Telco’s + Resources out of the cross hairs today, but banks targeted

It felt like a better session today for some of the market although we still finished lower overall with a wave of selling on the open met by strong buying soon after, particularly in the recent laggards like the Telco and Material sectors. BHP for instance traded down to a $23.33 low just after 10am before closing back in on the $24 handle by close of trade. Telstra was better closing up +3.25% to $4.13 while we also had some good corporate news with Brambles reaffirming guidance and rallying by ~6% while Downer was also in the winner’s circle, a rarity of late after completing their ~$1bn capital raising to finalise the acquisition of Spotless – a few at UBS (and those subbies who were also involved) will be licking their wounds on that one! But alas, the market can’t rally without the banks and they were too much of a drag today, with the BIG 4 detracting 17.5 index points from the broader market.

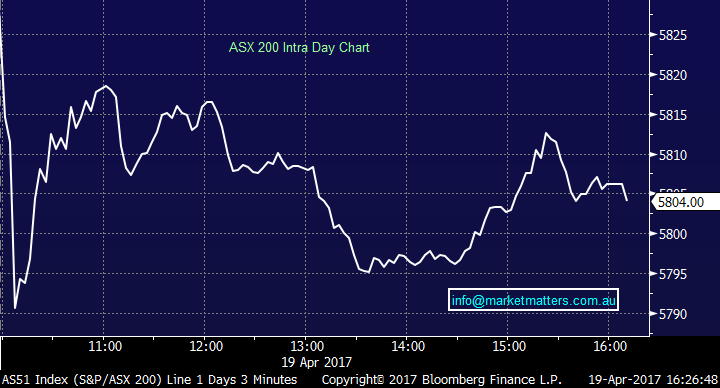

On the market today, we had a range of +/- 38 points, a high of 5829, a low of 5790 and a close of 5804, off -32pts or -0.56%. In terms of the technical picture for stocks, we broke through 5800 today however closed above it, and we continue to look for buying opportunities here in aggregate.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

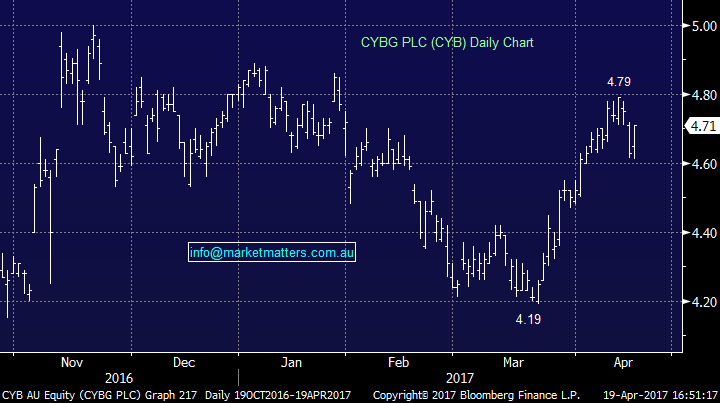

Firstly, in terms of activity today, we went from a limit order of $4.60 to buy CYB to a market order around $4.67. We ‘paid up’ for CYBG for a few reasons. 1. We like the stock fundamentally and want a higher exposure to it. 2. The pullback in the last few days has been corrective and on lowish volume. 3. Some reasonably big lines of stock went through today and 4. We’ve seen the British Pound rally overnight, a trend we think will continue and therefore CYB goes higher in the short term.

CYBG (CYB) Daily Chart

Elsewhere, Newcrest (NCM), a stock we bought yesterday rallied strongly from the lows today after looking weak early on. The US dollar looks soft here and a break of 100 is bearish in the near term, which is ultimately bullish for Gold. We allocated 5% of the MM portfolio into NCM yesterday, and we would average this position if the opportunity arises ~$21. We regard gold stocks as short-term / trading stocks to add cream to our portfolios performance. The sector has been very good to us over recent years, including 2 nice profits in recent weeks.

Newcrest (NCM) Daily Chart

We touched on our holding Ansell in the morning report today, and we continue to monitor this closely. It was weak today closing down -1.53% to $23.22 and there seems little catalyst for a rebound in the short term. This continues to be on our radar as a potential stock to SELL in the coming days to lock in another nice profit for the portfolio – however ideally closer to $24

Ansell (ANN) Daily Chart

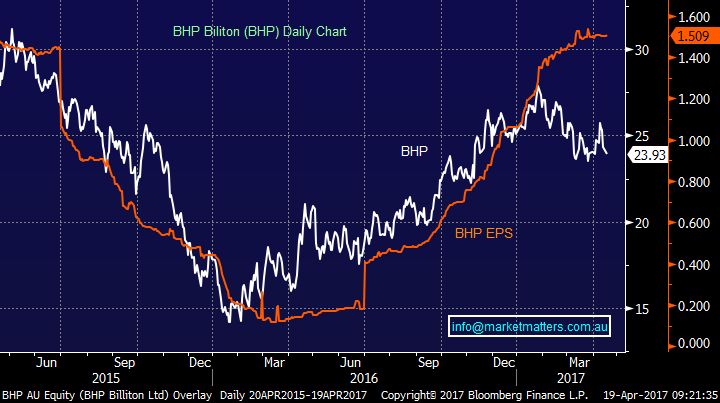

….and finally, BHP rebounded from the lows today as discussed earlier, and one chart that we like overlays earnings expectations with price. We’d be more concerned around BHP if we had an inverse of what’s actually playing out where prices had outpaced earnings. We know analysts lag however the gap here provides a reasonable buffer in the short term. Stabilisation on commodity prices will alleviate panic selling and the stock should bounce. Todays move was encouraging.

BHP Daily Chart (white line) BHP Earnings Per Share Est (orange line) – prices as at this morning

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/04/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here