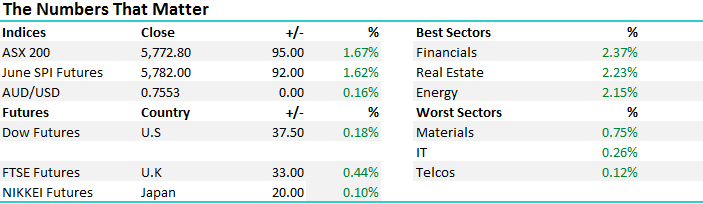

A lazy +95pts today as pent-up buying hits the tape

We often talk about the high amount of cash and the level of caution currently residing in the mkt which to us means a few things – and we’ve covered these in recent notes & video updates 1. A major market top is unlikely to play out when the mkt is positioned for one – the concept of mkts moving in the direction of most pain is relevant here 2. Aggressive buying of dips happen when cash levels are high, and todays move is testament to that 3. Seasonal weakness around May / June such a well-known thematic now that it’s almost self-fulfilling, so buying pressure keeps building and just one catalyst triggers the wave of buying, which we saw today.

After today’s very bullish move led by the financial sectors we now have at least one foot in the bullish camp. We wrote this morning that if the ASX200 can break over 5700 we believe it should target 5800 minimum fairly quickly. With the benefit of hindsight, that statement was well and truly undercooked given we cracked through 5700 early on today and roared up to close just -27pts below the 5800 level.

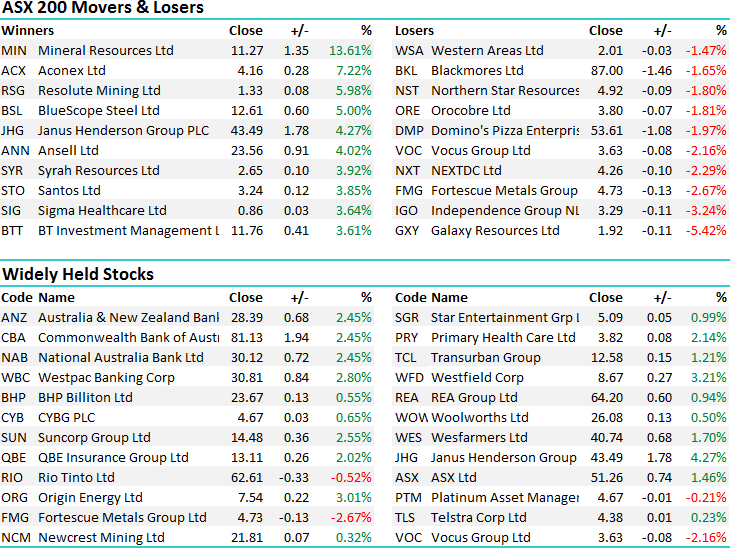

We are currently 90% invested in the MM Portfolio and some of our stocks had a good day – the likes of Janus Henderson (JHG) and BT (BTT) two of the best despite weakness in the British Pound which would normally be a headwind. Suddenly our 10% cash holding goes from ‘feeling perfect’ to feeling like a bit of a weight! That said, we continue to think markets will throw up opportunities and we clearly have the ammunition to take advantage of them when they arise.

Back on the 6th June with the ASX down more than -80pts the banks only accounted for -20pts of that decline which showed aggression of selling targeting that sector was starting to ease after the -11% fall from May highs. Today the mkt put on +95 and the banks accounted for +34pts – the strongest sector on the day. The US will raise interest rates this week – it’s a given – and the mkt is positioned for the hike, but it’s not positioned for many more. If the Fed are more bullish on rates then expect the financials to do well at the expense of growth (tech) and that suggests our market will start to outperform the US.

On the broader market today we had an overall range of +/- 91 points, a high of 5772, a low of 5681 and a close of 5772, up +95pts or +1.67%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

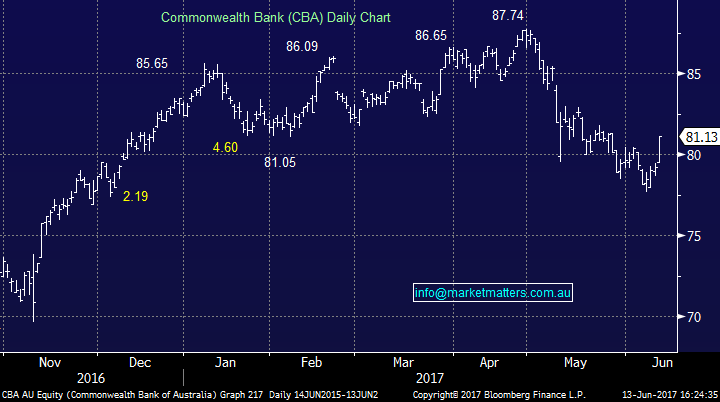

A couple of v interesting moves today in stocks we own. Obviously Banks were strong and we have WBC, NAB and CBA in the portfolio - Westpac the best of them putting on +2.8% while it was a very strong move in CBA. Banks have a weak May, which we know (and they certainly did) however they often base out in June before July is the best month of the year for them. We think this year will track historical seasonality and we’ve now seen the short term low for the banks stocks.

Commonwealth Bank (CBA) Daily Chart

Elsewhere, the diversified financials also had a crack today, particularly the UK facing ones which rallied hard even though the pound has been weak – which is obviously a headwind for these guys. They had a lot thrown at them last week with the UK election result and now the uncertainty around how BREXIT will play out, however they bounced back hard and the positive trends seem well ingrained. Henderson changed names and code today and is now Janus Henderson under a new code JHG.

It’s a pretty simple story in JHG, being very cheap relative to peers both in Oz and Globally, is now on the radar of more global investors, they’ll talk big in terms of synergies which are typically very achievable in a funds management business (so much leverage through scale) and then they’ll be revenue benefits through cross selling etc. I know what you’re saying, why did we trim our holding recently if we’re bullish? Simple answer – risk.; Having 8% in a stock going through a major restructure, merger etc carries risk, and we felt more comfortable with 5% in it, and 5% in BT.

Janus Henderson (JHG) Daily Chart

BT Investment Management (BTT) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/06/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here