What a day….Banks spring back from post budget hangover!

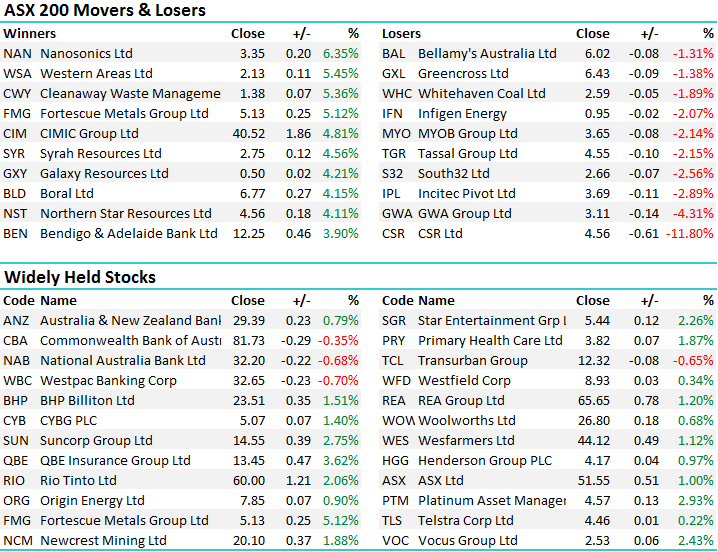

Carnage on the open this morning saw banks sold off hard from the get go following confirmation overnight that there will be a $6.2bn transaction tax imposed on the big 4 banks to plug the budget black hole, however as is often the case when an event like this prompts BIG selling pressure, we see a snap back – and the market rallied hard for the rest of the session with the index +71pts from the session lows driven by a big turnaround in the banks. CBA opened sub $80, a level we’ve spoken about as a BUY however unfortunately, it traded there briefly before buyers stepped in. Fictitious ‘model’ portfolios would have gotten filled but unfortunately the alert process saw us miss the proposed sub $80 buy level for CBA and the sub $32 buy level for Westpac for the MM portfolio - we’ll continue to monitor.

Massive Intra-Day moves in the Banks from the lows today…ANZ the biggest of them after getting pummelled in the last few days!

Westpac (WBC) – BIG bounce from lows

Elsewhere the resources were strong early and built on the strength throughout the session with RIO the clear standout adding +2.06% to close back at $60.00 on the back of a +1.84% move higher in Iron Ore throughout Asian trade. It looks distinctly like the resource stocks can find some form here after a fairly difficult period. We’re long BHP, RIO and Oz Minerals…

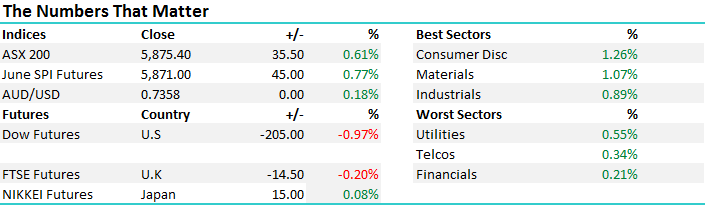

On the broader market, it opened down but as suggested above, the market rallied hard which happens when fund managers are holding high cash levels. We had a range today of +/- 71 points, a high of 5888, a low of 5816 and a close of 5875, up +34pts or +0.61%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

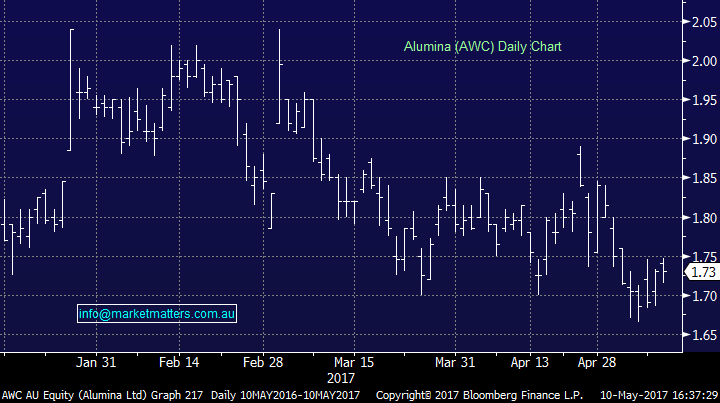

Staying in the resource space and a stock we wrote about earlier in the week – Alumina (AWC) looking to buy sub $1.70 had an interesting update today……traded up to $1.73 and we now see CITIC Resources, they’re major shareholder once again creeping up the register after a 6 month hiatus…adding another +1.1%n to hold just shy of 20%....some action bubbling under the surface it would seem. We didn’t pull the trigger given our existing resource exposure however the stock looks interesting.

Alumina (AWC) Daily Chart

Elsewhere, we finally saw a breakout in QBE Insurance (QBE) while Suncorp was also strong on the session. QBE the standout though with the $13.30 resistance finally giving way and the stock closed up +3.62% to $13.45. A level we’ve often flagged and now it’s been broken a run up to $14 in short order seems the likely outcome…We’ve owned the stock since $10.49, have been patient given the positive trends in terms of Insurance premiums and interest rates and it’s now paying off it would seem.

QBE Insurance (QBE) Daily Chart

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/05/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here