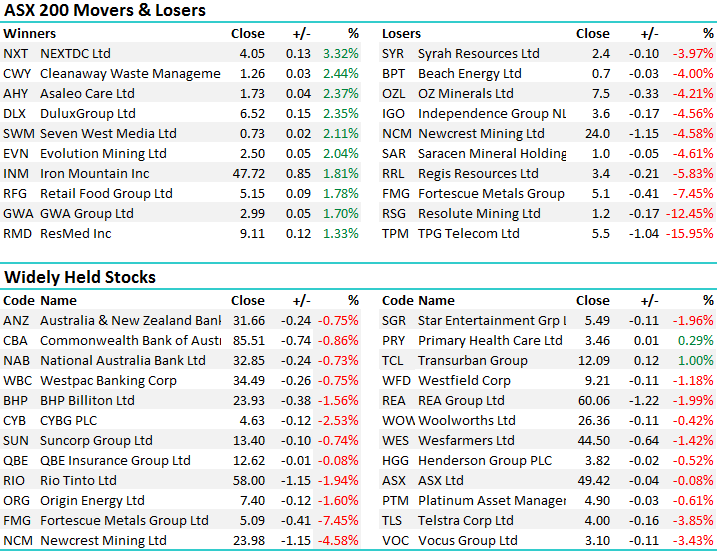

Another wave of selling hit the ASX today with bigger picture geo-political concerns fusing with some company specific landmines (think Telco’s & Gold), and the negativity, as it often does has filtered over into broader profit taking across the market - in a heartbeat we find the market off -114pts or -1.9% from the 5950 high set last Tuesday.

From an index level today we opened reasonably well but sell orders dominated the screens from early on, particularly in the Telco and Materials sectors, with Golds also very weak following a poor update from Newcrest. The RBA minutes released at 2.30pm had a slight positive impact (but not enough) in what was another ordinary session for stocks. We had a range today of +/- 67points, a high of 5887, a low of 5820 and a close of 5836, off -53pts or -0.90%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

A few aspects of the market to address this evening and we’ll likely focus on them in tomorrow mornings report to reinforce our views .

Firstly, in terms of our portfolio amendments today, we sold our 4% holding in Ramsay Healthcare (RHC) and allocated 5% of our holding to Newcrest Mining (NCM) into today’s weakness. We made a small profit in Ramsay + retained the franking credits from the 53cps dividend, however in the shorter term, we think the upside for the sector and Ramsay specifically is fairly limited. Our view remains that Ramsay will likely trade in a fairly tight range between $60-$70 a share and considering we are at the top of that range + we have already accrued the dividend it made sense to sell even though at the time of purchase we had a more bullish expectation for the stock. As we’ve been harping on about in recent times, it’s important to remain flexible and open minded in this type of market. That sale increased our cash level to 20%, and our expectation was to hold that in the short term looking for opportunities in the coming weeks.

Ramsay Healthcare (RHC) Daily Chart

However, along came Newcrest Mining with a poor update from their Cadia mine and weakness in the broader Gold space, a sector we’d just taken a lovely profit in last week. The weakness we saw in the sector today looks likely to be short term in nature, and the update from Newcrest specifically will have an impact on FY17 numbers however it’s likely the market will look through this after an initial knew jerk reaction. We allocated 5% of our portfolio into Newcrest at good levels today. Two questions hit the desk a few times throughout the session. 1. What does the Cadia update mean and 2. Why we bought NCM rather than another mid cap gold play – Regis or EVN for instance given we’ve had these recently.

1. For those that missed it, NCMs Cadia mine near Orange in NSW was impacted by a seismic event and they’ve suspended operations. No one injured and initial assessments suggests minimal damage to underground roadways and or fixed plant/infrastructure (crushers/conveyors etc). As is normally the case in circumstances such as this, the Mines Department has issued a “prohibition Notice” with a list of works required to be undertaken prior to safe operational restart – including inspections, clean-up, remediation etc. So, only a guess at this stage, however the shutdown is likely to be weeks rather than days, but probably not months. It will mean they’re unlikely to meet FY17 production numbers and more work needs to be done to assess actual impact, however it’s unlikely we’ll see any impact on outer years, which the market will start to focus on in the not too distant future. All up, we might be early on the BUY however from experience short term issues like this are usually best bought when uncertainty remains high in the short term

2. In terms of our decision to buy NCM over RRL or EVN, firstly Evolution gave a good update today and the stock closed higher – up by 2.05% to $2.50. The report was a good one and we should see upgrades on the back of it. Regis was down -5.83% today however it looks less attractive in terms of its technical picture than Newcrest. It’s also a higher beta play and higher risk. We took the lower risk gold vehicle in this instance, and importantly, bought weakness after selling strength last week

Newcrest (NCM) Daily Chart

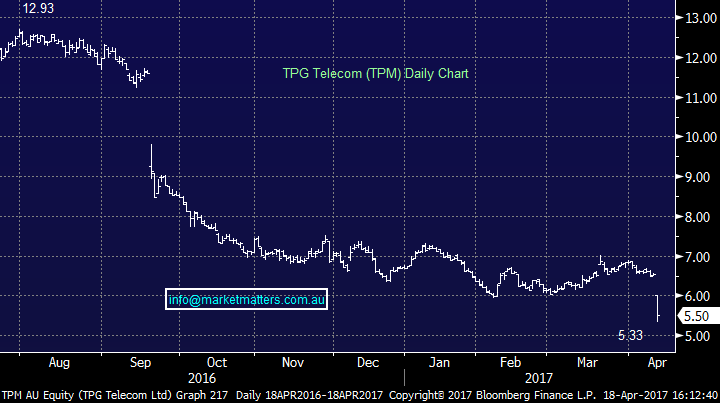

The Telco’s…nothing to say but Ouch! We sold our painful position in Vocus ~$3.80 and today it closed at $3.10 after hitting a low of $3.01. Certainly not a win – a long way from it, however it does show that making the call the sell at distressed levels can actually save meaningful amounts of money. We held TPG as a trading position and took a very slight profit on concern that they would pay a ‘full price’ for spectrum and a capital raising would follow. It has and the stock came back online today falling by 15.95% to close at $5.50. The stock now looks ‘sort of’ interesting from a trading perspective however the shares from the institutional component of the equity raise (at $5.25) will be issued on the 28th April so that will likely cap any rally for some time + the retail component will follow – therefore, any natural buyers of the stock have now bought, and we typically see a period of sideways trading action while the raise is digested.

TPG Telecom (TPM) Daily Chart

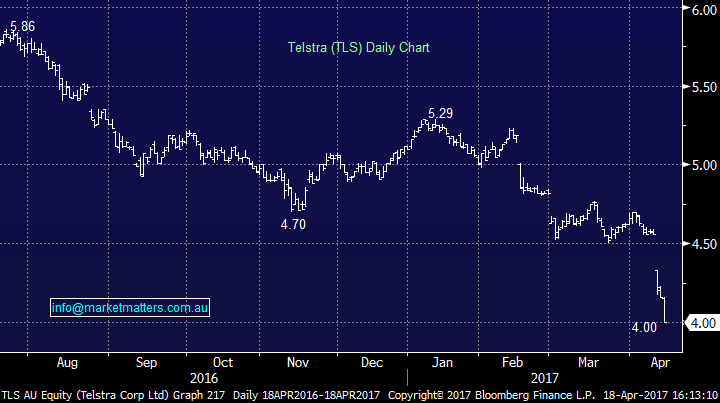

This now leads us to Telstra, a stock we’ve successfully avoided for some time (despite one successful short term play for the dividend), but a stock we now hold after buying ~$4.28 last week. Telstra today closed at $4.00, down another 3.85% on the session and we now sit on a paper loss of ~6.5%. As we wrote at the time of our ‘buy alert’ we’re reluctant to give TLS too much room and we’ll asses in the next few days if we cut our loses and move on. The uncertainty in terms of the mobile space, and the pricing for mobile and data services has intensified and we now see large institutions trimming their holdings in TLS. The volume in the market continues to be huge.

As we wrote at the time, the large one off NBN payments do give Telstra flexibility to diversify future earnings outside of Australia which we like, however the noise in the short term around aggressive discounting, price wars etc is a clear concern. Interesting to note that it’s actually TPG talking about this despite them being the new entrant into the mobile network space spending ~$2bn doing it. I say interesting because two very long term shareholders in David Theo and Soul Patts are the major shareholders of this company, and are clearly less concerned about near term price action of their stock, but more about creating long term value, potentially by reducing the competitive landscape!

Telstra (TLS) Daily Chart

…and finally, we put an alert out to add to our CYBG (CYB) holding by another +2.5% today $4.60 – this alert remains active and a text message will be sent on a price move to/below that level.

CYBG PLC (CYB) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here