Lift off for stocks today (sort of!)

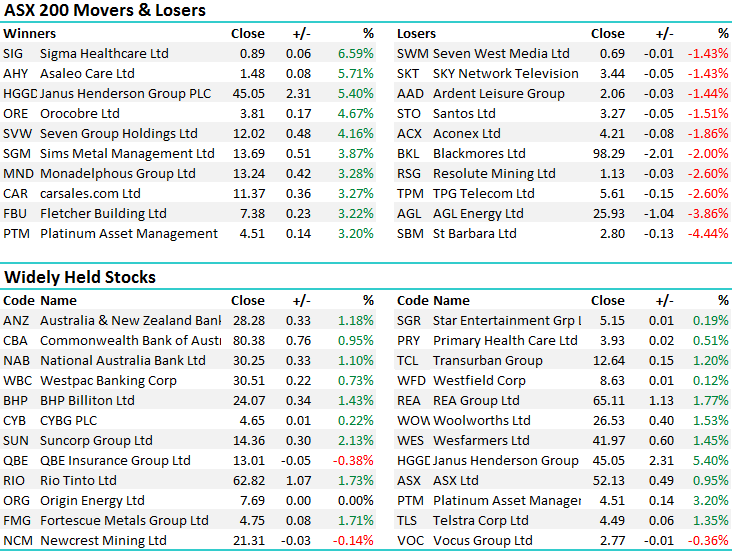

A good session to the end the week with stocks opening firm and trading higher through the day – a couple of standouts in Henderson Group (HGGDA) which traded up to our targeted level of the $44.00 (old $4.40) level and beyond however given we trimmed the position by 3% early in the weak to add BT to the portfolio, we’ll continue to hold our 5% position for now. The stock closed up 5.4% to $45.05, while BTT put on 2.34% to close at $11.36.

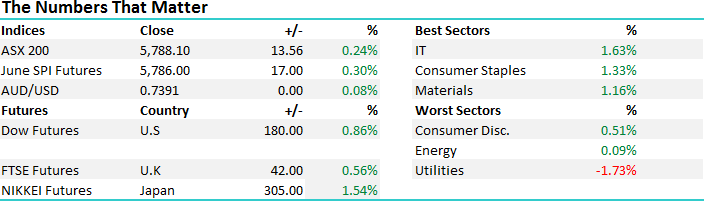

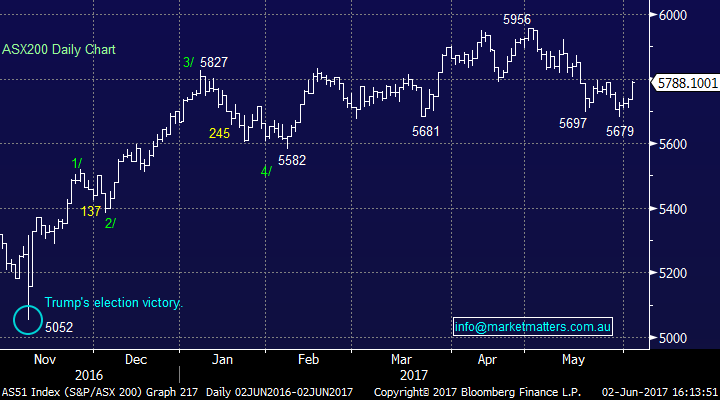

On the broader market today, the IT sector led the way, while most weakness was felt in the Utilities - an overall range of +/- 55 points, a high of 5793, a low of 5738 and a close of 5788, up +50pts or +0.87%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

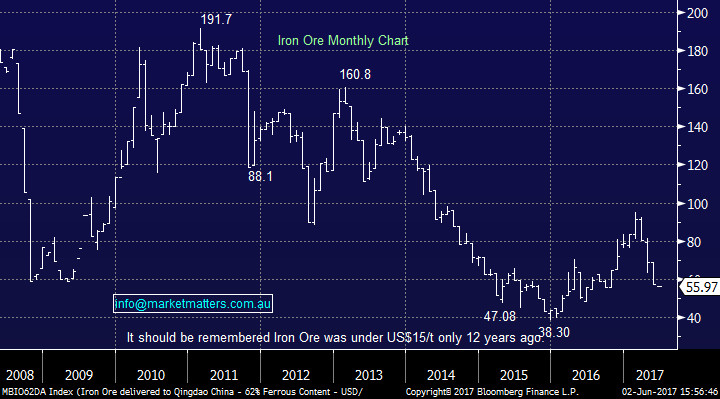

We talked Iron Ore this morning covering our three holdings in the sector, which is very high for us however the recent selloff has been reasonably extreme. Iron Ore in Asia bounced today by +2.25% and is attempting to find a base. We typically see reasonable strength in Iron Ore in June following what’s typically a weak period in May. Last year Iron Ore fell -24% in May before bouncing back in June by +11% then another +6.6% in July. This year we’ve seen some fairly extreme weakness in March (-11.92%), April (-14.42%) and May (-17.12%). Periods of excessive weakness are more often than not met with at least a strong counter trend bounce and that’s what we’re now positioned for.

Iron Ore Monthly Chart

In our top 10 prediction for 2017 released in January, we touched on both oil and Gold, and this helped to shape our investment decisions throughout the period.

Iron Ore will peak in Q1 and track lower in a choppy decline, targeting ~$60 by year end while Oil will range trade between $40 & $60 presenting good trading opportunities throughout 2017.

Iron Ore and Oil are two key commodities that fulfilled our predictions laid out in early 2016. For Iron Ore we predicted a move up from below $US40 /tonne to ~$US70 /tonne and we now sit ~$US81/tonne, so this has clearly surpassed our very bullish expectations while our call for Oil to trade up to ~$60 during the year when it was nearer to ~$30 certainly went against the grain at the time - with Oil hitting a high above $US55 /bbl. The risk / reward on both trades simply does not stack up at this juncture.

Chart as at 19th January 2017

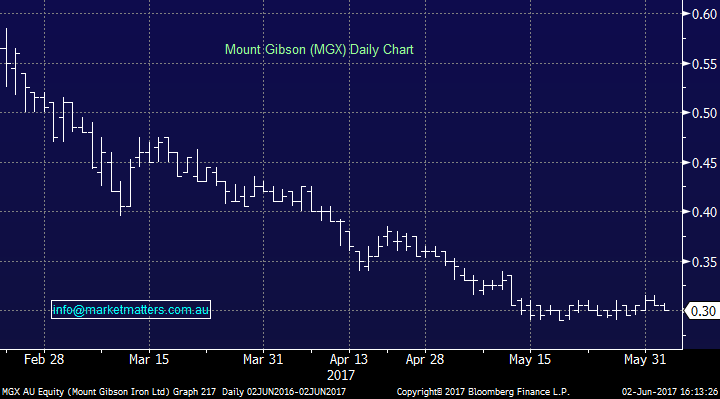

So at this juncture, the price of Iron Ore has traded back below our bearish downside target of $US60/ tonne to settle around $US56/tonne overnight. We continue to believe that this decline is now very mature, and good risk rewards trading opportunities are now starting to show. For those with an extremely high risk tolerance, Atlas Iron (AGO) and Mount Gibson (MGX) are two of the more leveraged Iron Ore stocks on the ASX, however they’re too speculative for us.

Mount Gibson (MGX) Daily Chart

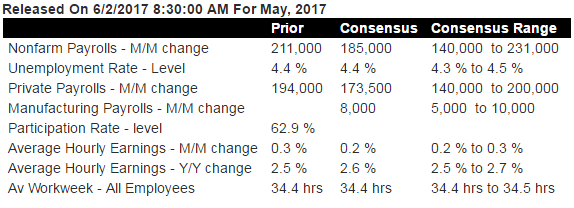

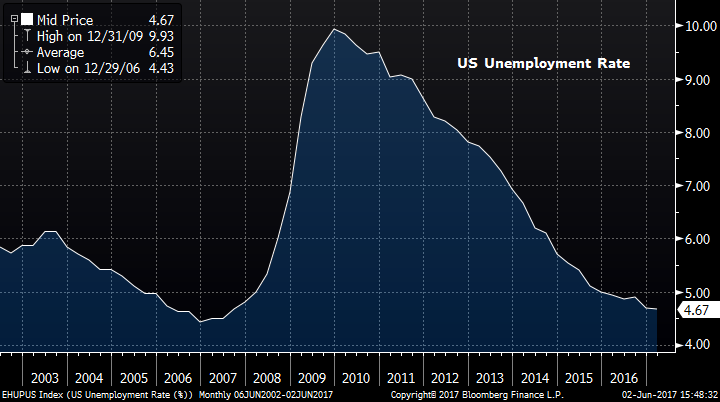

US Non-Farm Payrolls tonight which will be interestingly – looking for 185k jobs added and the unemployment rate to be 4.4% - which is pretty astonishing given it was near 10% in Dec 2009!

US Unemployment Rate

Have a great weekend and keep an eye out for the report on Sunday,

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/02/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here