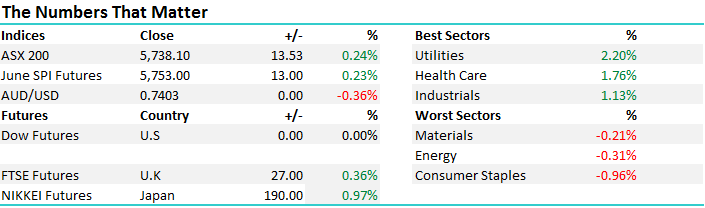

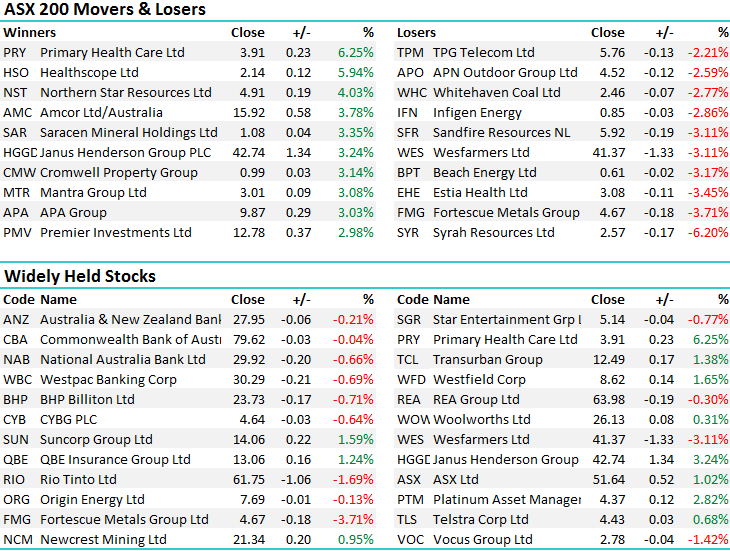

Stocks chop around early before rallying into the close

Stocks were higher today although trade was choppy particularly in the morning with better than expected retail sales data offset by weakness in the Caixin Chinese Manufacturing gauge which printed a very weak 49.6 versus expectations of 50.1. Interestingly, the official Chinese print out yesterday came ahead of expectations and importantly, was showing expansion – the vagaries of Chinese number crunching shine through again! Iron Ore was clobbered again today in Asian trade, down -4.20% at time of writing and that put pressure on the Iron Ore stocks today – Fortescue (FMG) the worst of the majors down -3.71% to close at $3.67 and we used todays weakness in FMG to add to the MM portfolio as a high risk BUY at $3.665. Interestingly, the stock was hit early, recovered well before being sold after the weak Chinese data, however the resilience into the close in the face of negativity, and importantly, the lack of any ‘big’ selling post the China data is a good indication that sellers are drying up here, and we have a high chance of a good bounce. When FMG moves, it can do so very quickly.

Fortescue Metals (FMG) Daily Chart

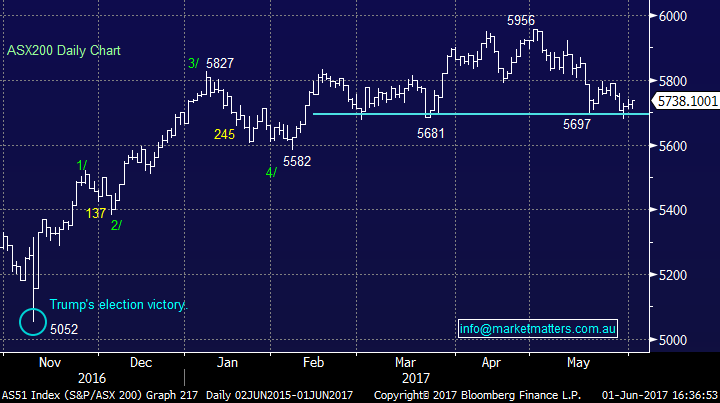

On the market today volatility was high early on with the index chopping around by +/-29 points, a high of 5753, a low of 5709 and a close of 5738, up +13pts or +0.24%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

We touched on healthcare stocks in the morning note today discussing the potential for regulatory risk given the Govt’s budget issues, concluding that we’ll give them a wide berth for now…impeccable timing given there were a number of them in the top performers list today!! Strong rally in Healthscope of +5.94% to close back at $2.14 while Primary Healthcare was also strong adding +6.25%. News is that Primary may buy Healthscope’s medical centres that are on the market for around $100m. HSO have been keen to offload for a while and if done this might open the door for increasing rumours around the potential for a restructure of the HSO property portfolio, either by spinning off the property assets from the listed vehicle or through a complete private equity takeover with the same outcome – but off market. We actually doubt this will happen internally and a takeover would be the only realistic avenue for this, however 20 times and an anaemic growth profile in the near term the stock is probably not cheap enough. If we were to see a downgrade and a gap lower in the share price, it would likely be a very good buying opportunity!

Healthscope (HSO) Daily Chart

Henderson Group (HGG) continues to perform strongly rallying again today (+3.24%) as it comes on the radar of a wider investment community post the share consolidation and Janus merger. We did trim back to a 5% portfolio weight recently (from 8%) to reduce stock specific risk, however importantly we remain keen on the stock moving forward.

Henderson Group (HGG) Daily Chart

Elsewhere, golds were good today with Northern Star (NST) up more than 4.03%. One of the themes that was covered at the Market Matters Live event on Tuesday evening was around the rise of passive index funds. Passive funds have clearly done well over time (given the markets have done well adding +250% from the depths of the GFC on March of 2009) however we enter a period now where risks are increasing, the chances of deeper market corrections at some point have firmed. The rise of passive investing is also prevalent in the commodity space with many of the commodity ETFS having expanded in size, and they now start to have a large impact on how stocks within them trade. For instance, the Market Vectors Gold ETF has the following components…Of interest is something like Evolution Mining (EVN) with the ETF owning 88.6m shares in the miner. Tweaks to the size of the ETF as demand ticks up (or on the flipside) can have a big bearing on EVN share price as it creates forced buying or selling. EVN traded 9.8m shares today which is just 10% of the total holding in this ETF!!

Source; Bloomberg

Have a great night,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here